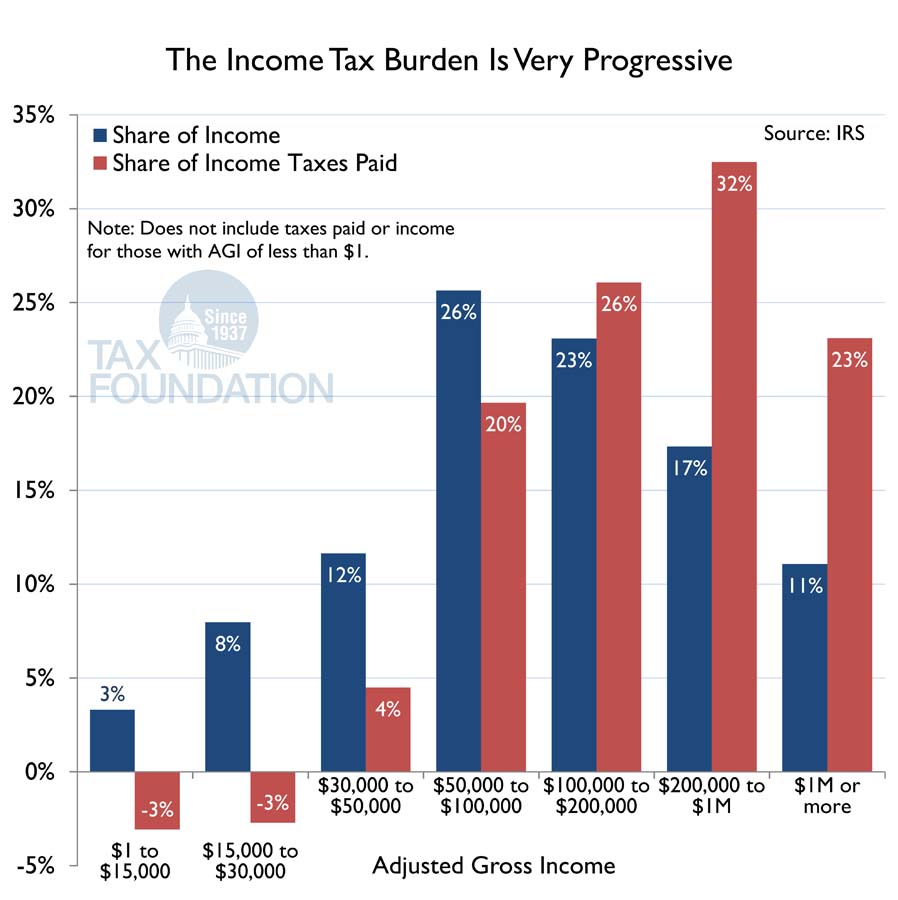

About half of the nation’s income is reported by taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. payers who make less than $100,000, and half is reported by taxpayers who make more. However, taxpayers who make less than $100,000 collectively pay just 18 percent of all income taxes while those who make more pay over 80 percent of all income taxes. The share of income taxes paid by upper-income Americans, those who earn $200,000 or more, is twice their share of the nation’s income and accounts for more than half of all income taxes paid in 2011. Those making less than $30,000 receive more back from the IRS than they pay in income taxes due to such preferences as the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. and the Child Credit.

For more charts like the one below, see the second edition of our chart book, Putting a Face on America’s Tax Returns.

Share