Key Findings

- Implemented in 1991, Sweden’s carbon tax was one of the first in the world, second only to Finland’s carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. , which was implemented a year earlier.

- Sweden levies the highest carbon taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate in the world, at SEK 1,190 (US $126) per metric ton of CO2. The tax is primarily levied on fossil fuels used for heating purposes and motor fuels.

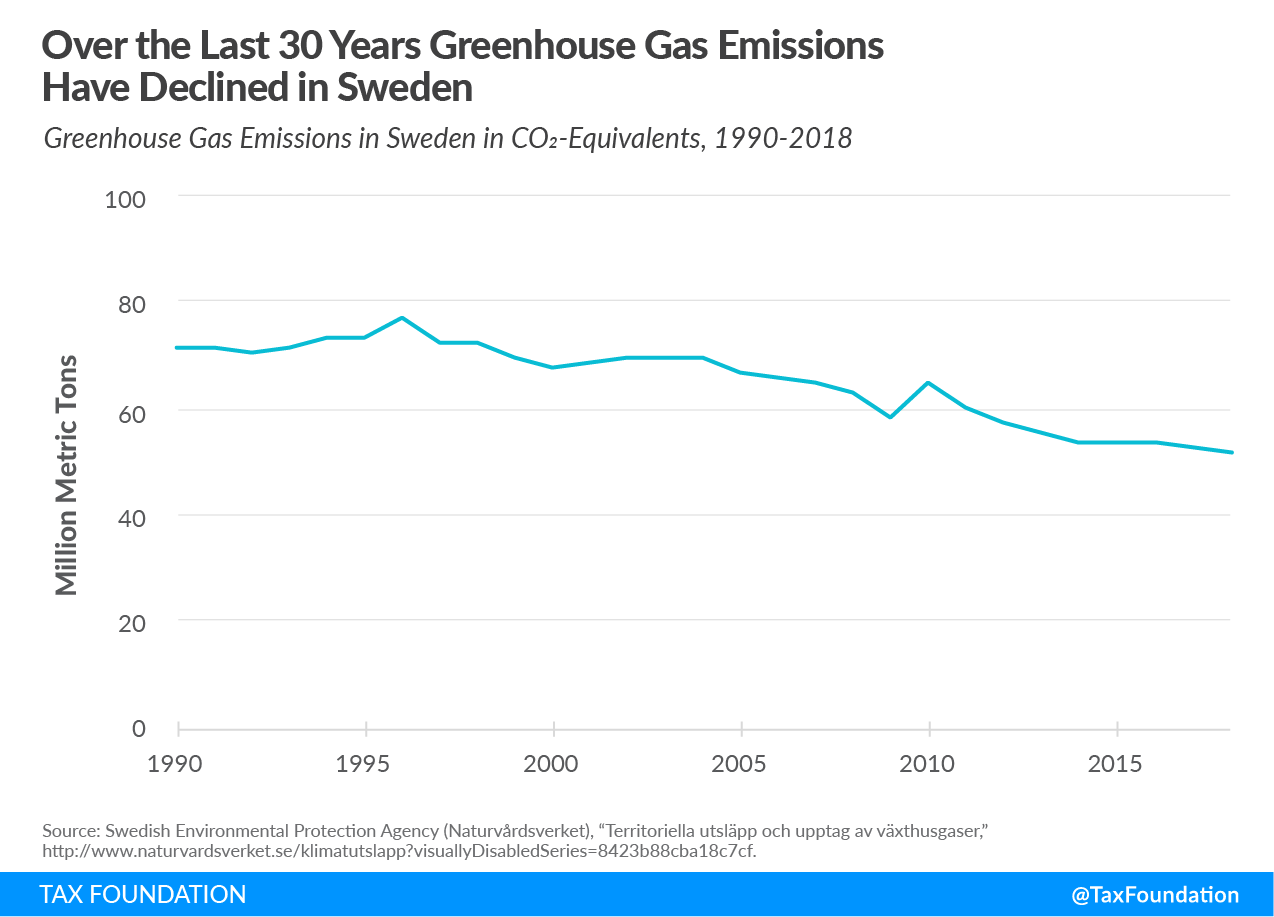

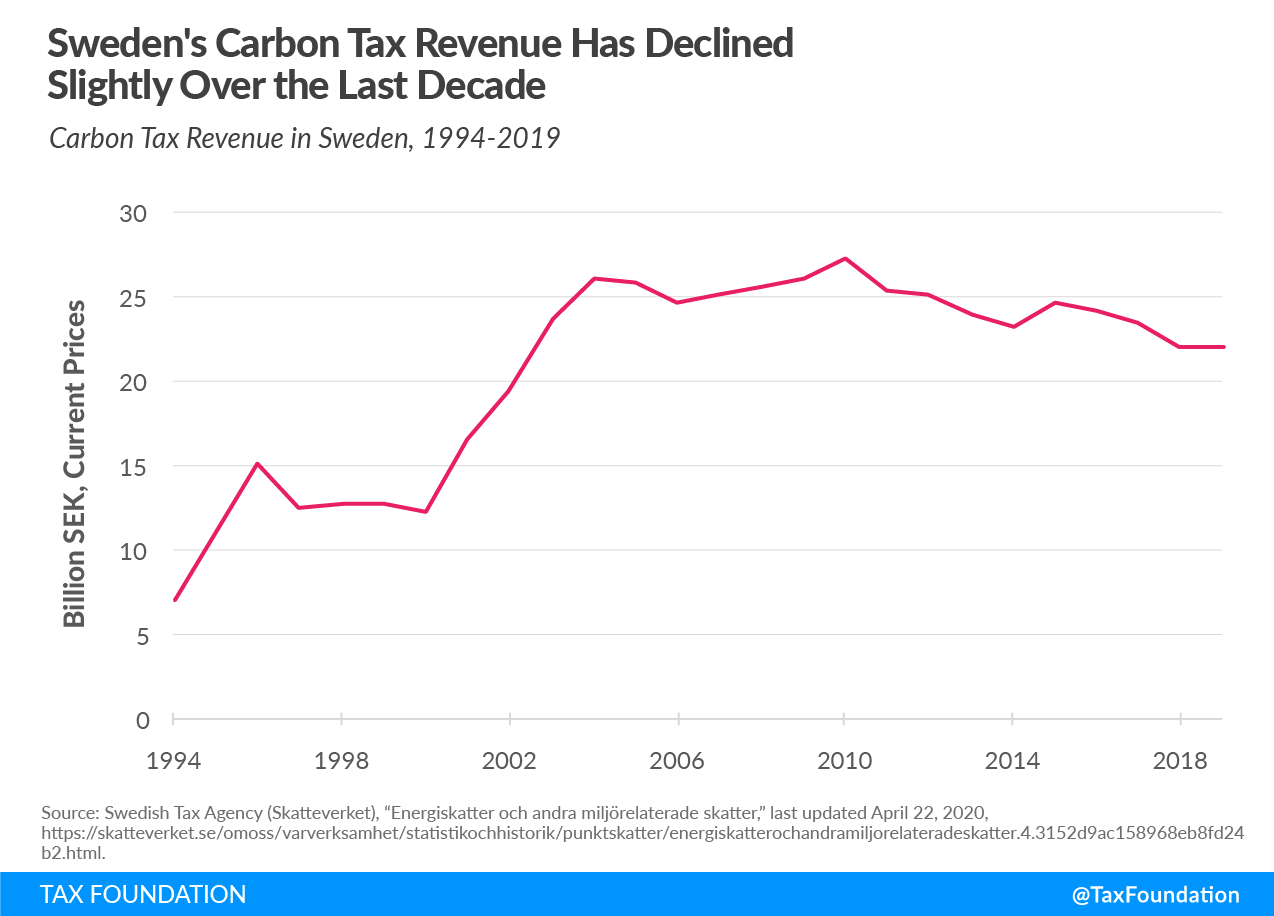

- Since the carbon tax was implemented 30 years ago, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Sweden’s carbon tax revenues are significant but have been decreasing slightly over the last decade.

- Due to numerous exemptions, Sweden’s carbon tax covers only about 40 percent of all greenhouse gases emitted nationally. While some of the exempted industries are subject to the EU ETS (the European Union Emission Trading Scheme, which generally levies a lower carbon price), others are not subject to any type of carbon pricing. Levying a single carbon tax on all sectors would eliminate these distortions and potentially further reduce emissions.

- The carbon tax is one of several environmental levies in Sweden; other levies include the energy tax, aviation tax, and vehicle tax. Sweden also participates in the EU ETS.

