CFC Rules in Europe

5 min readBy:Many businesses around the world operate in more than one country, making them subject to multiple tax jurisdictions. To prevent businesses from minimizing their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

CFC rules apply to certain income generated by foreign subsidiaries of a domestic firm. For example, if a business headquartered in France (with a combined corporate income tax rate of 32 percent) has a subsidiary in the Bahamas (which does not tax corporate income), France in certain cases may assert the right to tax the income earned by the Bahamian subsidiary. These rules aim to disincentivize businesses from moving their income to low-tax jurisdictions, as it can still be subject to domestic tax, and thus protect the domestic tax base.

CFC rules, although complex, generally follow the same basic structure. First, an ownership threshold is used to determine whether an entity is considered a controlled foreign corporation. Most European countries consider a foreign subsidiary a CFC if one or more related domestic corporations own at least 50 percent of the subsidiary.

Second, once a foreign subsidiary is considered a CFC, there is a test to determine whether the subsidiary’s income should be taxed domestically. Most European countries determine a subsidiary taxable if the foreign tax jurisdiction levies a tax rate below a certain threshold and/or a certain share of the subsidiary’s income is passive. Passive income includes non-traditional production activities, such as interest, dividends, rental income, and royalty income.

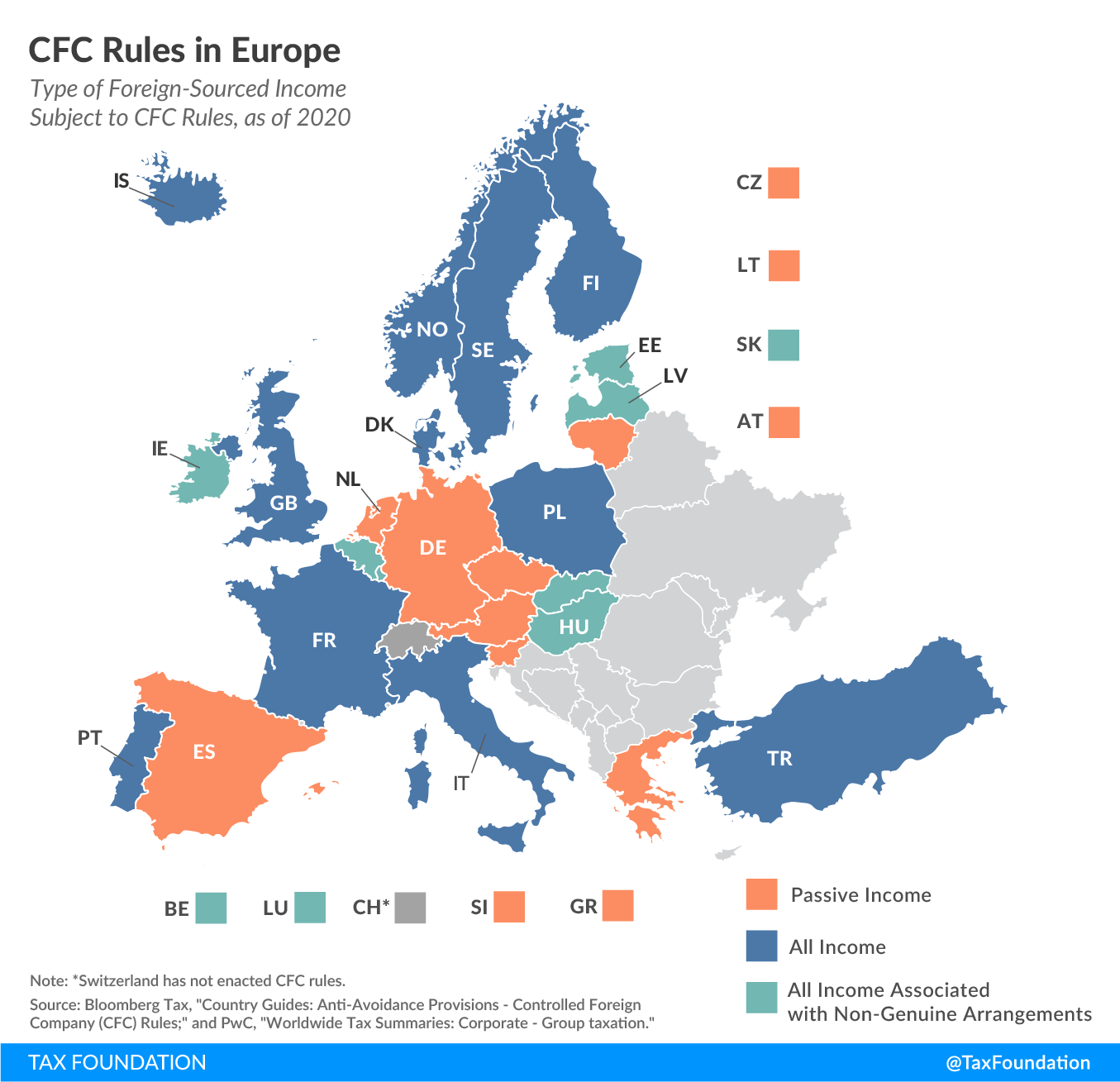

Third, once a foreign subsidiary is considered a CFC and its income is taxable domestically, a country defines what income earned by the foreign subsidiary is subject to tax. As the map below shows, this varies significantly among the European countries covered. While some countries tax only a CFC’s passive income, others tax all income of foreign subsidiaries (active and passive). Countries may also choose to tax all income associated with non-genuine arrangements. Non-genuine arrangements are those put in place in order to obtain a tax advantage for the parent company.

Eight of the 27 countries covered in this map tax only a CFC’s passive income: Austria, the Czech Republic, Germany, Greece, Lithuania, the Netherlands, Slovenia, and Spain.

Eleven countries tax both active and passive income earned by a CFC: Denmark, Finland, France, Iceland, Italy, Norway, Poland, Portugal, Sweden, Turkey, and the United Kingdom.

Seven countries tax all income associated with non-genuine arrangements: Belgium, Estonia, Hungary, Ireland, Latvia, Luxembourg, and Slovakia.

Switzerland is the only country covered that has not enacted CFC rules.

Most countries’ CFC rules have various exemptions. For example, many EU member states do not apply their CFC rules to subsidiaries located in other EU countries.

| Country | Covered Type(s) of Income | CFC Rule Exemptions |

|---|---|---|

|

Austria (AT) |

Passive |

CFC with substantive economic activities exempted |

|

Belgium (BE) |

All income associated with non-genuine arrangements |

None |

|

Czech Republic (CZ) |

Passive |

CFC with substantive economic activities exempted |

|

Denmark (DK) |

All income |

Foreign subsidiaries are exempt if less than 1/3 of their income is financial income |

|

Estonia (EE) |

All income associated with non-genuine arrangements |

CFC-exempt if profits below €750,000 or passive income below €75,000 |

|

Finland (FI) |

All Income |

CFC-exempt if i) located in EU or EEA and not an artificial arrangement; ii) industrial, manufacturing, and shipping business; or iii) Finland has a double-tax treaty with the foreign country (excluding tax treaty countries mentioned in a “black list”) |

|

France (FR) |

All income |

CFC-exempt if located in EU and not an artificial arrangement, or if CFC carries out trading or manufacturing activity |

|

Germany (DE) |

Passive |

CFC-exempt if located in EU or EEA and not an artificial arrangement |

|

Greece (GR) |

Passive |

CFC-exempt if located in EU or EEA country with exchange of information agreement and not an artificial arrangement |

|

Hungary (HU) |

All income associated with non-genuine arrangements |

CFC exempt if i) real economic activity; ii) below certain profit threshold and ratio; or iii) located in country with treaty allowing for an exemption |

|

Iceland (IS) |

All income |

CFC-exempt if located in EEA countries or has a double-tax treaty with Iceland and not an artificial arrangement |

|

Ireland (IE) |

All income associated with non-genuine arrangements |

CFC-exempt if i) below certain profit and income thresholds; ii) transfer pricing rules apply; or iii) passes the essential purpose test |

|

Italy (IT) |

All income |

CFC with substantive economic activities exempted |

|

Latvia (LV) |

All income associated with non-genuine arrangements |

CFC-exempt if profits below €750,000 or passive income below €75,000 and CFC is not based or incorporated in a tax haven |

|

Lithuania (LT) |

Passive |

CFC-exempt if country included in white list and not receiving special tax treatment |

|

Luxembourg (LU) |

All income associated with non-genuine arrangements |

CFC-exempt if i) not an artificial arrangement or ii) accounting profits below €750,000 or less than 10% of operating costs |

|

Netherlands (NL) |

Passive |

CFC-exempt if not an artificial arrangement |

|

Norway (NO) |

All income |

CFC-exempt if located in EEA country and not an artificial arrangement or located in tax treaty country and not mainly passive income |

|

Poland (PL) |

All income |

CFC-exempt if not an artificial arrangement |

|

Portugal (PT) |

All income |

CFC-exempt if located in EU and EEA countries and not an artificial arrangement |

|

Slovak Republic (SK) |

All income associated with non-genuine arrangements |

None |

|

Slovenia (SI) |

Passive |

Substantial economic activities exemption |

|

Spain (ES) |

Passive |

CFC-exempt if located in EU and not an artificial arrangement |

|

Sweden (SE) |

All income |

CFC-exempt if located in EEA and not an artificial arrangement or located in white list countries |

|

Switzerland (CH)* |

N/A |

N/A |

|

Turkey (TR) |

All income |

None |

|

United Kingdom (GB) |

All income |

Various exemptions can apply |

|

*— Switzerland does not apply CFC rules. Sources: Bloomberg Tax, “Country Guides: Anti-Avoidance Provisions – Controlled Foreign Company (CFC) Rules,” https://www.bloomberglaw.com/product/tax/bbna/chart/3/10077/347a743114754ceca09f7ec4b7015426; and PwC, “Worldwide Tax Summaries: Corporate – Group taxation,” https://taxsummaries.pwc.com/australia/corporate/group-taxation. |

||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe