Recent Changes in Corporate Income Tax Rates in Europe, 2018-2021

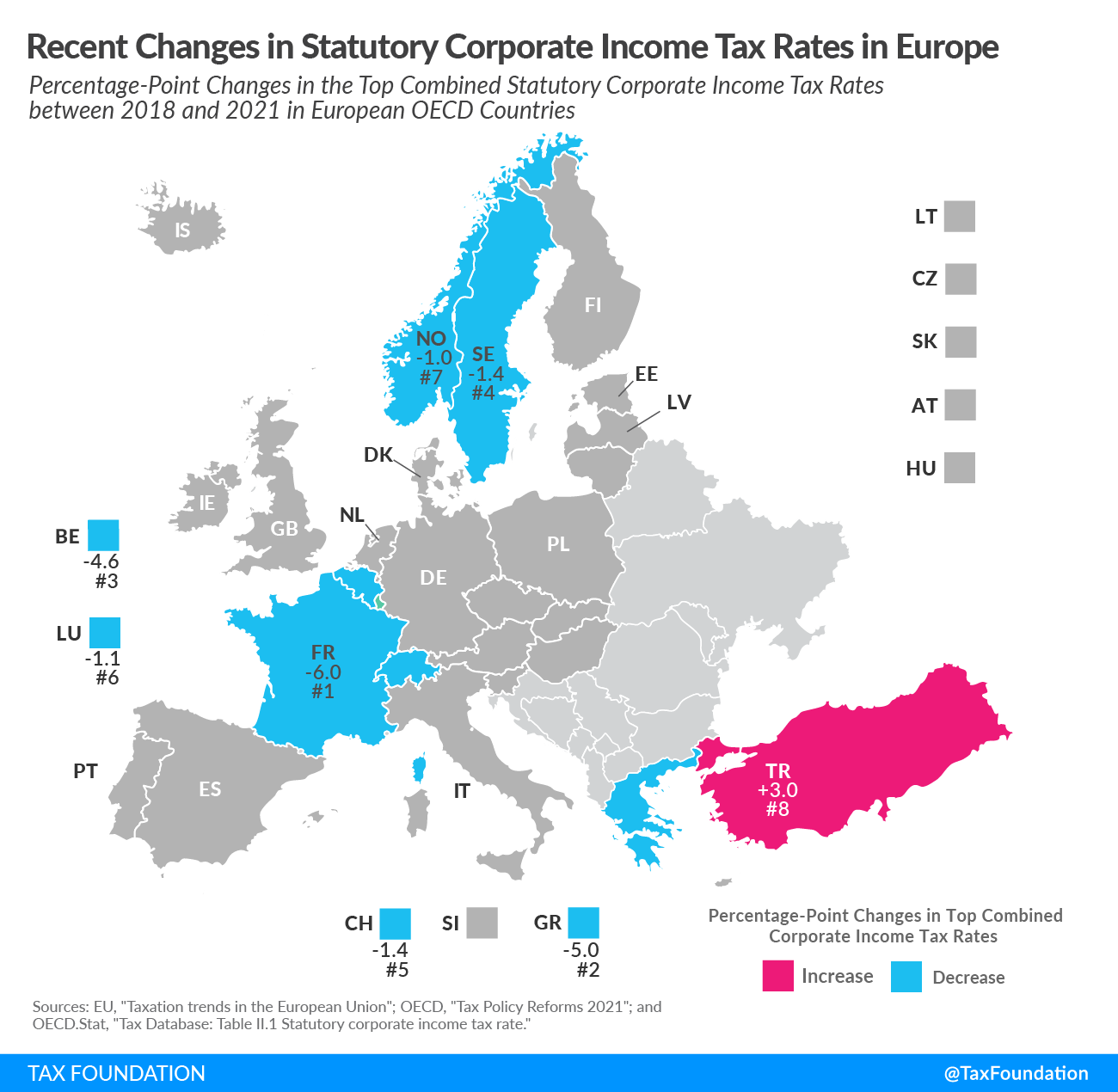

2 min readBy:Corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates have been declining around the world for the last two decades. Today’s map shows the most recent changes in corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2018 and 2021. The average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of all European countries covered has declined from 22.8 percent in 2018 to 21.8 percent in 2021.

Combined statutory corporate income tax rates capture central and subcentral corporate income tax rates. Statutory tax rates do not necessarily reflect the actual tax burden of a business as they do not capture adjustments in the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Effective corporate income tax rates, on the other hand, reflect both statutory tax rates and provisions impacting the tax base, such as capital allowances, inventory valuation methods, or international tax rules.

Belgium

Belgium lowered its combined statutory corporate income tax from 34 percent in 2017 to 29.6 percent in 2018. In 2020, the rate was further reduced to 25 percent. Since 2018, small and medium-sized businesses are subject to a reduced rate of 20 percent on the first €100,000 (US $118,000) in taxable profits.

France

France levies a standard top corporate income tax rate of 27.5 percent and a 3.3 percent surcharge, resulting in a combined statutory rate of 28.41 percent. In 2017, France levied a temporary one-off surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on corporate profits of businesses with revenues exceeding €250 million (US $295 million) at a rate of 10.7 percent. This surtax was removed in 2018, reducing the top combined statutory rate from 44.4 percent in 2017 to 34.4 percent. France has further rate cuts scheduled, leading to a combined rate of 25.8 percent by 2022.

Greece

In 2019, Greece reduced its corporate rate from 29 percent to 28 percent, and then to 24 percent.

Luxembourg

Luxembourg’s combined corporate income tax rate has been reduced gradually from 27.1 percent in 2017 to 26 percent in 2018, 25 percent in 2019, and 24.9 percent in 2020.

Norway

Norway reduced its corporate tax rate from 24 percent in 2017 to 23 percent in 2018 and 22 percent in 2019.

Sweden

Sweden legislated a decrease in its corporate tax rate, from 22 percent in 2018 to 21.4 percent in 2019. In 2021, Sweden further reduced the corporate tax rate to 20.6.

Switzerland

Switzerland’s combined corporate tax rate dropped from 21.1 percent to 19.7 percent in 2021. While the central government’s corporate tax rate was unchanged, at 8.5 percent, the representative sub-central government corporate income tax rate dropped from 14.4 percent to 12.9 percent.

Turkey

In 2018, Turkey increased its statutory rate from 20 percent to 22 percent for 2018, 2019, and 2020. In 2021, it increased it further to 25 percent.

| Country | 2018 Tax Rates | 2019 Tax Rates | 2020 Tax Rates | 2021 Tax Rates |

|---|---|---|---|---|

| Belgium (BE) | 29.6% | 29.6% | 25.0% | 25.0% |

| France (FR) | 34.4% | 34.4% | 32.0% | 28.4% |

| Greece (GR) | 29.0% | 28.0% | 24.0% | 24.0% |

| Luxembourg (LU) | 26.0% | 25.0% | 24.9% | 24.9% |

| Norway (NO) | 23.0% | 22.0% | 22.0% | 22.0% |

| Sweden (SE) | 22.0% | 21.4% | 21.4% | 20.6% |

| Switzerland (CH) | 21.1% | 21.1% | 21.1% | 19.7% |

| Turkey (TR) | 22.0% | 22.0% | 22.0% | 25.0% |

|

Source: EU, “Taxation trends in the European Union,” June 24, 2021, https://op.europa.eu/en/publication-detail/-/publication/d5b94e4e-d4f1-11eb-895a-01aa75ed71a1/language-en; OECD, “Tax Policy Reforms 2021: Special Edition on Tax Policy during the COVID-19 Pandemic,” Apr. 21, 2021, https://www.oecd.org/ctp/tax-policy-reforms-26173433.htm; and OECD.Stat, “Table II.1 Statutory corporate income tax rate,” 2021, https://stats.oecd.org/Index.aspx?DataSetCode=CTS_CIT#. |

||||