Net Operating Loss Carryforward and Carryback Provisions in Europe, 2022

4 min readBy:Loss carryover taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. provisions allow businesses to either deduct current year losses against future profits (carryforwards) or current year losses against past profits (carrybacks). Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

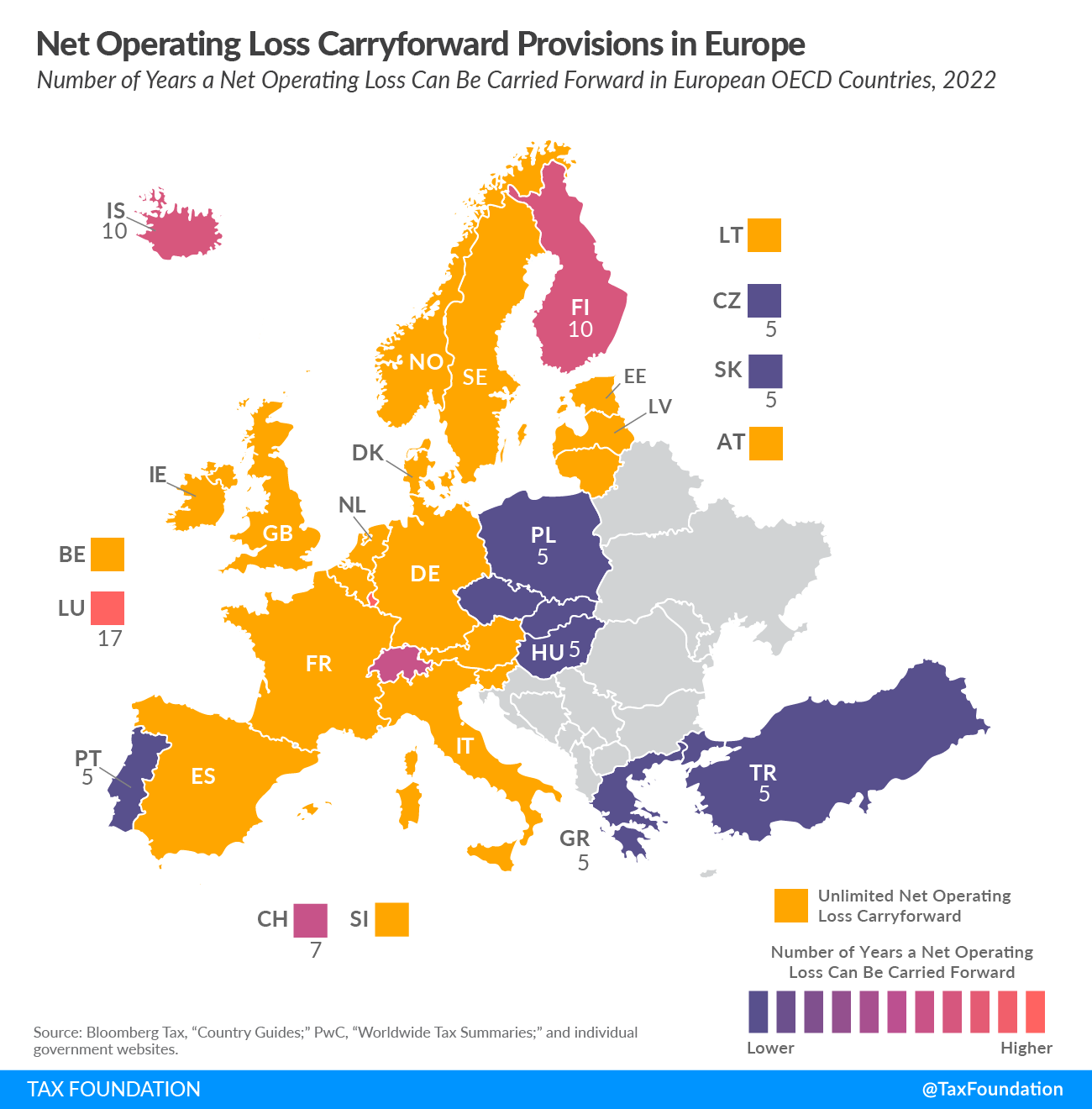

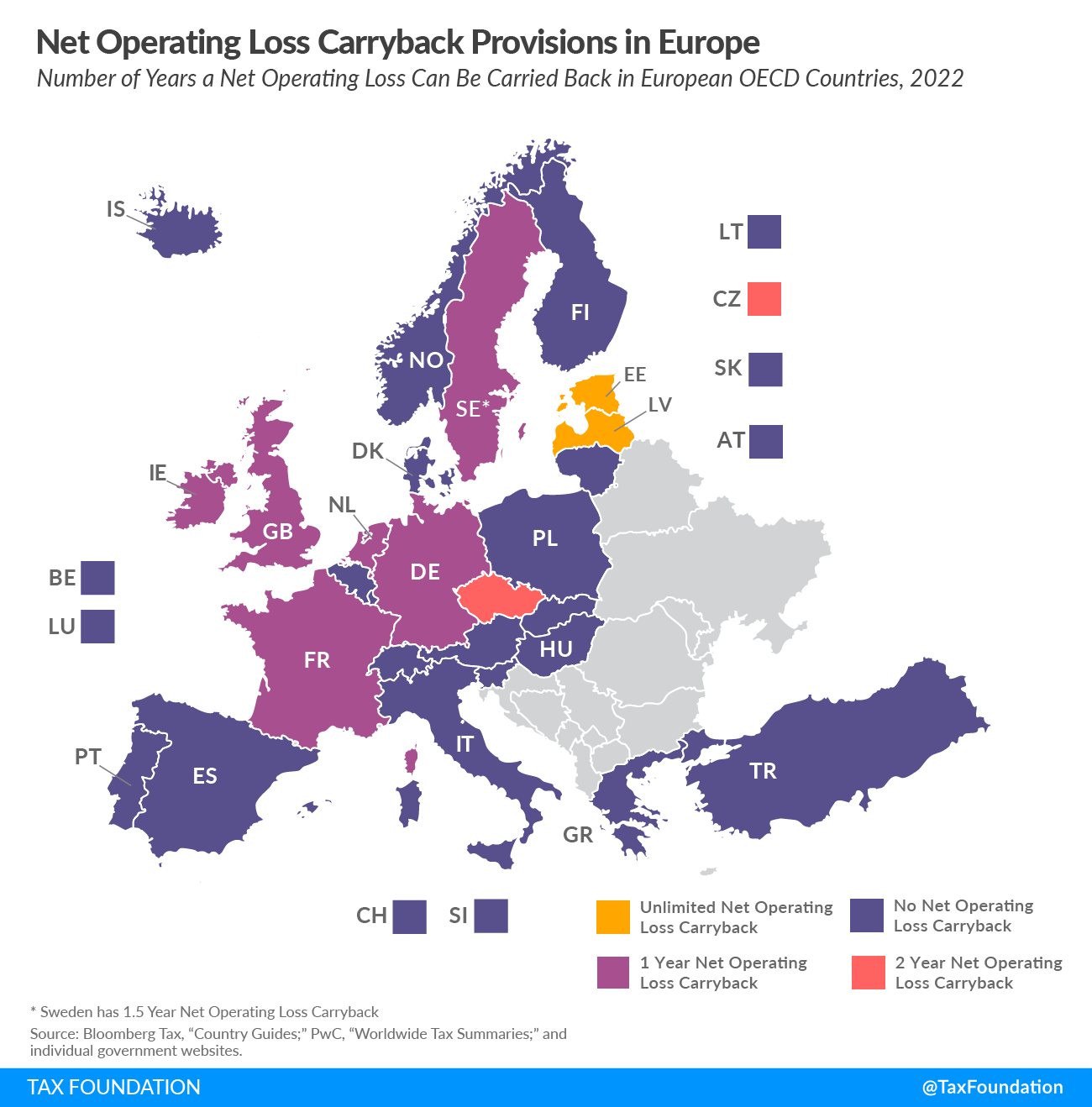

Ideally, a tax code allows businesses to carry over their losses for an unlimited number of years, ensuring that a business is taxed on its average profitability over time. While some countries do allow for indefinite loss carryovers, others have time limits. The following two maps look at this time restriction on loss carryovers, showing the number of years a business is allowed to carry forward and carry back net operating losses (NOLs).

Sixteen out of the 27 European OECD countries allow businesses to carry forward their net operating losses (NOLs) for an unlimited number of years. Of the remaining countries, Luxembourg has the most generous limit, at 17 years, while the Czech Republic, Greece, Hungary, Poland, Portugal, Slovakia, and Turkey limit their carryforwards to five years.

While all European OECD countries allow their businesses to carry forward losses, they tend to be much more restrictive with carryback provisions. Of the nine countries that allow carrybacks, only Estonia and Latvia provide them without a time limit.

It is worth noting that Estonia and Latvia do not explicitly allow for indefinite loss carryovers. Both of their corporate tax systems utilize a so-called “cash-flow tax.” This tax is only levied when a business distributes its profits to its shareholders, making calculating the annual taxable profits—including potential loss deductions—redundant. Compared to a traditional corporate tax system, such a cash-flow tax effectively allows for indefinite loss carryovers.

In addition to year limits, several countries impose deductibility limits. For example, Italy’s loss deduction can only be applied to 80 percent of taxable income.

| Country | Loss Carryback (Number of Years) | Loss Carryforward (Number of Years) |

|---|---|---|

| Austria | 0 | No limit, capped at 75% of taxable income |

| Belgium | 0 | No limit, capped at 70% of taxable income exceeding EUR 1 million |

| Czech Republic | 2, limited to CZK 30 million | 5 |

| Denmark | 0 | No limit, capped at 60% of taxable income exceeding DKK 8,872,500 for 2022 |

| Estonia | No limit (cash-flow tax) | No limit (cash-flow tax) |

| Finland | 0 | 10 |

| France | 1, limited to EUR 1 million | No limit, capped at 50% of taxable income exceeding EUR 1 million |

| Germany | 2, limited to EUR 10 million | No limit, capped at 60% of taxable income exceeding EUR 1 million |

| Greece | 0 | 5 |

| Hungary | 0 | 5, capped at 50% of taxable income |

| Iceland | 0 | 10 |

| Ireland | 1 | No limit |

| Italy | 0 | No limit, capped at 80% of taxable income |

| Latvia | No limit (cash-flow tax) | No limit (cash-flow tax) |

| Lithuania | 0 | No limit, capped at 70% of taxable income |

| Luxembourg | 0 | 17 |

| Netherlands | 1 | No limit, capped at 50% of taxable income exceeding EUR 1 million |

| Norway | 0 | No limit |

| Poland | 0 | 5, capped at 50% of total loss per year |

| Portugal | 0 | 5, capped at 70% of taxable income |

| Slovak Republic | 0 | 5, capped at 50% of taxable income |

| Slovenia | 0 | No limit, capped at 63% of taxable income |

| Spain | 0 | No limit, capped at 70% of taxable income exceeding EUR 1 million (additional revenue-based restrictions apply) |

| Sweden | 1.5 (tax allocation reserve) | No limit |

| Switzerland | 0 | 7 |

| Turkey | 0 | 5 |

| United Kingdom | 1 | No limit, capped at 50% of taxable income exceeding GBP 5 million |

|

Sources: Bloomberg Tax, “Country Guides,” https://www.bloomberglaw.com/product/tax/toc/source/511920/147664382; PwC, “Worldwide Tax Summaries,” https://www.pwc.com/gx/en/services/tax/worldwide-tax-summaries.html; and individual government websites. |

||