Table of Contents

- Introduction

- Design of Sweden’s Carbon Tax

- — Carbon Tax Base

- — Carbon Tax Rate

- — Points of Taxation

- Thirty Years of Taxing Carbon: Effects on GDP, Carbon Emissions, and Tax Revenue

- — Economic Development

- — Carbon Emissions

- — Carbon Tax Revenue

- — Criticism of Sweden’s Approach to Taxing Carbon

- Sweden’s Other Environmental Taxes

- — Energy Tax

- — Aviation Tax

- — EU Emissions Trading Scheme (EU ETS)

- — Taxes on Vehicles

- Carbon Taxes around the World

- — Finland

- — Canada

- Conclusion

Introduction

In 1896, Swedish scientist Svante Arrhenius was the first to calculate how increases in atmospheric carbon dioxide could raise Earth’s surface temperature through the greenhouse effect.[1] A century later, Sweden was one of the earliest adopters of a tax on carbon, implementing it in 1991, just one year after Finland, which was the first country to do so.[2]

Sweden has a long history of levying taxes on energy products. This tradition, combined with infrastructure for energy taxes in place, may have made it easier to implement a carbon tax in Sweden. Petrol has been taxed since 1924, diesel has been taxed since 1937, and coal, oil, and electricity for heating purposes have been taxed since the 1950s. The levy on all these energy products is a single tax, the so-called energiskatt, or “energy tax.” When implemented, this tax was not considered an environmental measure, but rather a fiscal tool purely used to raise tax revenue.[3]

Prior to the implementation of the carbon tax, most environmental measures consisted of regulations and prohibitions. It was not until the 1980s that a consensus began building for the use of more economic instruments. In 1987, economics professor Erik Dahmén wrote an article in Svensk Tidskrift titled “The environment and the market.” He noted that all political parties in Sweden seem to have underestimated market mechanisms as a potential tool to reduce emissions, as they considered regulations the only viable option.[4] However, this was about to change in Sweden. On March 24, 1988, Swedish meteorologist Bert Bohlin, who would later become the first chairman of the Intergovernmental Panel on Climate Change (IPCC), published an article in Sweden’s major daily newspaper Dagens Nyheter, proposing that Sweden should implement a tax on carbon.[5]

Growing environmental concerns, combined with the historical taxing of energy products and a new awareness of market mechanisms that can address environmental issues, led to Sweden’s implementation of a carbon tax in 1991. At the same time, the already existing energy tax was lowered, as it was seen as a complementary rather than separate environmental levy to the new carbon tax. These two taxes have shaped Sweden’s environmental policy for the last 30 years.

The implementation of the carbon tax was part of a major tax reform in 1990-1991 that had grön skatteväxling as one of its aims. Loosely translating to “green tax-switch,” it means that environmental taxes increase while other taxes decrease. In 1990-1991, the marginal income tax rate for individuals was significantly reduced, lowering the highest rates from 80 percent to 50 percent. The corporate tax rate was lowered from 57 to 30 percent (while the corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. was broadened), and capital income—interest, dividends, and capital gains—were taxed at a uniform rate of 30 percent.[6] In addition, during the last 30 years, Sweden has abolished or reformed several other taxes to encourage economic growth, including the abolition of the inheritance taxAn inheritance tax is levied upon the value of inherited assets received by a beneficiary after a decedent’s death. Not to be confused with estate taxes, which are paid by the decedent’s estate based on the size of the total estate before assets are distributed, inheritance taxes are paid by the recipient or heir based on the value of the bequest received. in 2004, the entrepreneurial tax in 2005, and the wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. in 2007.[7] Note that these changes have been undertaken by left-wing as well as right-wing governments.

This report describes the most important features of Sweden’s carbon tax, provides an insight into how GDP, emissions, and carbon tax revenues have been developing since the tax was first implemented in 1991, summarizes some of the criticism of the Swedish carbon tax that has emerged in recent years, discusses other environmental levies Sweden has introduced, and, finally, draws comparisons to the Finnish and Canadian carbon taxes.

Design of Sweden’s Carbon Tax

Since its implementation in 1991, Sweden’s carbon tax has been modified multiple times. Today, compared to other countries’ carbon taxes, it is characterized by a high tax rate that is predominantly levied on fossil fuels used as motor fuels and for heating purposes.

Carbon Tax Base

The carbon tax targets fossil fuels—such as petrol, oil, and coal—used for heating purposes as well as motor fuels. The tax is calculated based on the estimated amount of CO2 emissions covered energy products emit upon combustion—a measure that is based on the so-called carbon content of fossil fuels.

Major exemptions have been part of the Swedish carbon tax since its implementation. The industrial sector constitutes the most significant exemption. (Large parts of the sector, however, were subjected to the European Union Emission Trading Scheme (EU ETS) when it was launched in 2005.) Other sector exemptions include mining, agriculture, and forestry.

In addition to the various sector exemptions, there are also exemptions for fuel depending on its use. For example, fuel used for purposes other than motors or heating is not subject to the tax. Commercial use of fuel for maritime or aviation purposes is also exempt.[8]

Taking these exemptions into account, the Swedish carbon tax covers approximately 40 percent of Sweden’s greenhouse gases.[9]

Carbon Tax Rate

In 2020, the carbon tax rate stands at SEK 1,190 (US $126[10]) per metric ton of CO2. The tax rate has been increasing gradually since the tax was first implemented in 1991 at SEK 250 ($26) per ton of CO2. There was a sharp increase in the tax rate in the early 2000s, when it was raised from around SEK 300 ($32) in 2000 to around SEK 900 ($95) in 2004.[11]

Historically, a lower tax rate was applied to the industrial sector outside the EU ETS. (The part of the industrial sector covered by EU ETS is entirely exempt from the national carbon tax.) For some industries the carbon tax was capped (see more in “Criticism of Sweden’s Approach to Taxing Carbon”). In 2018, however, the tax rate for the industrial sector outside the EU ETS was raised to align with the general rate.[12]

Points of Taxation

The tax on the fossil fuels covered is collected upon either consumption or delivery to a non-registered taxpayer. As there is effectively no production of fossil fuels in Sweden, taxpayers consist solely of importers, distributors, and large consumers.[13]

Using importers, distributors, and large consumers as the points of taxation results in a relatively low administrative burden, as they are significantly fewer in numbers than, say, final consumers. For example, gas delivered to gas stations is already taxed at the importer or distributor level, meaning that no tax has to be administered on the gas station operator or the final consumer purchasing the gas at the pump.

It is important to note here that the legal incidence differs from the economic incidence of the carbon tax. Although levied at the importer, distributor, or large consumer level, the costs are likely fully or partially passed on to consumers and businesses further down in the supply chain. In the case of gas, for example, the tax is ultimately borne by the distributors or owners of gas stations through lower profits or lower wages, as well as by the final consumer through higher gas prices.[14]

Thirty Years of Taxing Carbon: Effects on GDP, Carbon Emissions, and Tax Revenue

Thirty years have passed since Sweden’s carbon tax was first implemented. How has it performed? This chapter provides some insight into the economic development during that time, how emissions have been reduced, the revenue raised through the tax, and, finally, some criticism of the design of the tax that has emerged in recent years.

Economic Development

Since the implementation of the carbon tax 30 years ago, Sweden has been able to reduce carbon emissions while maintaining solid GDP growth. In fact, GDP per capita increased in real terms by more than 50 percent between 1990 and 2019.[15] However, while frequently highlighted by Swedish politicians, it is difficult to disentangle the relationship between carbon taxes and GDP growth.

An empirical 2019 study by economist Gilbert Metcalf found no adverse impact of Canadian British Columbia’s carbon tax on the region’s GDP between 1990 and 2016. For European Union countries his findings suggest that carbon taxes may even have had a slightly positive impact on GDP. Metcalf suggests that this slightly positive effect may be partially due to carbon tax revenue being used to lower other types of taxes, as has been the case in Sweden.[16]

Carbon Emissions

Between 1990 and 2018, Sweden decreased its greenhouse gas emissions by 27 percent, most of that since the early 2000s. According to the Swedish environmental protection agency, the largest reductions in emissions come from heating homes and industrial facilities. In recent years, lower emissions in the industrial sector and in domestic transport have also significantly contributed to the overall reduction in emissions. Among other measures, the carbon tax as well as a push for CO2-free electricity production (e.g., through hydropower and nuclear power) have facilitated the cut in emissions.[17]

In terms of emission reductions, a carbon tax is most successful if both businesses and households have realistic alternatives to fossil fuels at hand. In the Swedish case, CO2-free electricity production through hydropower, nuclear power, solar power, and wind power has been expanded, providing an alternative to fossil fuels.

Carbon Tax Revenue

The revenue raised through the carbon tax was increasing steadily up to around 2004, when it stabilized until 2010 before declining slightly over the last decade. In 2019, Sweden’s carbon tax raised SEK 22.2 billion ($2.3 billion),[18] or approximately 1 percent of total tax revenues.[19]

The fluctuations in revenues are due to a gradually rising carbon tax rate, a declining tax base (carbon emissions have gradually decreased), and modifications to the exemptions and rate reductions for certain sectors. The rapid increase in revenue between 2000 and 2004 is due to a sharp increase in the carbon tax rate, tripling from around SEK 300 ($32) in 2000 to around SEK 900 ($95) in 2004.[20]

Sweden’s carbon tax revenue is not earmarked, and thus goes into the overall government budget. Other countries, as discussed in a later chapter, do earmark their carbon tax revenues.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeCriticism of Sweden’s Approach to Taxing Carbon

Sweden’s carbon tax, however, has not been without its critics, especially in recent years. In 2019, an expert group from the Stockholm School of Economics concluded that the carbon tax’s effect on emission reductions has been below its potential. The study focused on CO2 emitted by Swedish companies between 1990-2008 and found that while many companies cut their emissions, the large pollution sectors that were responsible for 70-75 percent of Sweden’s emissions did in fact not cut their emissions but potentially even increased them. Large polluters are mainly companies that manufacture construction material such as steel and concrete.

According to Per Strömberg, a professor at the university and coauthor of the report, one of the main reasons for the failure is the cap—a maximum amount of carbon tax a single taxpayer can be required to pay—that applied to many major polluters before they became subject to the EU ETS. The cap was originally implemented to alleviate the tax burden on very large polluters, such as the steel industry, that may have been put out of business if they had to pay the tax on the total amount of emissions. However, for these large polluters that exceeded the cap, the marginal emission did not face a tax, and thus these businesses had no incentive to decrease their emissions.

In addition to the cap, the Swedish steel industry had also been largely exempted from carbon taxation until the introduction of the EU ETS. This was due to the steel industry being considered of national interest and it realistically not being able to decrease its emissions within a short period of time. Professor Strömberg concludes by stating that the tax would be more effective if it had a lower tax rate applied to all emitters instead of the current high tax rate combined with its various exemptions, as this would incentivize all polluters to lower emissions.[21],[22] With the introduction of the EU ETS and the phasing out of exemptions the Swedish government has been taking steps in the direction proposed by Strömberg and others.

A 2014 report by Jacob Lundberg argues that the Swedish carbon tax rate is unreasonably high. Comparing different models for calculating the optimal carbon tax rate, he concludes that the carbon tax rate should not exceed SEK 300-400 ($32-42) per metric ton of carbon—a significant difference to the current rate of SEK 1,190 ($126). Lundberg, like Strömberg and others, also points out that the effectiveness of the Swedish carbon tax is likely undermined by its many exemptions.[23]

Sweden’s Other Environmental Taxes

Even though the carbon tax is viewed as the cornerstone of Sweden’s environmental policy, it is only one of a number of environmental levies. Over the last 30 years, Sweden has continuously been one of the most progressive countries in the world when it comes to environmental reforms. The following section provides a brief overview of other environmental taxes Sweden levies and how they interact with its carbon tax.

Energy Tax

The energy tax was first introduced in 1924 and levied on petrol. It was extended to diesel in 1937, and to gas oil, coal, and electricity used for heating purposes during the 1950s. Natural gas and liquefied petroleum gas (LPG) were later added as taxable products. Even though the energy tax was lowered when the carbon tax was implemented, it was never abolished. The energy tax, unlike the carbon tax, is often primarily considered a tax aimed at raising revenue rather than changing consumer behavior. A number of products are subject to both the carbon tax and the energy tax. For example, the gasoline price for consumers consists of the carbon tax, the energy tax, as well as the Value-added Tax (VAT), in addition to the manufacturing costs and profits.

Aviation Tax

The Chicago convention prohibits countries from taxing aviation fuel used for international flights. Hence, neither the carbon tax nor the energy tax applies to the aviation industry. To address this gap, Sweden imposes a so-called flight tax which puts a fixed duty rate on all flight tickets. The duty rate differs depending on the destination, with lower rates for shorter distances and domestic and European destinations.[24] In this case, the coexistence of the flight tax and the carbon tax does not lead to double taxation. Instead, the flight tax complements the carbon tax in an area where the carbon tax cannot be applied due to legal restrictions.

EU Emissions Trading Scheme (EU ETS)

The EU ETS was implemented in Sweden in 2005 under the emissions trading directive.[25] The EU ETS constitutes a market-based solution to reduce carbon emissions by providing emission permits that European countries and companies can trade. As the number of permits on the market is restricted, it indirectly puts a price on carbon and thus functions similarly to a carbon tax. The EU ETS mainly targets heavy industry and power plants.

To avoid double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. , Sweden excluded all industries affected by the EU ETS from the national carbon tax. However, this has had implications on businesses in Sweden. While the carbon tax rate has remained relatively high (and generally increased), the price for emission permits has on average been relatively low. As a result, businesses subject to the carbon tax pay a much higher price for emitting carbon than a business subject to the EU ETS.[26]

Taxes on Vehicles

In addition to taxing emissions and fuel directly, Sweden also taxes vehicles. The so-called vehicle tax is applied annually. The tax can be seen as both fiscal and environmental as it is applied to almost all types of vehicles, and vehicles have, regardless of environmental reasons, always been taxed to some degree.

In 2018, the Swedish government implemented a system known as the “bonus-malus system.” This system ranks vehicles on a scale based on a vehicle’s average carbon emissions. The lower carbon emissions a vehicle has, the lower the vehicle tax. It is too early to fully evaluate the effects of the bonus-malus system but there are indications that both sales and the value of used cars have increased.

Furthermore, driving a vehicle in certain areas in Sweden can also subject you to a congestion charge—an extra fee paid for driving inside major cities such as Stockholm.

Carbon Taxes around the World

This chapter will give a brief overview of two other countries’ carbon taxes, namely Finland and Canada. As previously stated, Finland was the first country to introduce a carbon tax, in 1990. Since Sweden’s carbon tax was imposed just a year later, and given the two countries’ demographic and economic similarities, Finland’s carbon tax is a natural pick for comparison. Canada’s federal carbon tax was implemented just last year, making it one of the most recent initiatives.

Finland

Much like Sweden, Finland implemented a number of exemptions right from the beginning to minimize the tax’s potential negative effects on certain industries. This includes peat and natural gas having a favorable deduction scheme for the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. to partially offset the carbon tax, as well as Finland’s export-oriented wood industry being exempted from the carbon tax altogether. Finally, fuels used in industrial production as raw material or manufacturing input have also been exempted.[27]

As Finland has implemented carveouts similar to Sweden, the Finnish carbon tax faces similar criticism. Exempting, or favorable treatment of, major polluters leads to lower emission reductions, as those sectors are not facing the disincentivizing effect of the carbon tax. Furthermore, there has also been criticism regarding administrative issues, as stated in a working group report of the Finnish prime minister’s economic council regarding Finland’s commitment to the Kyoto protocol in 2000:

“The Finnish environmental and energy tax system is the product of a number of conflicting factors. In addition to furnishing the government with revenues, the taxes collected have also been used to promote various policy goals involving environmental, energy and transport considerations. Administering the system has proved complicated and difficult. This is partly because of tax subsidies and partly because of procedures related to combined heat and power production (CHP). The system has also been changed several times.”[28]

In conclusion, the Finnish tax on carbon is in many ways similar to Sweden’s carbon tax. Both are characterized by early implementation as well as providing several exemptions for different industries.

Canada

The Canadian federal carbon tax was implemented in 2019, making it one of the most recent carbon pricing initiatives. The tax is implemented at the provincial level if a province either does not already levy a carbon tax or if its carbon tax does not meet federal standards. As of 2020, all provinces without a carbon tax that meets federal standards are subject to the federal carbon tax.[29]

The structure of the tax differs depending on the province. Some provinces have implemented the federal carbon tax, some have an alternative regional carbon tax, and others are currently involved in a legal process that aims to avoid the implementation of a carbon tax. However, all carbon taxes upon implementation seem to follow a similar structure: There is a single carbon tax rate for smaller businesses and households while industrial emitters face a separate carbon pricing scheme based on a portion of their emissions rather than on fuel purchases.[30]

The Canadian government has promised that all the carbon tax revenue collected from a province will be returned to that province in one way or another. Canada has put a carbon dividend system in place to secure the popularity of the carbon tax and to alleviate its economic and distributional burden. Citizens in provinces that have fully implemented the tax are eligible for a tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. based on the carbon tax revenues. This credit can either reduce an individual’s tax bill or, in the case of a negative income tax, increase a tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s. by the same amount.[31]

Conclusion

Carbon taxation is sometimes viewed, maybe rightfully so, as the reform to end all other reforms when it comes to climate change. If well designed, carbon taxes provide an incentive to cut emissions on a large scale with comparably low economic costs. In 2019, over 3,000 economists, including all former chairs of the Federal Reserve and numerous Nobel Laureates, stated in the largest public statement of economists in history that carbon taxes are the most cost-effective mechanism to decrease emission levels at the speed and scale necessary.[32]

Sweden’s carbon tax can be described as relatively narrow, as only 40 percent of its greenhouse gases are covered. Certain industries are either exempt from the carbon tax or subject to the—generally lower-rate—EU ETS. Sweden levies the highest carbon tax rate in the world, at 1,190 SEK ($126) per metric ton of CO2.

Between 1990 and 2018, Sweden has decreased its greenhouse gas emissions by 27 percent. Research indicates that the Swedish carbon tax has incentivized some businesses to lower their emissions; however, due to various exemptions and carveouts, very large polluters and exempted industries may not have reduced their emissions, leaving the Swedish carbon tax below its emission reduction potential.

The Swedish example, along with other carbon taxes around the world, provides several lessons. First, the large discrepancy between the tax rate of the national carbon tax and the implied tax rate of the EU ETS can lead to distortions, favoring EU ETS-covered businesses over businesses subject to the national tax.[33] Second, Sweden’s comparably very high carbon tax rate arguably led to exemptions of sectors that are particularly affected by international competition but also considered large polluters which, in turn, may leave the carbon tax below its emission reduction potential. A lower standard tax rate applied to all sectors instead of the high tax rate combined with exemptions could eliminate this distortion. Finally, the Canadian carbon dividend system provides an example of how the economic and distributional impact of carbon taxes can be addressed—something to consider in a high-tax country such as Sweden.

[1] Svante Arrhenius, Ueber den Einfluss des atmosphärischen Kohlensäuregehalts auf die Temperatur der Erdoberfläche (Stockholm: Kungliga Vetenskapsakademien, 1896).

[2] World Bank, “Carbon Pricing Dashboard,” last updated Apr. 1, 2020, https://carbonpricingdashboard.worldbank.org/map_data.

[3] Henrik Hammar and Susanne Åkerfeldt, “CO2 taxation in Sweden: 20 years of experience and looking ahead,” Global Utmaning, 2011, https://www.globalutmaning.se/wp-content/uploads/sites/8/2011/10/Swedish_Carbon_Tax_Akerfedlt-Hammar.pdf.

[4] Erik Dahmén, “Miljön och marknaden,” Svensk Tidskrift, Dec. 31, 1987, https://www.svensktidskrift.se/erik-dahmen-miljon-och-marknaden/.

[5] Bert Bolin and Måns Lönnroth, “Introduce a tax on Carbon Dioxide,” Dagens Nyheter, Mar. 24, 1988, http://www.galileomovement.com.au/docs/BertBolin-articleDN-March24-1988.pdf.

[6] Government Offices of Sweden (Regeringskansliet), “Budgetpropositionen för 1998: Bilaga 6,” Sept. 11, 1997, https://www.regeringen.se/rattsliga-dokument/proposition/1997/09/prop.-1997981-/.

[7] Anders Ydstedt and Amanda Wollstad, “Ten years without the Swedish inheritance tax: Mourned by no one – missed by few,” Confederation of Swedish Enterprise, December 2015, https://www.svensktnaringsliv.se/bilder_och_dokument/inheritance-taxpdf_636574.html/BINARY/Inheritance%20tax.pdf.

[8] Tax and Customs Department (Skatte och tullavdelningen), “Höjd energiskatt och koldioxidskatt på bränslen vid viss användning samt höjd skatt på kemikalier i viss elektronik,” 2019, https://www.regeringen.se/490aef/contentassets/e9aac44d7310494da86ab1b49b5bc1ba/hojd-energiskatt-och-koldioxidskatt-pa-branslen-vid-viss-anvandning-samt-hojd-skatt-pa-kemikalier-i-viss-elektronik.pdf.

[9] World Bank, “Carbon Pricing Dashboard.” Greenhouse gases broadly include CO2, methane, nitrous oxide, and fluorinated gases.

[10] The 2019 average yearly exchange rate was used (9.457). See Internal Revenue Service, “Yearly Average Currency Exchange Rates,” accessed Aug. 4, 2020, https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates.

[11] Government Offices of Sweden (Regeringskansliet), “Sweden’s carbon tax,” updated Feb. 25, 2020, https://www.government.se/government-policy/taxes-and-tariffs/swedens-carbon-tax/.

[12] Ibid.

[13] Hammar and Åkerfeldt, “CO2 taxation in Sweden: 20 years of experience and looking ahead.”

[14] Henrik Scharin and Jenny Wallström, “The Swedish CO2 tax – an overview,” Mar. 5, 2018, http://www.enveco.se/wp-content/uploads/2018/03/Anthesis-Enveco-rapport-2018-3.-The-Swedish-CO2-tax-an-overview.pdf.

[15] OECD, “Gross domestic product (GDP): GDP per capita, USD, constant prices and PPPs, reference year 2005,” https://stats.oecd.org/index.aspx?queryid=61432#.

[16] Gilbert E. Metcalf, “On the Economics of a Carbon Tax for the United States,” Brookings Institution, Mar. 7, 2019, https://www.brookings.edu/wp-content/uploads/2019/03/Metcalf_web.pdf. Another empirical study, Gilbert E. Metcalf and James H. Stock, “Measuring the Macroeconomic Impact of Carbon Taxes,” AEA Papers and Proceedings 110 (March 2020), 101-06, https://doi.org/10.1257/pandp.20201081, shows similar results, suggesting no or slightly positive effects of carbon taxes on GDP and employment. Unlike these empirical studies, economic modeling of carbon taxes frequently suggests slightly negative economic impacts; see Alexander R. Barron, Allen A. Fawcett, Marc A.C. Hafstead, James R. McFarland, and Adele C. Morris, “Policy Insights from the EMF 32 Study on U.S. Carbon Tax Scenarios,” Climate Change Economics 9:1 (March 2018).

[17] Swedish Environmental Protection Agency (Naturvårdsverket), “Territoriella utsläpp och upptag av växthusgaser,” last updated Dec. 12, 2019, http://www.naturvardsverket.se/Sa-mar-miljon/Statistik-A-O/Vaxthusgaser-territoriella-utslapp-och-upptag/.

[18] Swedish Tax Agency (Skatteverket), “Energiskatter och andra miljörelaterade skatter,” last updated April 22, 2020, https://skatteverket.se/omoss/varverksamhet/statistikochhistorik/punktskatter/energiskatterochandramiljorelateradeskatter.4.3152d9ac158968eb8fd24b2.html.

[19] OECD, “Global Revenue Statistics Database,” last updated July 23, 2020, https://stats.oecd.org/Index.aspx?DataSetCode=RS_GBL.

[20] Government Offices of Sweden (Regeringskansliet), “Sweden’s carbon tax.”

[21] Sveriges Television,“Forskning: Svensk koldioxidskatt ineffektiv,” Dec. 7, 2019, https://www.svt.se/nyheter/inrikes/forskning-svensk-koldioxidskatt-ineffektiv. As of August 2020, the report referenced in SVT has not been published but is set to be published in its entirety later in 2020. The report will be published as Gustav Martinsson, Laszlo Sajtos, Per Strömberg, and Christian Thomann, “The world’s highest carbon tax,” and will be available at https://www.hhs.se/en/houseoffinance/about/people/people-container/per-stromberg/.

[22] Boqiang Lin and Xuehui Li, “The effect of carbon tax on per capita CO2 emissions,” Energy Policy 39:9 (September 2011), 5137-5146, https://ideas.repec.org/a/eee/enepol/v39y2011i9p5137-5146.html, empirically studies the effect of carbon taxes on emissions for Denmark, Finland, Netherlands, Norway, and Sweden. For Sweden, they find the effect to be negative but not significant, and they, like Per Strömberg, also suggest that the mitigation effects of the carbon tax have been weakened due to the tax exemption of certain energy-intensive industries.

[23] Jacob Lundberg, “Rätt pris på koldioxid,” Timbro, November 2014, https://timbro.se/app/uploads/2017/01/ratt_pris_pa_koldioxid_101.pdf.

[24] European Commission, “Taxes in the field of aviation and their impact,” June 6, 2019, https://op.europa.eu/en/publication-detail/-/publication/0b1c6cdd-88d3-11e9-9369-01aa75ed71a1.

[25] European Union, “Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a scheme for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC,” Oct. 25, 2003, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32003L0087.

[26] Svebio, “Koldioxidskatt,” https://www.svebio.se/vi-verkar-for/koldioxidskatt/.

[27] Sustain able!, “Carbon tax system in Finland,” Feb. 7, 2013, https://blogs.ubc.ca/rosonluo/2013/02/07/finlands-carbon-tax-system/.

[28] Economic Council of the Finnish Prime Minister’s Office, “Environmental and Energy Taxation in Finland,” 2000,

[29] The Canadian Press, “How carbon pricing works across the country,” Global News, Jan. 20, 2020, https://globalnews.ca/news/6438852/carbon-tax-canada-by-province/.

[30] Kathryn Harrison, “Commentary: How Canada’s carbon tax works,” Global News, Updated Sept. 12, 2019, https://globalnews.ca/news/5125670/how-the-carbon-tax-works/.

[31] Ibid.

[32] The Wall Street Journal, “Economists’ statement on carbon dividends,” Jan. 17, 2019, https://clcouncil.org/economists-statement/.

[33] Price volatility can also discourage clean investment, as discussed in Florens Flues and Kurt van Dender, “Carbon pricing design: Effectiveness, efficiency and feasibility,” OECD Taxation Working Papers No. 48, June 22, 2020, https://doi.org/10.1787/22235558. ETS tend to produce more volatile prices, which might affect clean investments by Sweden’s ETS-covered industries.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe