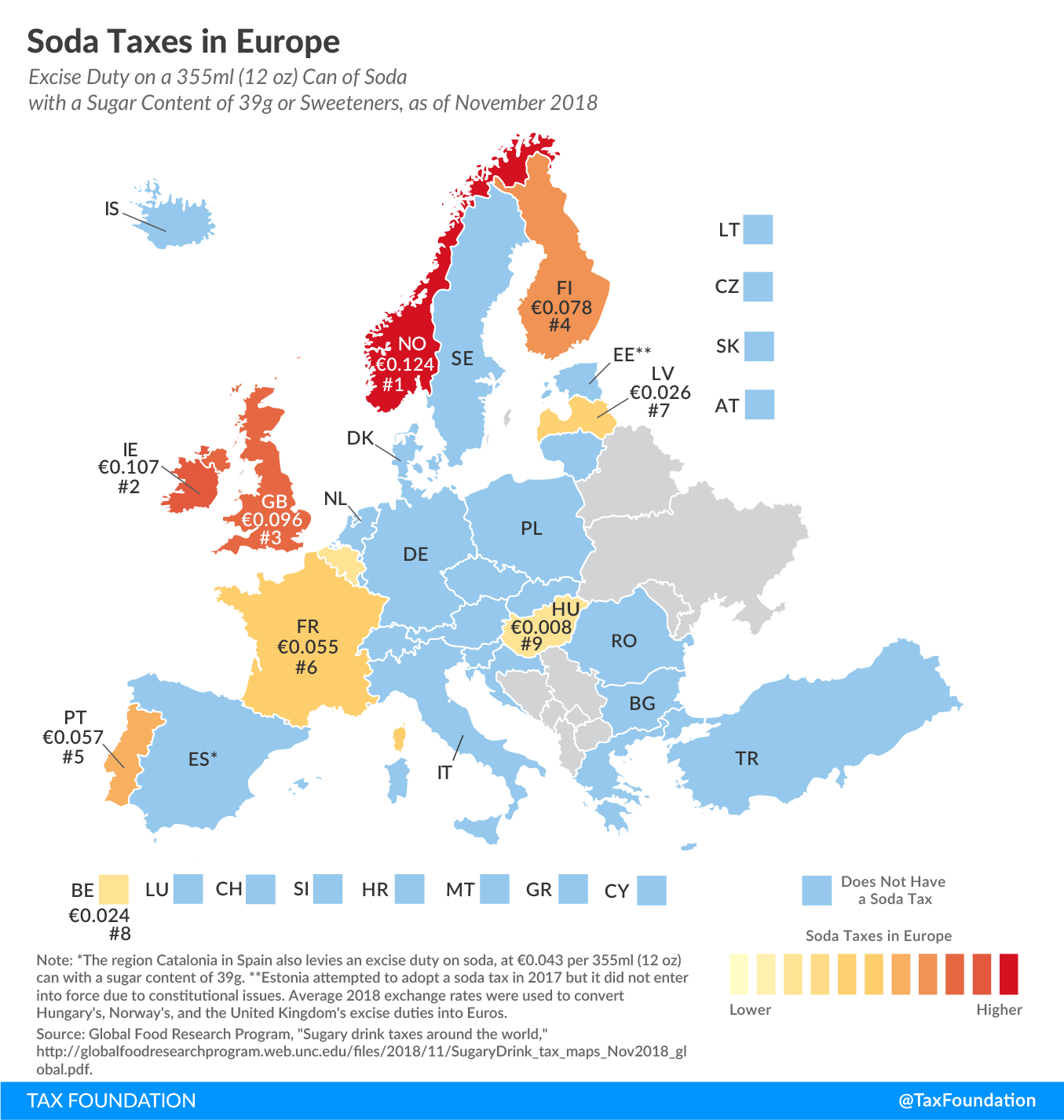

Soda Taxes in Europe

2 min readBy:Over the last years, several countries and cities around the world have implemented excise duties on sugary drinks as a step toward the goal of combating sugar’s potential adverse health effects. Though it is questionable whether these taxes help achieve that goal, nine European countries covered in today’s map do levy soda taxes at an average of €0.064 (US $0.075) per 355ml (12oz) can of soda.

Norway levies the highest excise duty, at €0.124 ($0.146) per can of soda. Ireland and the United Kingdom follow, at €0.107 ($0.126) and €0.096 ($0.113), respectively. You’ll find the lowest soda taxes in Hungary (€0.008 or $0.009), Belgium (€0.024 or $0.028), and Latvia (€0.026 or $0.031).

Most countries levy soda taxes based on the amount of sugar per volume. Some countries, however, taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. soda that contains sweeteners or only includes added sugar (as opposed to total sugar).

While soda taxes are a more recent trend, two Scandinavian countries started levying an excise duty on sugary drinks decades ago. Finland’s first tax on soft drinks dates to 1940, and Norway first implemented one in 1981.

Erratum: The map initially showed that Estonia levies a soda taxA soda tax, often discussed under a broader policy category of a sugar-sweetened beverage tax, is an excise tax on sugary drinks. Most soda taxes apply a flat rate tax per ounce of a sugar-sweetened beverage, though some jurisdictions levy an ad valorem tax based on the beverage’s price. , at €0.107 ($0.126) per 355ml (12oz) can of soda. However, the soda tax Estonia attempted to adopt in 2017 was not implemented due to constitutional issues and was thus removed from the map.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe