A Partial Defense of the QBAI Exclusion

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our preliminary analysis of the Senate Finance tax plan finds the major tax provisions would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade.

11 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read 2025 Tax Brackets

2025 Tax Brackets Facts & Figures 2025: How Does Your State Compare?

Facts & Figures 2025: How Does Your State Compare? Summary of the Latest Federal Income Tax Data, 2025 Update

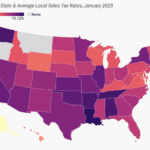

Summary of the Latest Federal Income Tax Data, 2025 Update State and Local Sales Tax Rates, 2025

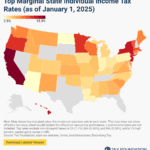

State and Local Sales Tax Rates, 2025 State Individual Income Tax Rates and Brackets, 2025

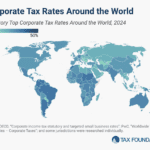

State Individual Income Tax Rates and Brackets, 2025 Corporate Tax Rates Around the World, 2024

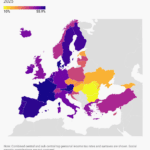

Corporate Tax Rates Around the World, 2024 Top Personal Income Tax Rates in Europe, 2025

Top Personal Income Tax Rates in Europe, 2025

The Tax Foundation is the world’s leading nonpartisan tax policy 501(c)(3) nonprofit. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Our vision is a world where the tax code doesn’t stand in the way of success. Every day, our team of trusted experts strives towards that vision by remaining principled, insightful, and engaged and by advancing the principles of sound tax policy: simplicity, neutrality, transparency, and stability.

TaxEDU is designed to advance tax policy education, discussion, and understanding in classrooms, living rooms, and government chambers. It combines the best aspects of cutting-edge and traditional education to elevate the debate, enable deeper understanding, and achieve principled policy.

TaxEDU gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, lawmakers crash courses to write smarter laws, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

Understand the terms of the debate with our comprehensive glossary, including over 100 tax terms and concepts.

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

Our primers are classroom-ready resources for understanding key concepts in tax policy.

Learn about the principles of sound tax policy—simplicity, transparency, neutrality, and stability—which should serve as touchstones for policymakers and taxpayers everywhere.

Our Tax Foundation University and State Tax Policy Boot Camp lecture series are designed to educate tomorrow's leaders on the principles of sound tax policy.

Commentary

See All CommentaryThe One Big Beautiful Tax Bill: What’s In It, What’s Out

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

New Jersey Taxpayers Deserve Tax Relief

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

Breaking Down the Senior Deduction in the One, Big, Beautiful Bill

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

Trump’s Policies Deal a Double Blow to Tax-Cutting States

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

Rhode Island Should Not Imitate Massachusetts’ Tax Mistakes

Rhode Island lawmakers are debating raising the state’s top income tax rate. Though billed as a tax hike on high earners, the consequences would manifest across the state’s entire economy—creating a risk that Rhode Island will tax its way into uncompetitiveness.

Senators Must Hold Down the SALT Cap

As the Senate considers next steps for the House-passed “big, beautiful” tax bill, the battle lines have been drawn for a showdown over the state and local tax (SALT) deduction.

States Lose When Credit Unions Acquire Banks

One, Big, Beautiful Bill: The Good, the Bad, and the Ugly

Are Trump’s Tariffs Legal? Here’s What the Courts Say

A Tax War That Makes Americans Poorer

Where the Republican Tax Bill Falls Short

The One Big Beautiful Bill, Explained