All Related Articles

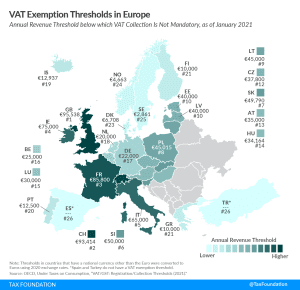

VAT Exemption Thresholds in Europe

To reduce tax compliance and administrative costs, most countries have VAT exemption thresholds: If a business is below a certain annual revenue threshold, it is not required to participate in the VAT system.

2 min read

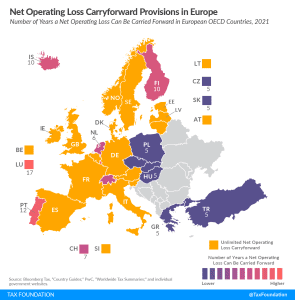

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2021

Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

7 min read

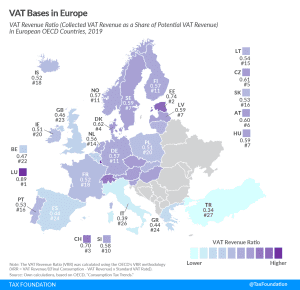

VAT Bases in Europe

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

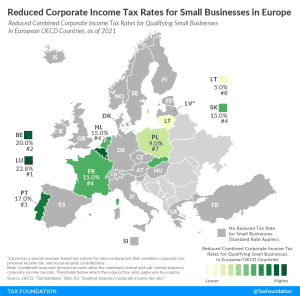

Reduced Corporate Income Tax Rates for Small Businesses in Europe

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate tax rate on businesses that have revenues or profits below a certain threshold.

3 min read

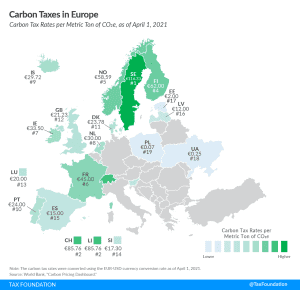

Carbon Taxes in Europe, 2021

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

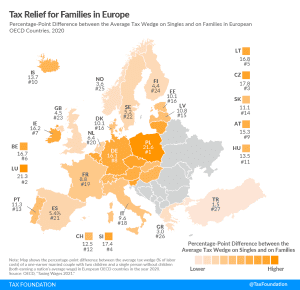

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

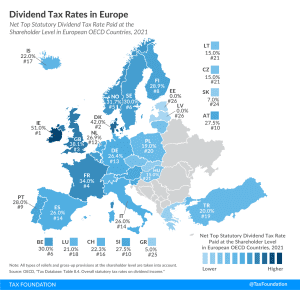

Dividend Tax Rates in Europe, 2021

2 min read

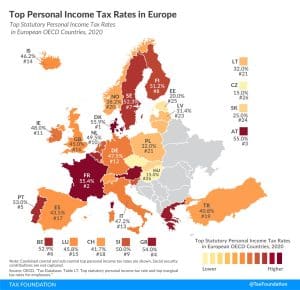

Top Personal Income Tax Rates in Europe, 2021

Most countries’ personal income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across Europe, with Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) having the highest top statutory personal income tax rates among European OECD countries.

3 min read

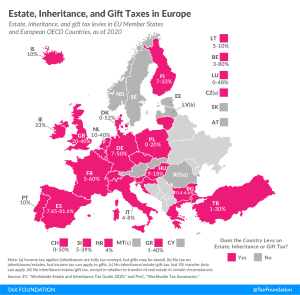

Estate, Inheritance, and Gift Taxes in Europe, 2021

Estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes.

3 min read