Cigarette Taxes in Europe, 2021

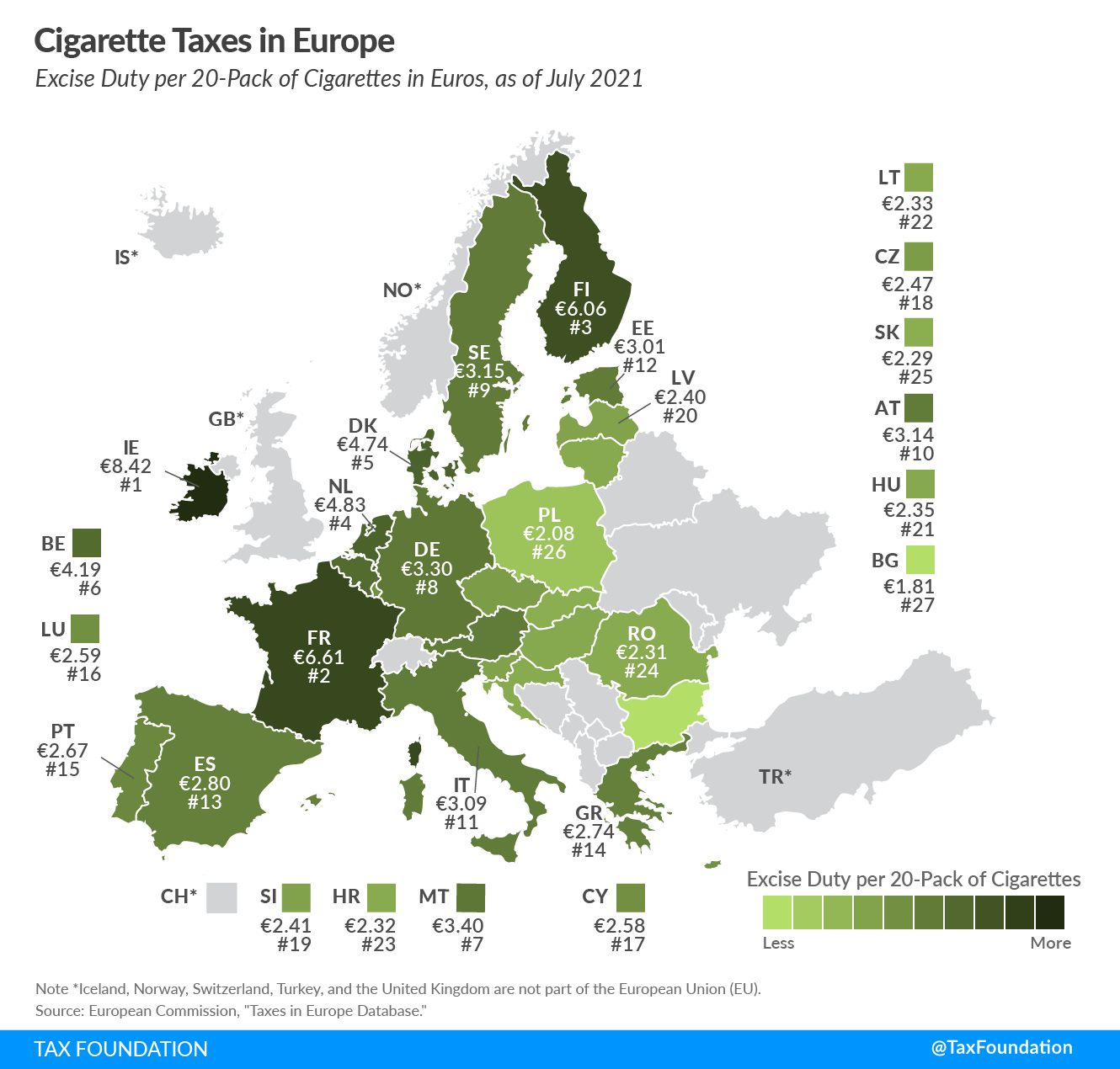

3 min readBy:To ensure the functioning of its internal market, the European Union (EU) sets a minimum excise duty on cigarettes. It consists of a specific component and an ad valorem component, resulting in a minimum overall excise duty of €1.80 (US $2.05) per 20-cigarette pack and 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). As this map shows, most EU countries levy much higher excise duties on cigarettes than legally required.

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.42 ($9.60) and €6.61 ($7.53) per 20-cigarette pack, respectively. This compares to an EU average of €3.34 ($3.80). Bulgaria (€1.81 or $2.06) and Poland (€2.08 or $2.37) levy the lowest excise duties.

On top of excise duties, all EU countries levy a value-added tax (VAT) on cigarettes. Considering both excise duties and VAT, the average share of taxes paid on a 20-pack of cigarettes ranges from 69.3 percent in Luxembourg to 89.8 percent in Finland (of the weighted average retail selling price).

KPMG estimates that 34.2 billion counterfeit and contraband (C & C) cigarettes were consumed in the EU in 2020, representing 7.8 percent of total cigarette consumption and a loss of €8.5 billion ($9.7 billion) in taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenues. The largest consumers of C & C cigarettes as a percentage of total consumption were France (23.1 percent), Greece (22.4 percent), and Lithuania (20.2 percent).

| Excise Duty | Total Tax (Excise Duty and VAT) | Weighted Average Retail Selling Price (Including Excise Duty and VAT) | Tax as a Share of the Weighted Average Retail Selling Price | ||||

|---|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | ||

| Austria (AT) | €3.14 | $3.58 | €3.99 | $4.55 | €5.15 | $5.87 | 77.6% |

| Belgium (BE) | €4.19 | $4.78 | €5.30 | $6.04 | €6.40 | $7.29 | 82.9% |

| Bulgaria (BG) | €1.81 | $2.06 | €2.27 | $2.59 | €2.77 | $3.16 | 81.9% |

| Croatia (HR) | €2.32 | $2.64 | €3.06 | $3.49 | €3.71 | $4.23 | 82.5% |

| Cyprus (CY) | €2.58 | $2.94 | €3.28 | $3.74 | €4.36 | $4.97 | 75.2% |

| Czech Republic (CZ) | €2.47 | $2.82 | €3.13 | $3.57 | €3.80 | $4.34 | 82.3% |

| Denmark (DK) | €4.74 | $5.40 | €6.12 | $6.98 | €6.92 | $7.89 | 88.5% |

| Estonia (EE) | €3.01 | $3.43 | €3.72 | $4.24 | €4.27 | $4.87 | 87.2% |

| Finland (FI) | €6.06 | $6.91 | €7.73 | $8.81 | €8.60 | $9.80 | 89.8% |

| France (FR) | €6.61 | $7.53 | €8.22 | $9.38 | €9.70 | $11.06 | 84.8% |

| Germany (DE) | €3.30 | $3.77 | €4.29 | $4.89 | €6.18 | $7.05 | 69.4% |

| Greece (GR) | €2.74 | $3.13 | €3.55 | $4.05 | €4.19 | $4.78 | 84.7% |

| Hungary (HU) | €2.35 | $2.68 | €3.19 | $3.63 | €3.93 | $4.49 | 81.0% |

| Ireland (IE) | €8.42 | $9.60 | €10.64 | $12.13 | €12.81 | $14.61 | 83.1% |

| Italy (IT) | €3.09 | $3.52 | €4.02 | $4.58 | €5.16 | $5.88 | 77.8% |

| Latvia (LV) | €2.40 | $2.74 | €3.04 | $3.46 | €3.67 | $4.18 | 82.8% |

| Lithuania (LT) | €2.33 | $2.65 | €2.98 | $3.40 | €3.76 | $4.29 | 79.3% |

| Luxembourg (LU) | €2.59 | $2.95 | €3.28 | $3.74 | €4.73 | $5.39 | 69.3% |

| Malta (MT) | €3.40 | $3.88 | €4.23 | $4.82 | €5.39 | $6.15 | 78.3% |

| Netherlands (NL) | €4.83 | $5.51 | €6.08 | $6.93 | €7.16 | $8.16 | 84.9% |

| Poland (PL) | €2.08 | $2.37 | €2.70 | $3.08 | €3.32 | $3.79 | 81.3% |

| Portugal (PT) | €2.67 | $3.04 | €3.54 | $4.03 | €4.64 | $5.29 | 76.2% |

| Romania (RO) | €2.31 | $2.64 | €2.95 | $3.36 | €3.97 | $4.52 | 74.3% |

| Slovakia (SK) | €2.29 | $2.61 | €2.86 | $3.27 | €3.46 | $3.95 | 82.8% |

| Slovenia (SI) | €2.41 | $2.75 | €3.10 | $3.53 | €3.81 | $4.34 | 81.3% |

| Spain (ES) | €2.80 | $3.20 | €3.59 | $4.10 | €4.53 | $5.17 | 79.3% |

| Sweden (SE) | €3.15 | $3.59 | €4.33 | $4.94 | €5.91 | $6.74 | 73.3% |

| Average | €3.34 | $3.80 | €4.27 | $4.86 | €5.27 | $6.01 | 80.4% |

|

Source: European Commission, “Taxes in Europe Database,” accessed July 26, 2021, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html. Note: The excise duties were converted into USD using the average 2020 USD-EUR exchange rate (0.877); see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. |

|||||||