CFC Rules in Europe

5 min readBy:Businesses around the world often operate in more than one country, making them subject to multiple tax jurisdictions. To prevent businesses from minimizing their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability by taking advantage of cross-country differences, countries have implemented various anti-tax avoidance measures, such as the so-called Controlled Foreign Corporation (CFC) rules.

Controlled Foreign Corporation rules apply to certain income generated by foreign subsidiaries of a domestic firm. For example, if a business headquartered in France (with a combined corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate of 28.4 percent) has a subsidiary in the Bahamas (which does not tax corporate income), French tax authorities may, in some cases, assert the right to tax the income earned by the Bahamian subsidiary. These rules aim to disincentivize shifting income to low-tax jurisdictions by subjecting businesses that do so to domestic tax on that income, thus protecting the domestic tax base.

Controlled Foreign Corporation rules, although complex, generally follow the same basic structure. First, an ownership threshold is used to determine whether an entity is considered a Controlled Foreign Corporation. Most European countries consider a foreign subsidiary a Controlled Foreign Corporation if one or more related domestic corporations own at least 50 percent of the subsidiary.

Second, once a foreign subsidiary is considered a Controlled Foreign Corporation, there is a test to determine whether the subsidiary’s income should be taxed domestically. Most European countries deem a subsidiary’s income taxable to the domestic parent if the subsidiary’s income is taxed at a rate below a certain threshold, or a certain share of the subsidiary’s income is passive. Passive income includes non-traditional production activities, such as interest, dividends, rental income, and royalty income.

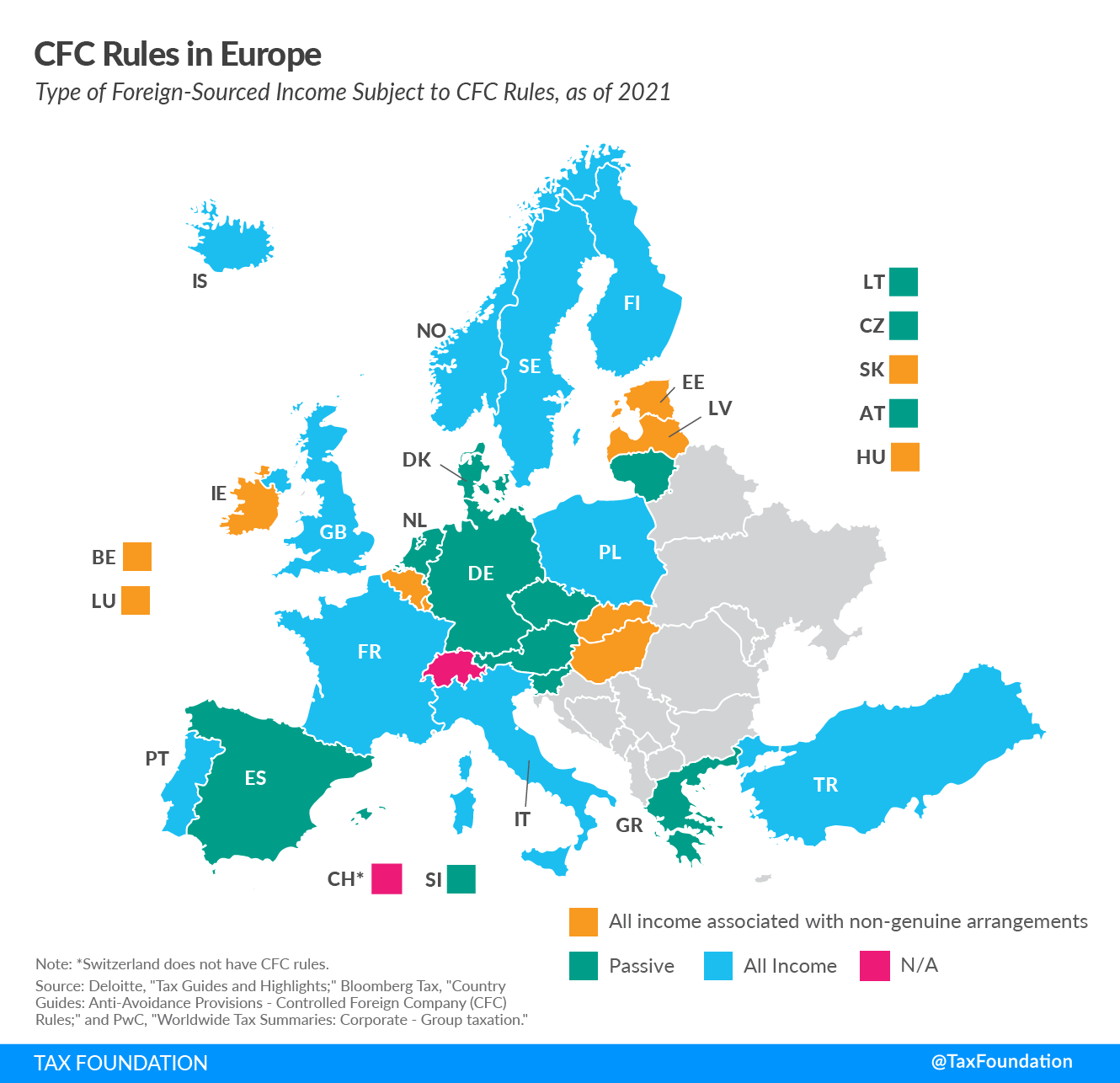

Third, once a foreign subsidiary is considered a Controlled Foreign Corporation and its income is taxable domestically, a country defines what income earned by the foreign subsidiary is subject to tax. As the accompanying map shows, this varies significantly among the European countries covered. While some countries tax only a Controlled Foreign Corporation’s passive income, others tax all income of foreign subsidiaries (active and passive). Countries may also choose to tax all income associated with non-genuine arrangements, which are arrangements established to obtain a tax advantage for the parent company.

Nine of the 27 countries covered in this map tax only a CFC’s passive income: Austria, the Czech Republic, Denmark, Germany, Greece, Lithuania, the Netherlands, Slovenia, and Spain.

Ten countries tax both active and passive income earned by a CFC: Finland, France, Iceland, Italy, Norway, Poland, Portugal, Sweden, Turkey, and the United Kingdom.

Seven countries tax all income associated with non-genuine arrangements: Belgium, Estonia, Hungary, Ireland, Latvia, Luxembourg, and Slovakia.

Switzerland is the only country covered that has not enacted CFC rules.

Most countries have various exemptions to their CFC rules. For example, many EU member states do not apply their CFC rules to subsidiaries located in other EU countries. The following table provides a basic outline of the CFC rule exemptions used by the countries covered in the map. More details can be found here.

| Country | Covered Type(s) of Income | CFC Rule Exemptions |

|---|---|---|

| Austria (AT) | Passive | CFC with substantive economic activities exempted |

| Belgium (BE) | All income associated with non-genuine arrangements | None |

| Czech Republic (CZ) | Passive | CFC with substantive economic activities exempted |

| Denmark (DK) | Passive | Foreign subsidiaries are exempt if less than 1/3 of their income is passive income |

| Estonia (EE) | All income associated with non-genuine arrangements | CFC exempt if profits below €750,000 or passive income below €75,000; CFC located in countries that are Estonian Tax Treaty Partners |

| Finland (FI) | All Income | CFC exempt if i) located in EU or EEA and not an artificial arrangement; ii) industrial, manufacturing, and shipping business; or iii) Finland has a double-tax treaty with the foreign country (excluding tax treaty countries mentioned in a “blacklist”) |

| France (FR) | All Income | CFC exempt if located in EU and not an artificial arrangement, or if CFC carries out trading or manufacturing activity |

| Germany (DE) | Passive | CFC exempt if located in EU or EEA and not an artificial arrangement |

| Greece (GR) | Passive | CFC exempt if located in EU or EEA country with exchange of information agreement and not an artificial arrangement; CFC shares traded on a regulated market |

| Hungary (HU) | All income associated with non-genuine arrangements | CFC exempt if i) real economic activity; ii) below certain profit threshold and ratio; or iii) located in country with treaty allowing for an exemption |

| Iceland (IS) | All Income | CFC exempt if located in EEA countries or has a double-tax treaty with Iceland and not an artificial arrangement |

| Ireland (IE) | All income associated with non-genuine arrangements | CFC exempt if i) below certain profit and income thresholds; ii) transfer pricing rules apply; or iii) passes the essential purpose test |

| Italy (IT) | All Income | CFC with substantive economic activities exempted |

| Latvia (LV) | All income associated with non-genuine arrangements | CFC exempt if profits below €750,000 or passive income below €75,000 and CFC is not based or incorporated in a tax haven |

| Lithuania (LT) | Passive | CFC exempt if country included in white list and not receiving special tax treatment |

| Luxembourg (LU) | All income associated with non-genuine arrangements | CFC exempt if i) not an artificial arrangement or ii) accounting profits below €750,000 or less than 10% of operating costs |

| Netherlands (NL) | Passive | CFC exempt if not an artificial arrangement |

| Norway (NO) | All Income | CFC exempt if located in EEA country and not an artificial arrangement or located in tax treaty country and not mainly passive income |

| Poland (PL) | All Income | CFC exempt if not an artificial arrangement |

| Portugal (PT) | All Income | CFC exempt if located in EU and EEA countries and not an artificial arrangement; other exemptions can apply |

| Slovak Republic (SK) | All income associated with non-genuine arrangements | Substantive activities exemption |

| Slovenia (SI) | Passive | Substantial economic activities exemption |

| Spain (ES) | Passive | CFC exempt if located in EU and not an artificial arrangement |

| Sweden (SE) | All Income | CFC exempt if located in EEA and not an artificial arrangement or located in white list countries |

| Switzerland (CH)* | N/A | N/A |

| Turkey (TR) | All Income | CFCs with gross revenue less than TRY 100,000 are exempt |

| United Kingdom (GB) | All Income | Various exemptions can apply |

|

Note: *Switzerland does not apply CFC rules. Source: Deloitte, “Tax Guides and Highlights,” https://www.dits.deloitte.com/#TaxGuides; Bloomberg Tax, “Country Guides: Anti-Avoidance Provisions – Controlled Foreign Company (CFC) Rules,” https://www.bloomberglaw.com/product/tax/bbna/chart/3/10077/347a743114754ceca09f7ec4b7015426; and PwC, “Worldwide Tax Summaries: Corporate – Group taxation,” https://www.taxsummaries.pwc.com/australia/corporate/group-taxation. |

||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe