Real Property Taxes in Europe, 2020

3 min readBy:Early property taxes, which were first implemented in feudal times, were levied primarily against land. Hence, property tax was paid mostly by those that worked as farmers. In modern times, property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. is also levied against assets like real estate. The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. is paid on a recurrent basis on property owned by individuals or legal entities.

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

Nineteen of the 27 countries covered allow businesses to deduct property or land tax from corporate income, which mitigates the tax burden of the tax and encourages businesses to invest.

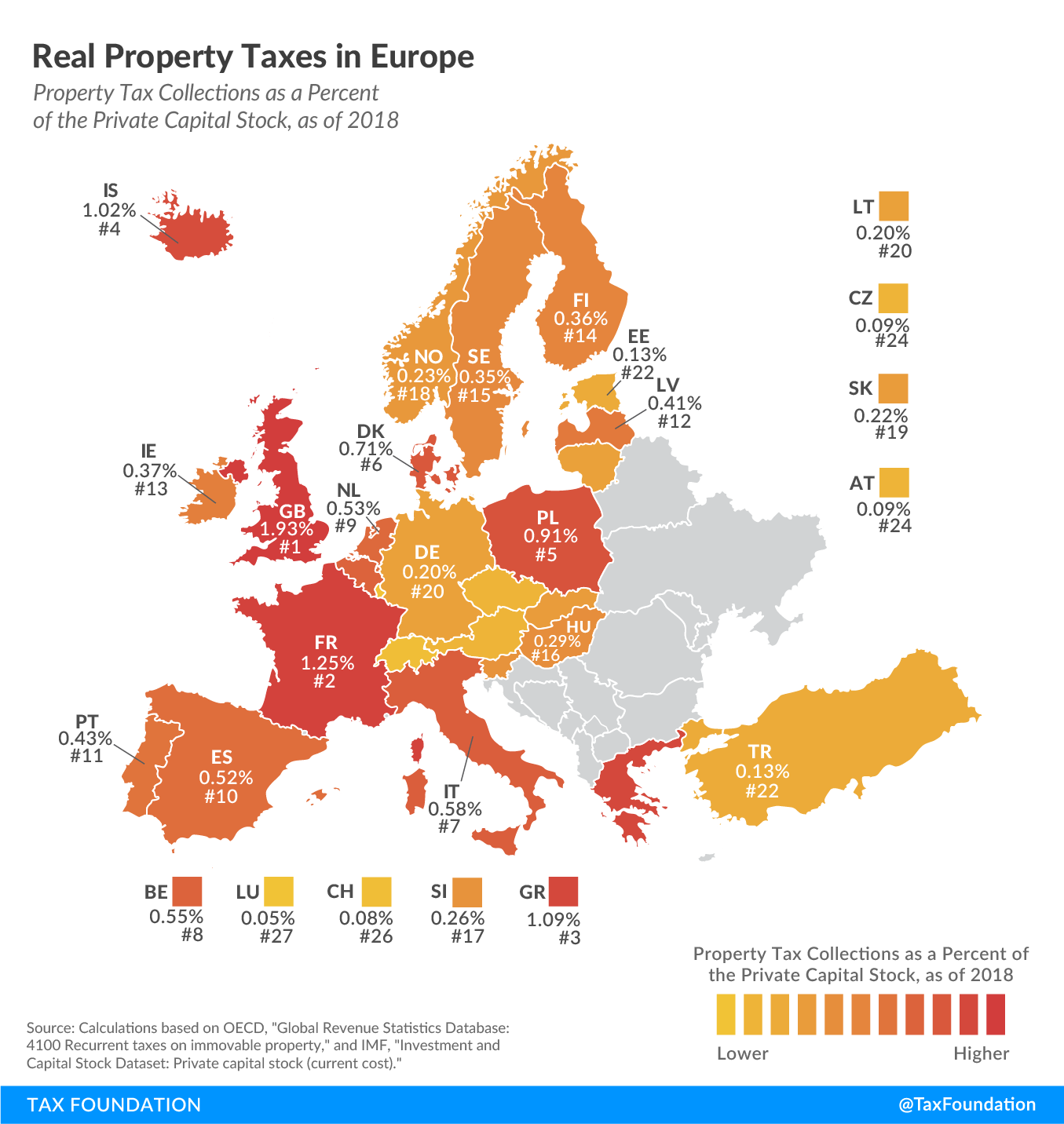

Luxembourg has the lowest property tax as a share of private capital stock, at 0.05 percent. Switzerland has the second-lowest share, at 0.08 percent, followed by the Czech Republic and Austria, both at 0.09 percent. The highest property taxes as a share of the private capital stock occur in the United Kingdom (1.93 percent), France (1.25 percent), and Greece (1.09 percent).

Estonia is the only country in this map which taxes only land, meaning that its real property tax is the most efficient.

| Country | Property Tax as Share of Private Capital Stock | Real Property or Land Tax | Real Property or Land Taxes Deductible from Corporate Income Tax |

|---|---|---|---|

| 0.09% | Tax on Real Property | No | |

| 0.55% | Tax on Real Property (a) | Yes | |

| 0.09% | Tax on Real Property | Yes | |

| 0.71% | Tax on Real Property | Yes | |

| 0.13% | Land Tax | No | |

| 0.36% | Tax on Real Property | Yes | |

| 1.25% | Tax on Real Property | Yes | |

| 0.20% | Tax on Real Property | Yes | |

| 1.09% | Tax on Real Property | No | |

| 0.29% | Tax on Real Property | No | |

| 1.02% | Tax on Real Property | No | |

| 0.37% | Tax on Real Property | Yes | |

| 0.58% | Tax on Real Property | No | |

| 0.41% | Tax on Real Property | Yes | |

| 0.20% | Tax on Real Property | Yes | |

| 0.05% | Tax on Real Property | Yes | |

| 0.53% | Tax on Real Property | Yes | |

| 0.23% | Tax on Real Property | Yes | |

| 0.91% | Tax on Real Property | Yes | |

| 0.43% | Tax on Real Property | Yes | |

| 0.22% | Tax on Real Property | Yes | |

| 0.26% | Tax on Real Property | No | |

| 0.52% | Tax on Real Property | No | |

| 0.35% | Tax on Real Property | Yes | |

| 0.08% | Tax on Real Property | Yes | |

| 0.13% | Tax on Real Property | Yes | |

| 1.93% | Tax on Real Property | Yes | |

|

Note: (a) Tax on the imputed rent of properties. Applies to machinery. Source: Calculations for “Property Tax as Share of Private Capital Stock” are based on 2018 data from OECD, “Global Revenue Statistics Database: 4100 Recurrent taxes on immovable property,” last updated July 2020, https://stats.oecd.org/Index.aspx?DataSetCode=RS_GBL; and IMF, “Investment and Capital Stock Dataset: Private capital stock (current cost),” https://www.imf.org/external/np/fad/publicinvestment/#5. For the type of property tax and whether it is deductible, see PwC, “Worldwide Tax Summaries,” https://taxsummaries.pwc.com/ (2020 data). |

|||