State Tax Changes Taking Effect January 1, 2024

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

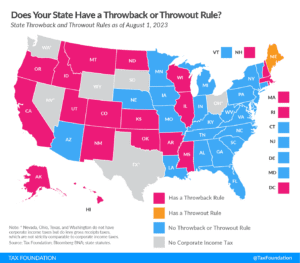

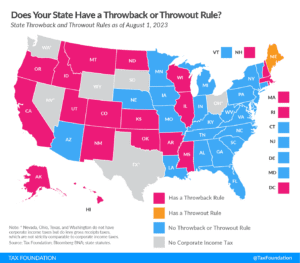

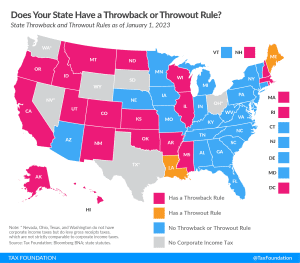

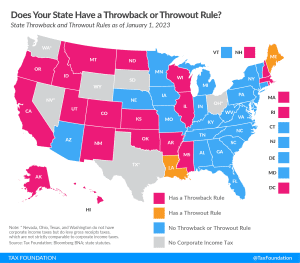

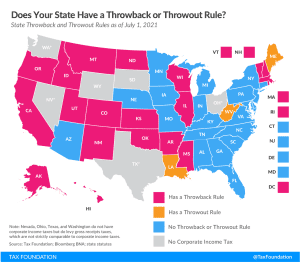

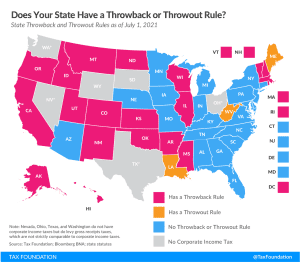

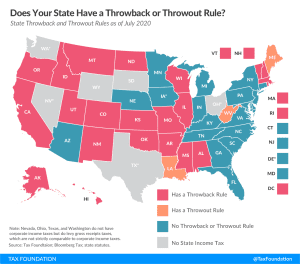

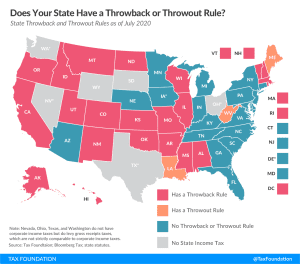

As more and more states move away from throwback or throwout rules, those states that still impose these rules are becoming less attractive for businesses, which are incentivized to relocate their sales activities to non-throwback states.

6 min read

Accelerating its current individual income tax triggers and setting up the corporate income tax for eventual elimination would increase Missouri’s attractiveness among states at a time when businesses are increasingly mobile and tax competition matters more than ever.

4 min read

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

4 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

While high top tax rates may provide “sticker shock” for corporations looking for a state to call home, they are just one of several important drivers of businesses’ tax burdens and tax compliance costs.

5 min read

As Wisconsin emerges from the pandemic, state policymakers have a rare opportunity to reinvest excess revenues in a structurally sound manner that will make the state more attractive to individuals and businesses, promote a quicker and more robust economic recovery, and put the state on the path to increased in-state investment and growth for many years to come.

7 min read

Last Friday, Oklahoma Governor Kevin Stitt (R) signed House Bills 2960, 2962, and 2963 into law as part of a budget agreement, bringing the legislature’s tax plans across the finish line. These bills will reduce the state’s corporate and individual income tax rates beginning in tax year 2022.

3 min read

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

7 min read

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read