All Related Articles

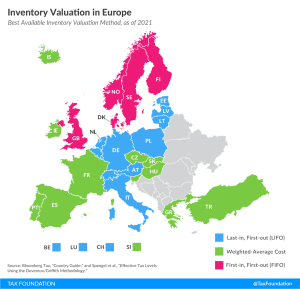

Inventory Valuation in Europe

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

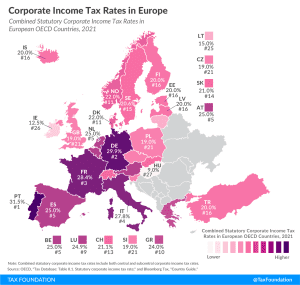

Corporate Income Tax Rates in Europe, 2021

On average, European OECD countries currently levy a corporate income tax rate of 21.7 percent. This is below the worldwide average which, measured across 177 jurisdictions, was 23.9 percent in 2020.

2 min read

Marginal Effective Tax Rates and the 2021 UK Budget

The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent in 2023. These policies have differential impacts on marginal effective tax rates for different assets, implying investment incentives will not be uniform.

15 min read

The EU Determined to Reform the Business Tax

The EU recently launched a consultation to reform the business tax system, which will outline the priorities for corporate taxation over the coming years to meet the needs of a globalized economy that struggles to recover from the consequences of the COVID-19 crisis. It will also set EU actions regarding the ongoing international discussion on the taxation of the digital economy and a global minimum tax.

3 min read

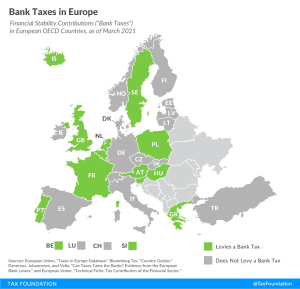

Bank Taxes in Europe

Today’s map shows which European OECD countries implemented financial stability contributions (FSCs), commonly referred to as “bank taxes.”

2 min read

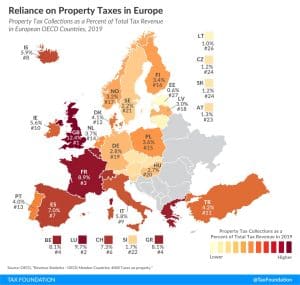

Reliance on Property Taxes in Europe

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as property taxes on land and buildings) the only ones levied by all countries covered. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

1 min read

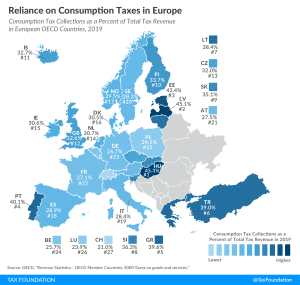

Reliance on Consumption Taxes in Europe

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

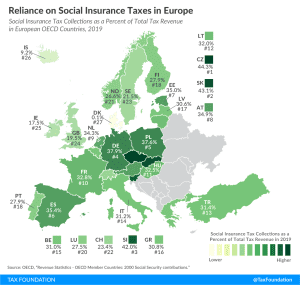

Reliance on Social Insurance Tax Revenue in Europe

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

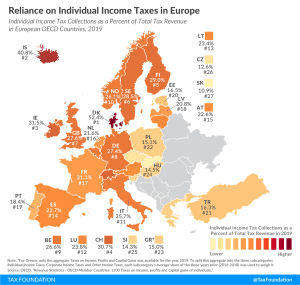

Reliance on Individual Income Tax Revenue in Europe

Denmark relies the most on revenue from individual income taxes, at 52.4 percent of total tax revenue, followed by Iceland and Ireland at 40.8 percent and 31.5 percent, respectively.

1 min read

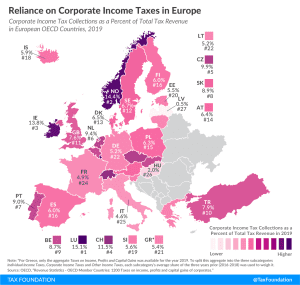

Reliance on Corporate Income Tax Revenue in Europe

Despite declining corporate income tax rates over the last 30 years in Europe (and other parts of the world), average revenue from corporate income taxes as a share of total tax revenue has not changed significantly compared to 1990.

1 min read