Gas Taxes in Europe, 2022

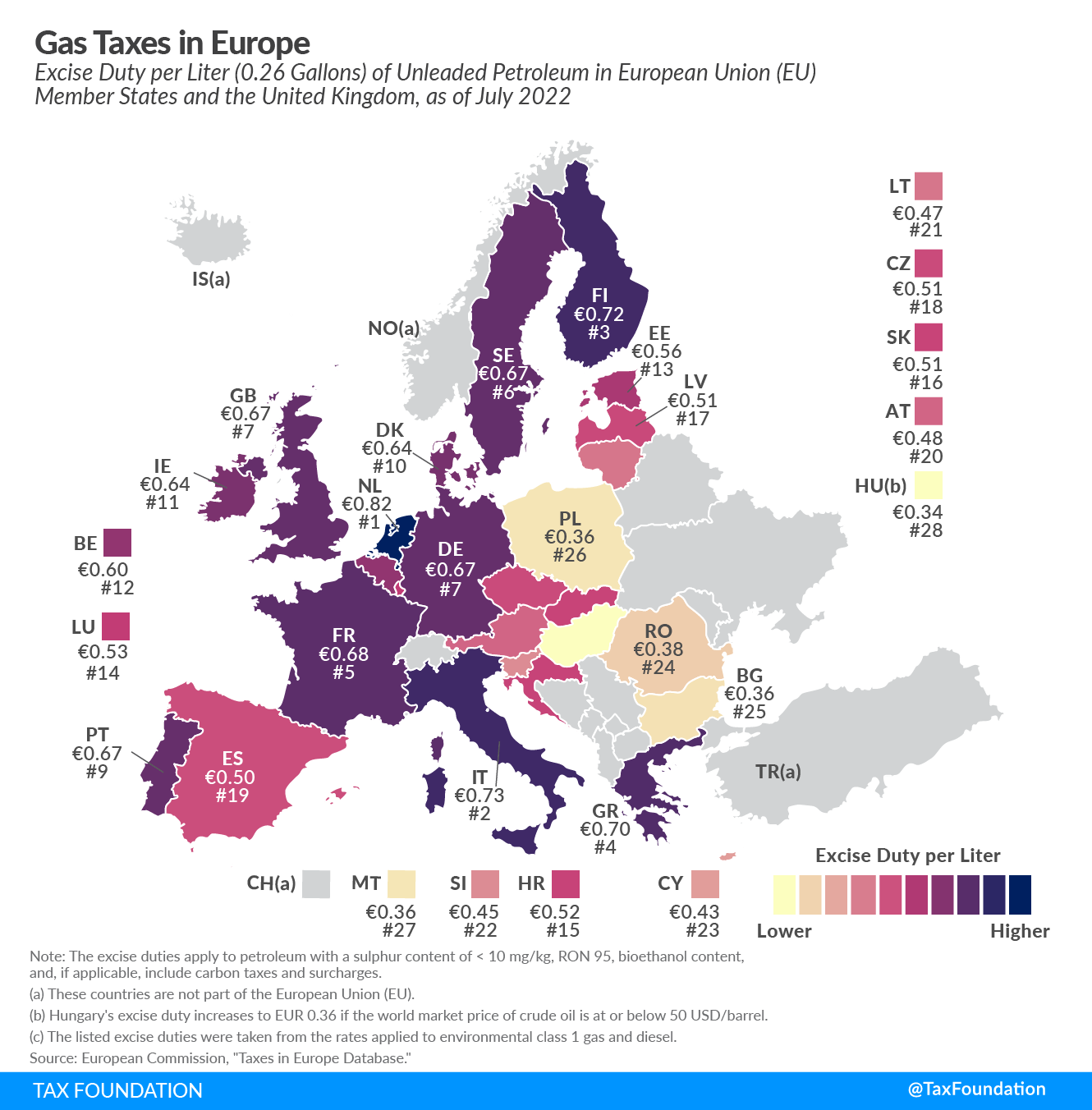

5 min readBy:The European Union requires EU countries to levy a minimum excise duty of €0.36 per liter (US $1.55 per gallon) on gasoline (petrol). Today’s map shows that only Bulgaria, Hungary, and Poland stick to the minimum fuel tax rate, while all other EU countries opt to levy higher excise duties on gas.

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

The lowest gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. is in Hungary, at €0.34 per liter ($1.49 per gallon), as the Hungarian rate is set in its domestic currency, the Forint, resulting in an average rate slightly below the EU minimum after exchange rate fluctuations. The next lowest are Bulgaria and Poland, both at €0.36 per liter ($1.61 per gallon).

Roughly 30 percent of new passenger vehicles in the European Union are diesel vehicles. Therefore, many European consumers face excise duties on diesel instead of gas. The EU sets a slightly lower minimum excise duty of €0.33 per liter ($1.48 per gallon) on diesel.

Twenty-five out of 27 EU countries levy a lower excise duty on diesel than on gas. Both the United Kingdom, which is no longer part of the EU, and Belgium levy the same rate on the two fuel types, while Slovenia taxes diesel at a rate of €0.01 ($0.09 per gallon), higher than its rate on unleaded gasoline. The average excise duty on gas is €0.55 per liter ($2.47 per gallon) in Europe, and €0.44 per liter ($1.98 per gallon) on diesel.

The United Kingdom levies the highest excise duty on diesel, at €0.67 per liter ($3.00 per gallon), followed by Italy (€0.62 per liter or $2.76 per gallon) and Belgium (€0.60 per liter or $2.68 per gallon).

The countries with the lowest excise duties on diesel are Hungary, at €0.31 per liter ($1.38 per gallon), again below the minimum rate due to the exchange rate, followed by Malta, Bulgaria and Poland, which charge duties of €0.33 per liter ($1.48 per gallon).

This year, European countries saw energy prices increase significantly, in part due to the Russian invasion of Ukraine. Eleven countries temporarily cut their gas and diesel taxes to partially combat the higher prices. Germany implemented the largest temporary gasoline cut, from €0.67 to €0.36, followed by Belgium’s cut from €0.60 to €0.46. All the temporary cuts are scheduled to expire no later than the end of the calendar year.

All EU countries also levy a value-added tax (VAT) on gas and diesel. The excise amounts shown in the map relate only to excise taxes and do not include the VAT, which is charged on the sales value of gas and diesel.

| Temporary Tax Rate as of July 1, 2022 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Gas Tax | Diesel Tax | Gas Tax | Diesel Tax | |||||

| Per Liter in EUR | Per Gallon in USD | Rank | Per Liter in EUR | Per Gallon in USD | Rank | Per Liter in EUR | Per Liter in EUR | |

| Austria (AT) | €0.48 | $2.16 | 20 | €0.40 | $1.78 | 18 | ||

| Belgium (BE) | €0.60 | $2.68 | 12 | €0.60 | $2.68 | 3 | €0.46 | €0.46 |

| Bulgaria (BG) | €0.36 | $1.62 | 25 | €0.33 | $1.48 | 25 | ||

| Croatia (HR) | €0.52 | $2.30 | 15 | €0.41 | $1.83 | 16 | €0.41 | €0.35 |

| Cyprus (CY) | €0.43 | $1.92 | 23 | €0.40 | $1.79 | 17 | €0.36 | €0.33 |

| Czech Republic (CZ) | €0.51 | $2.27 | 18 | €0.39 | $1.76 | 19 | €0.45 | €0.33 |

| Denmark (DK) | €0.64 | $2.87 | 10 | €0.44 | $1.95 | 12 | ||

| Estonia (EE) | €0.56 | $2.52 | 13 | €0.37 | $1.66 | 21 | ||

| Finland (FI) | €0.72 | $3.24 | 3 | €0.50 | $2.24 | 8 | ||

| France (FR) | €0.68 | $3.06 | 5 | €0.59 | $2.66 | 4 | ||

| Germany (DE) | €0.67 | $3.00 | 7 | €0.49 | $2.19 | 9 | €0.36 | €0.33 |

| Greece (GR) | €0.70 | $3.13 | 4 | €0.41 | $1.83 | 15 | ||

| Hungary (HU)** | €0.34 | $1.50 | 28 | €0.31 | $1.38 | 28 | ||

| Ireland (IE) | €0.64 | $2.85 | 11 | €0.54 | $2.39 | 5 | €0.47 | €0.41 |

| Italy (IT) | €0.73 | $3.26 | 2 | €0.62 | $2.76 | 2 | ||

| Latvia (LV) | €0.51 | $2.28 | 17 | €0.41 | $1.85 | 14 | ||

| Lithuania (LT) | €0.47 | $2.09 | 21 | €0.37 | $1.66 | 21 | ||

| Luxembourg (LU) | €0.53 | $2.36 | 14 | €0.42 | $1.86 | 13 | €0.46 | €0.35 |

| Malta (MT)*** | €0.36 | $1.61 | 27 | €0.33 | $1.48 | 27 | €0.36 | €0.33 |

| Netherlands (NL) | €0.82 | $3.69 | 1 | €0.53 | $2.36 | 6 | ||

| Poland (PL) | €0.36 | $1.61 | 26 | €0.33 | $1.48 | 26 | ||

| Portugal (PT) | €0.67 | $2.99 | 9 | €0.51 | $2.30 | 7 | ||

| Romania (RO) | €0.38 | $1.71 | 24 | €0.35 | $1.57 | 24 | ||

| Slovakia (SK) | €0.51 | $2.30 | 16 | €0.37 | $1.65 | 23 | ||

| Slovenia (SI) | €0.45 | $1.99 | 22 | €0.46 | $2.08 | 11 | €0.37 | €0.34 |

| Spain (ES) | €0.50 | $2.25 | 19 | €0.38 | $1.70 | 20 | ||

| Sweden (SE)**** | €0.67 | $3.00 | 6 | €0.47 | $2.12 | 10 | €0.53 | €0.33 |

| United Kingdom (GB) | €0.67 | $3.00 | 7 | €0.67 | $3.00 | 1 | €0.62 | €0.62 |

| Average | €0.55 | $2.47 | €0.44 | $1.98 | ||||

| Minimum Rate | €0.36 | $1.61 | €0.33 | $1.48 | ||||

|

Notes: The excise duties apply to petroleum and diesel with a sulphur content of < 10 mg/kg, RON 95 (gas), bioethanol content, and, if applicable, include carbon taxes and surcharges. The excise duties were converted into USD using the average 2021 USD-EUR exchange rate (0.846); see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. * These countries are not part of the EU ** Hungary’s excise duty decreases to EUR 0.35 per liter for gas and EUR 0.34 per liter for diesel if the world market price of crude oil is at or below $50 USD/barrel. *** Malta’s temporary rate decrease is in effect for all of 2022. **** The listed excise duties were taken from the rates applied to environmental class 1 gas and diesel. Source: European Commission, “Taxes in Europe Database,” https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and HM Revenue and Customs, “UK Trade Tariff: excise duties, reliefs, drawbacks, and allowances,” https://www.gov.uk/government/publications/uk-trade-tariff-excise-duties-reliefs-drawbacks-and-allowances/uk-trade-tariff-excise-duties-reliefs-drawbacks-and-allowances. |

||||||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe