Recent Changes in Top Personal Income Tax Rates in Europe

3 min readBy: ,In 2017, revenue from personal income taxes made up 23.9 percent of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue across OECD countries. Countries tax labor income in various ways through payroll taxes, personal income taxes, and, in some cases, surtaxes.

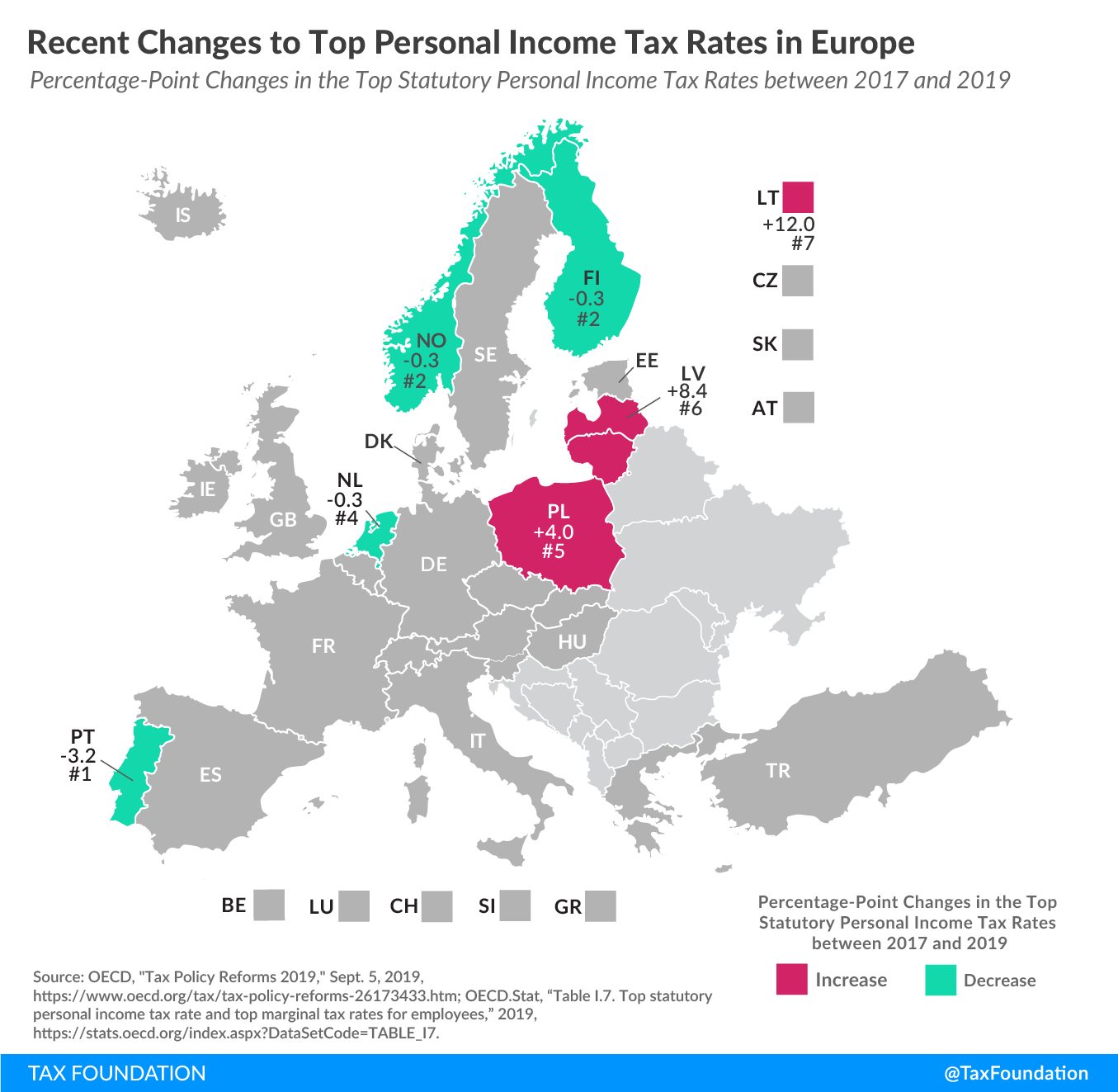

From 2017 to 2019, seven European countries in the OECD changed their top personal income tax rates. Of these seven countries, four cut their top personal income tax rates while the other three raised their top rates.

Latvia and Lithuania moved from flat taxes on personal income to progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. structures. Poland introduced a solidarity surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. while Portugal eliminated a surtax. Finland, the Netherlands, and Norway all made slight cuts to their personal income tax rates.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeFinland

Finland levies a central government income tax and a local income tax. In 2018, the top rate of the federal income tax was lowered to 31.25 from 31.5. Municipal taxes on personal income are levied at flat rates. In 2019, the tax rate varies between 16.50 and 22.50 percent, the average rate being approximately 19.86 percent in 2018. This is a slight decrease from 2017 of 19.91 percent. In addition to the top rate cut, the other bracket rates of the tax scale were also lowered by 0.25 percentage points.

Latvia

In 2018, Latvia shifted its system from a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. on personal income to a progressive tax. Prior to this change, Latvia applied a 23 percent flat tax. The new system has three separate brackets, at 20 percent, 23 percent, and 31.4 percent. The top rate applies to income above €55,000 (US $60,821).

Lithuania

Lithuania in 2019 moved its system from a 15 percent flat personal income tax to a progressive income tax with two brackets, with rates of 20 percent and 27 percent. The top bracket applies to income above 120 percent of average wages which, in 2018, was €133,334 (US $147,467).

Netherlands

The progressive tax system in the Netherlands moved from four brackets with a top personal income tax rate of 52 percent to three brackets with a top rate of 51.75 percent. The bracket structure is expected to be amended further in 2021, resulting in two brackets with a top rate of 49.5 percent.

Norway

Norway applies personal income taxes on two separate tax bases with separate rates. Net ordinary income is taxed at a combined municipal and national rate of 22 percent (a reduction from 23 percent in 2018). Gross personal income is taxed in a progressive manner with four brackets. The top rate on personal income in 2019 is 16.2 percent (an increase from 14.5 percent in 2017), with an income threshold of NOK 964,800 (US $107,864). Overall, the top rate on personal income fell slightly from 38.4 percent in 2018 to 38.2 percent in 2019.

Poland

Poland has a progressive tax on personal income with a top rate of 32 percent that applies to income above PLN 85,528 (US $21,780). Starting in 2019, individuals with income above PLN 1 million (US $254,860) will pay a solidarity tax of 4 percent. Combined, the solidarity tax, which works as a surtax on personal income, and the top personal income tax bracket result in a total top personal rate of 36 percent, up from 32 percent in 2018.

Portugal

Portugal has a top rate of 48 percent on its personal income tax schedule. This rate applies to income above €80,640 (US $89,240). A solidarity tax has also been part of the Portuguese system since 2012, and a rate of 5 percent applies to income over €250,000 (US $276,600). A separate extraordinary surcharge of 3.25 percent on income over €80,640 (US $89,240) was eliminated in 2018. With this change, the solidarity tax and the top rate on the personal income bracket schedule result in a rate of 53 percent, down from 56.25 percent in 2017 prior to the elimination of the extraordinary surcharge.

|

Source: OECD, “Tax Policy Reforms 2019,” Sept. 5, 2019, https://www.oecd.org/tax/tax-policy-reforms-26173433.htm; OECD.Stat, “Table I.7. Top statutory personal income tax rate and top marginal tax rates for employees,” 2019, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_I7. |

|||

| Country | 2017 Tax Rates | 2018 Tax Rates | 2019 Tax Rates |

|---|---|---|---|

| Finland | 0.514 | 0.511 | 0.511 |

| Latvia | 0.23 | 0.314 | 0.314 |

| Lithuania | 0.15 | 0.15 | 0.27 |

| Netherlands | 0.52 | 0.52 | 0.5175 |

| Norway | 0.385 | 0.384 | 0.382 |

| Poland | 0.32 | 0.32 | 0.36 |

| Portugal | 0.562 | 0.53 | 0.53 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe