Bank Taxes in Europe

2 min readBy:The 2007-2008 financial crisis triggered a global debate on whether, and if so how, taxation can be used as an instrument to stabilize the financial sector and to generate revenue to partially cover the costs associated with the recent and potential future crises.

Three approaches were mainly discussed, namely

- financial stability contributions (levied on financial institutions’ liabilities and/or assets)

- financial activities taxes (levied either on financial institutions’ profits or remunerations)

- financial transaction taxes (levied on trade in financial instruments such as stocks, bonds, derivatives, and currencies)

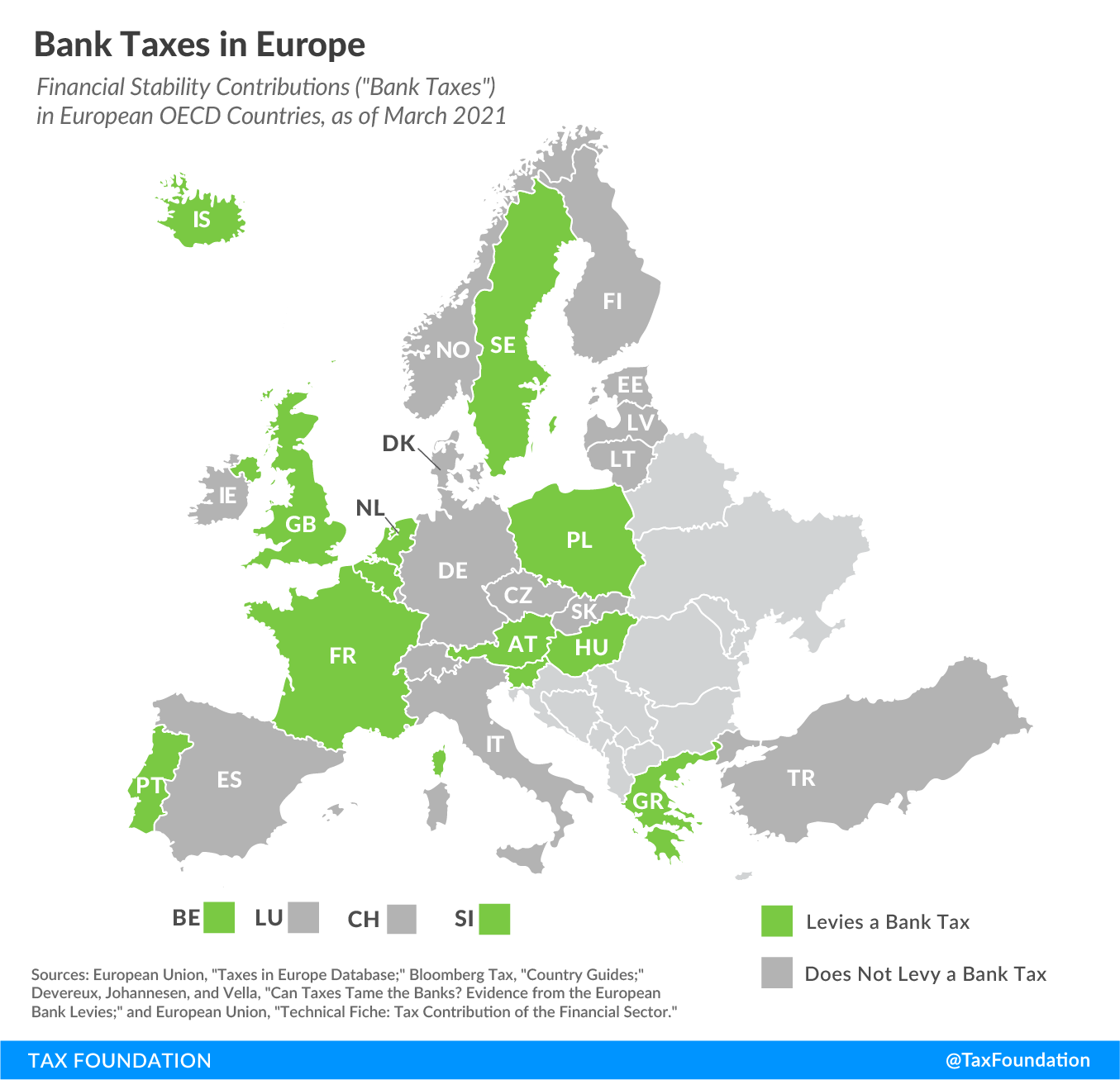

Today’s map shows which European OECD countries implemented financial stability contributions (FSCs), commonly referred to as “bank taxes.”

Austria, Belgium, France, Greece, Hungary, Iceland, the Netherlands, Poland, Portugal, Slovenia, Sweden, and the United Kingdom all levy bank taxes. Almost all of these countries implemented the levy following the 2007-2008 financial crisis, with Greece (1975) the only exception. Slovakia repealed its bank levy as of January 2021.

Most countries levy their bank taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on a measure of liabilities or a measure of assets. However, some countries decided on a different tax base. For example, France taxes the minimal amount of capital necessary to comply with the regulatory requirements.

| OECD Country | Tax Rate | Tax Base | Year of Implementation |

|---|---|---|---|

| Austria (AT) | 0.024% – 0.029% | Total liabilities net of equity and insured deposits | 2011 |

| Belgium (BE) | Varying Rates | Various tax bases depending on size of institution, risk, and destination of tax payments | 2012 |

| France (FR) | 0.0642% | Minimum regulatory capital requirement | 2011 |

| Greece (GR) | 0.12% – 0.60% | Value of the credit portfolio | 1975 |

| Hungary (HU) | 0.15% – 0.20% | Total assets net of interbank loans | 2010 |

| Iceland (IS) | 0.145% | Total debt | 2011 |

| Netherlands (NL) | 0.033% – 0.066% | Total liabilities net of equity and insured deposits | 2012 |

| Poland (PL) | 0.44% | Total value of assets | 2016 |

| Portugal (PT) | 0.01% – 0.11% | Various tax bases | 2011 |

| Slovenia (SI) | 0.10% | Total assets | 2011 |

| Sweden (SE) | 0.05% | Total liabilities net of equity and insured deposits | 2015 |

| United Kingdom (GB) | 0.05% – 0.10% | Total liabilities net of insured deposits | 2011 |

|

Note: Most bank taxes have numerous exemptions and thresholds. Sources: European Union, taxes in Europe database; Bloomberg Tax, “Country Guides;” Devereux, Johannesen, and Vella, “Can Taxes Tame the Banks? Evidence from the European Bank Levies;” and European Union, “Technical Fiche: Tax Contribution of the Financial Sector.” |

|||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe