Greece has faced some of the most difficult economic challenges in the developed world over the last decade. Instead of growing, the Greek economy has contracted in eight of the last 10 years, growing by small amounts in just 2014 and 2017. In 2011, the Greek economy shrank by 9.2 percent. The unemployment rate peaked at 27.5 percent in 2013, a dramatic increase over the 7.8 percent unemployment rate in 2008. These challenges arose during a broader public finance crisis and economic weakness that was felt throughout Europe.

Now, however, Greece is forecast to grow, albeit slowly, over the next several years with unemployment slowly declining. This is allowing Greek policymakers to rethink previously planned budget cuts and develop plans to renegotiate with their creditors.

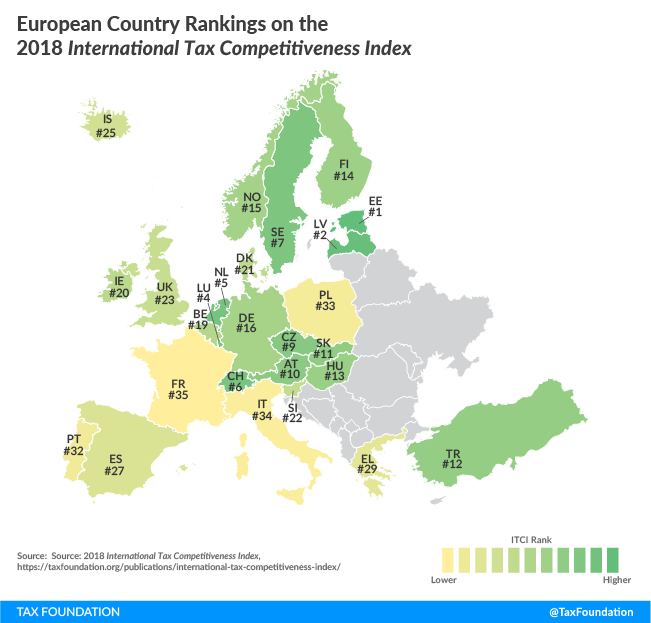

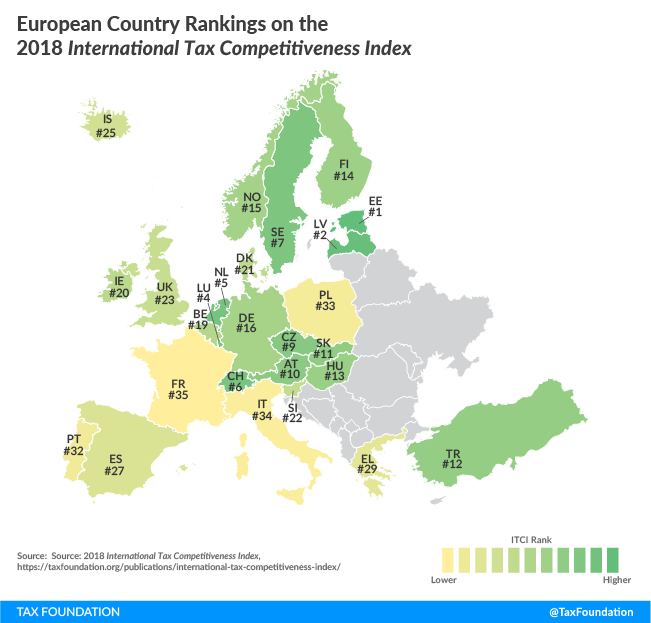

The growth outlook also provides an opportunity for Greece to assess the many challenges embedded in its taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system and how those policies could impact future growth. Greece ranks 29th out of 35 OECD countries on the 2018 International Tax Competitiveness Index (ITCI). The opportunities for improving both the efficiency and competitiveness of the Greek tax laws are many, but changes to corporate taxation, the value-added tax (VAT), and international tax ruleInternational tax rules apply to income companies earn from their overseas operations and sales. Tax treaties between countries determine which country collects tax revenue, and anti-avoidance rules are put in place to limit gaps companies use to minimize their global tax burden. s could go a long way to improving Greek tax policy.

[global_newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=6c6b782bd7&SIGNUP=ITCI”]

Over the past decades, Greece has gone from having a 40 percent combined statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate in 2000, to a 20 percent corporate tax rate as recently as 2012, to the current 29 percent rate. This roller-coaster ride has occurred while many of Greece’s neighboring countries like Bulgaria and Macedonia have cut their corporate tax rates to 10 percent. Some businesses have set up residence in these neighboring countries to avoid paying business taxes in Greece.

Greece also severely limits the amount of net operating losses that can be used by companies to offset future profits. This means that companies are not taxed on their average profitability. Companies are also not able to write off the full amount of their investments in plants, equipment, or buildings. This places a higher tax burden on business investment and directly impacts the incentives that businesses face when deciding whether to expand their operations in Greece.

Corporate tax compliance is a serious challenge in Greece. According to a World Bank/PwC study, companies spend 78 hours on average complying with corporate taxes. This is well above the average of 43 hours among OECD countries. Reducing the complexity of corporate tax laws would lower the cost of doing business significantly.

If Greece were to cut its corporate tax rate back to the 2012 level of 20 percent from the current 29 percent, the country’s ranking on the corporate taxes category in the ITCI would jump from 25th to 10th, and changes to the treatment of losses, business investment provisions, and compliance costs would improve it even further.

Corporate taxes are not the only weakness in the Greek tax code, though. The value-added tax (VAT) system in Greece is in much need of repair. The standard VAT rate is 24 percent, one of the highest rates in the OECD. In theory, a VAT with such a high rate would collect a significant amount of revenue. In Greece, though, the 24 percent rate only collects a bit more than one-third of the revenue it could. This is due in large part to the VAT Gap, which includes evasion and administrative inefficiencies.

On international provisions, Greece has room to improve as well. With a tax treaty network covering just 57 countries and complex tax rules that apply to foreign subsidiaries controlled by Greek companies, Greece is not an attractive place for multinational businesses to locate and grow.

The current challenges facing Greek policymakers include balancing potential tax changes against budget goals set by their creditors. However, options that minimize complexity could reduce avoidance and have a positive impact on both revenue and growth. Neutral cost recovery would improve the efficiency of the tax code with respect to business investment without significant revenue implications.

Greece has a long path to recovery ahead, and policymakers should focus on opportunities to adopt pro-growth policies that can secure the future for Greek workers and families. Tax competitiveness should be high on that list.

[global_newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=6c6b782bd7&SIGNUP=ITCI”]

Share