Digital Services Taxes in Europe, 2019

4 min readBy:Updated on 10/25/2019:

-

Austria approved its digital services tax, with plans to implement the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. in January 2020.

-

The Czech Republic published a revised draft of its digital services tax proposal, aiming at implementing the tax in mid-2020.

-

France has implemented its digital services tax, applying the tax retroactively as from January 2019 with the first payments due in November 2019.

-

Italy has announced plans to implement its previously approved digital services tax in January 2020.

-

Poland has suspended its work on digital taxation after announcing a digital tax earlier this year, stating that it would like to adopt a solution reached at the EU level.

-

Other countries outside of Europe like Canada and Uganda have also been considering digital services taxes.

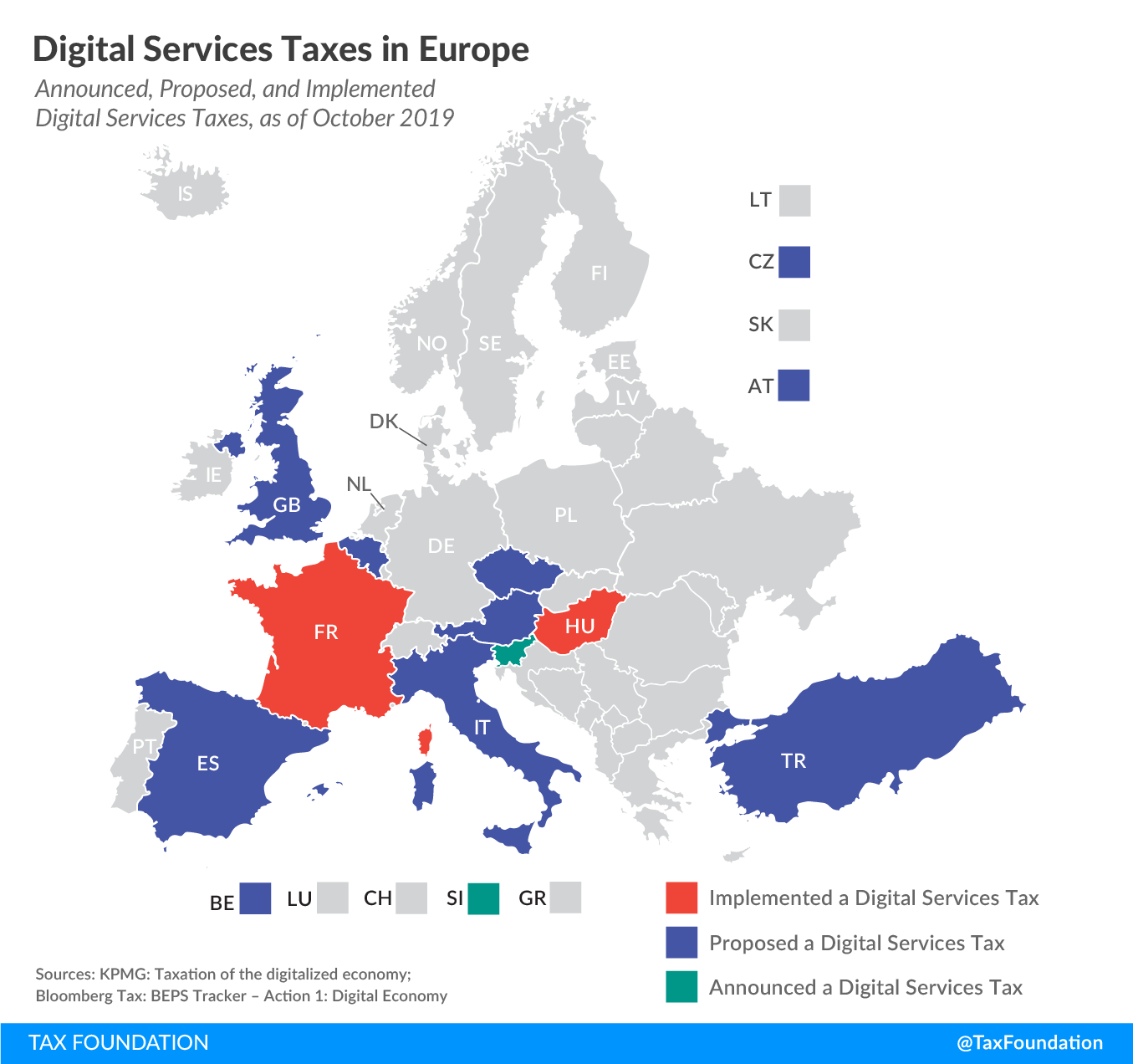

Last year, the European Union (EU) released a proposal to tax revenues from certain digital activities of multinational corporations. However, the EU could not reach an agreement on the digital services tax proposal. Although the OECD is currently working on an international solution for digital taxation, some countries have recently taken unilateral measures to implement a digital services tax. As shown in the following map, several European countries have either announced, proposed, or implemented such a tax unilaterally.

France is the most recent country to implement a digital services tax, despite the United States Trade Representative opening an investigation into the discriminatory nature of the tax. Hungary has previously implemented a type of digital services tax.

Austria, Belgium, the Czech Republic, Italy, Poland, Slovenia, Spain, Turkey, and the United Kingdom have all either announced or published a proposal to introduce a digital services tax, with Poland recently suspending its work on the digital services tax.

|

Sources: KPMG, “Taxation of the digitalized economy,” July 11, 2019, https://tax.kpmg.us/content/dam/tax/en/pdfs/2019/digitalized-economy-taxation-developments-summary.pdf; Bloomberg Tax, “BEPS Tracker – Action 1: Digital Economy,” https://www.bloomberglaw.com/product/tax/aqb_chart/2917a095db6af1d712cbf7034d7be88d; Finance Ministry of Slovenia, “NEWS – Adopted at the 36th regular government session,” June 6, 2019, http://www.mf.gov.si/si/medijsko_sredisce/novica/3621/. |

|||||

| Country | Global Revenue Threshold | Domestic Revenue Threshold | Tax Rate | Scope | Status |

|---|---|---|---|---|---|

| Austria (AT) | €750 million | €25 million | 5% | Online advertising | Proposed (implementation in January 2020) |

| Belgium (BE) | €750 million | €50 million in the EU | 3% | Selling of user data | Proposed |

| Czech Republic (CZ) | €750 million | CZK 50 million (€2 million) | 7% | · Targeted advertising · Use of multilateral digital interfaces · Provision of user data | Proposed |

| France (FR) | €750 million | €25 million | 3% | · Provision of a digital interface · Targeted advertising · Transmission of data collected about users for advertising purposes | Implemented (retroactively applicable as from January 1, 2019) |

| Hungary (HU) | HUF 100 million (€306,890) | N/A | 7.5% | Advertising revenue | Implemented |

| Italy (IT) | €750 million | €5.5 million | 3% | · Advertising on a digital interface · Multilateral digital interface that allows users to buy/sell goods and services · Transmission of user data generated from using a digital interface | Proposed (implementation in January 2020) |

| Poland (PL) | – | – | – | – | Deputy finance minister announced in May 2019 that Poland will introduce digital taxation. In September 2019, it was admitted that Poland has suspended its work on digital taxation, stating that it would like to adopt a solution reached at the EU level. |

| Slovenia (SI) | – | – | – | – | The Slovenian Ministry of Finance on June 20 announced a government proposal to submit a draft bill to the National Assembly introducing a digital services tax. No details published yet. |

| Spain (ES) | €750 million | €3 million | 3% | · Online advertising services · Selling of online advertising · Selling of data | Proposed. The Spanish Parliament rejected the government’s proposed budget bill for 2019, which included the digital services tax. However, the DST discussion will likely be re-introduced. |

| Turkey (TR) | €750 million | TRY 20 million (€3.1 million) | 7.5% | Online services including advertisements, sales of content, and paid services on social media websites | Proposed |

| United Kingdom (GB) | £500 million (€554 million) | £25 million (€28 million) | 2% | Revenues of search engines, social media platforms, and online marketplaces | Proposed |

The OECD is hopeful there will be a solution to reform the current international tax rules, including the taxation of the digital economy, in 2020. Unilateral measures can seriously undermine this multilateral approach. Further actions by individual countries should be set aside until the OECD has concluded its work.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe