Key Findings

- The 2021 UK budget introduces a two-year super-deductionA super-deduction is a tax deduction that permits businesses to deduct more than 100 percent of their eligible expenses from their taxable income. As such, the super-deduction is effectively a subsidy for certain costs. This policy sometimes applies to capital costs or research and development (R&D) spending. of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent in 2023.

- These policies have differential impacts on marginal effective tax rates (METRs) for different assets, implying investment incentives will not be uniform.

- While METRs will fall initially for equipment, by 2023 the METR will be higher than prior to the budget announcement.

- The METR on investments in intellectual property (IP) will rise initially before falling below the pre-budget level once the corporate tax rate comes in.

- Temporary policies and delayed tax hikes create contradictory incentives for businesses, and the 2021 UK budget will likely result in a whiplash effect for investment activity over the coming years.

Introduction

The 2021 UK budget announced by the Chancellor of the Exchequer Rishi Sunak on March 3, 2021 included two important corporate tax provisions that will impact incentives for business investment. First, the Chancellor proposed raising the corporate income tax rate from 19 percent to 25 percent in 2023. In addition, he proposed a temporary 130 percent super-deduction for investment in plant and equipment for the next two years.

On its own, raising the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate to 25 percent in 2023 will reduce the after-tax return on the majority of investment made in the year prior to the scheduled rate increase. A rate increase could also encourage firms to delay investments. However, the super-deduction more than offsets the negative incentive effects of the pending rate increase for investment in plant and equipment in 2021 and 2022. When the super-deduction expires and the corporate tax rate increases, the METR on those investments will be higher than it was prior to the 2021 budget announcement.

This paper presents estimates of how the budget will impact marginal effective tax rates (METR) on new investments using a model that incorporates the policy changes and their temporary and impending nature. Standard estimates of METRs assume that the corporate tax policy is permanent. The results presented here reflect the temporary super-deduction and the delayed corporate tax rate increase.

This paper also present estimates of an alternative policy that would immediately raise the corporate income tax rate to 25 percent and enact 100 percent expensing for plant and equipment, structures, and all intellectual property (IP) products. Although this policy would be less generous to plant and equipment in the short run, we find that this would increase the overall incentive to invest more than the budget proposal does in 2021 and beyond.

The Impact of a Pending Corporate Tax Rate Increase on Investment Decisions

Raising the corporate income tax rate increases the pretax required return on new investments. A higher required pretax return makes some investments no longer profitable for the firm. This leads to lower investment and, in the long run, a smaller capital stock. A smaller domestic capital stock reduces productivity, worker wages, and economic output.

Scheduling a future corporate income tax rate increase does not avoid this. Firms are forward-looking. When making an investment, a firm will project both the costs and revenues of a project. These costs include any taxes that a firm needs to pay on the returns to an investment net of any deductions they receive for the investment or any financing. If the statutory rate is projected to rise, firms will immediately incorporate the tax increase into their investment decisions.

In addition, a scheduled corporate rate increase can create the incentive for firms to delay investments they otherwise would have made today. Firms can increase the value of a tax deduction by waiting until the rate is higher and thus the tax value of the deduction is higher. This is especially true for assets that receive accelerated tax deductions or can be expensed (immediately deducted when the investment is made).

The impact a scheduled rate increase has on investment depends on the life of an asset, the timing of expected returns, the precise schedule of the corporate rate increase, and the timing of capital allowances. Very short-lived assets may face no immediate tax increase because their earnings may all occur prior to the scheduled rate increase. However, some short- to medium-lived assets may face a large immediate increase in effective tax rates, especially if their deductions are accelerated. Long-lived assets may face smaller, but more immediate tax increases because most of their profits are earned and deductions are taken in the future.

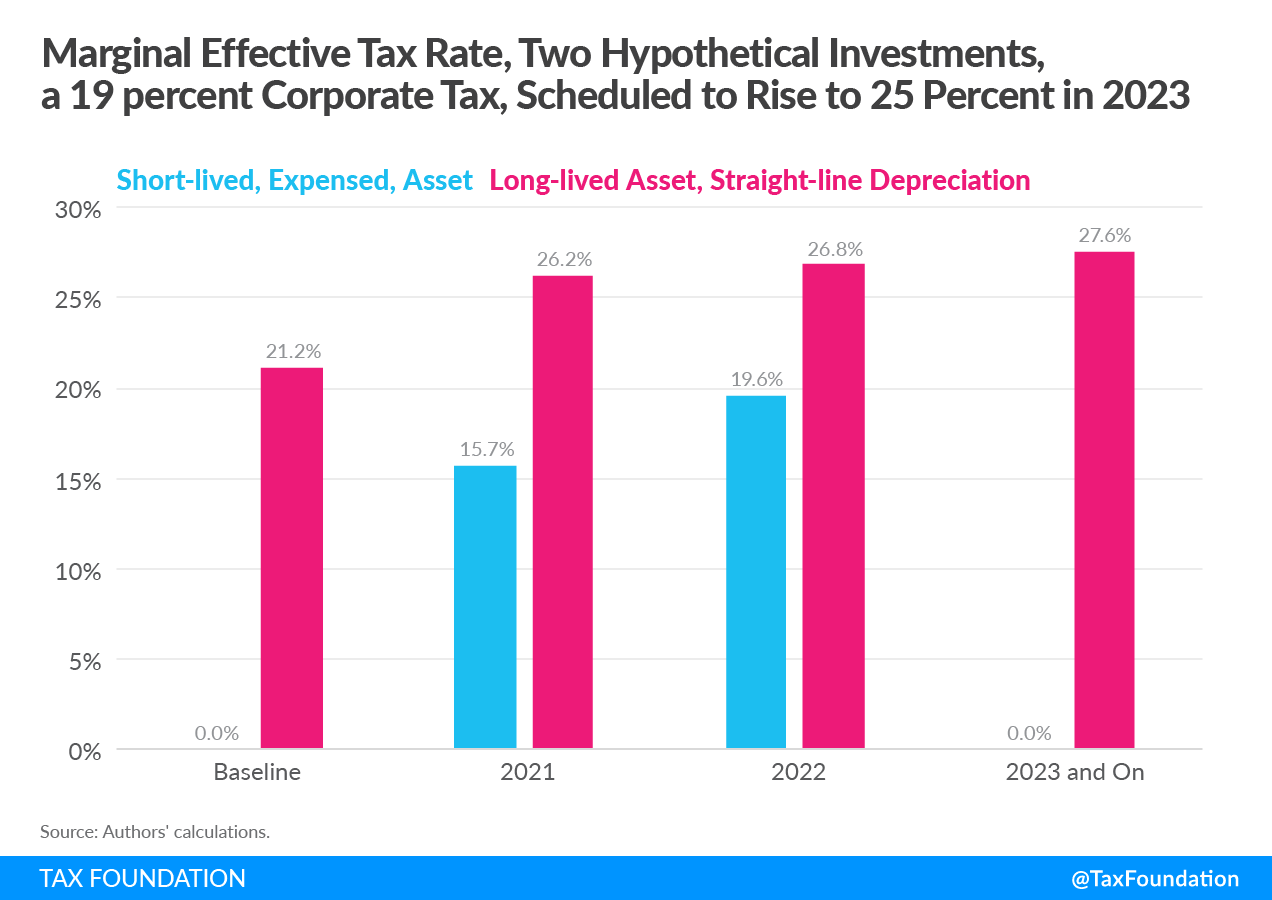

Take as an example how a scheduled rate increase impacts the METR on two hypothetical investments over a couple of years. METRs reflect how taxes impact business decisions on their next investment. The METR reflects corporate tax provisions including the statutory tax rate, deductions for investment costs, and financing options. High METRs are associated with low levels of business investment, but sometimes METRs can be negative, essentially reflecting a tax subsidy for certain types of investment or financing options.

The first investment is a relatively short-lived asset that benefits from expensing. The second investment is a relatively long-lived asset that is deducted over a long period of time. Under a 19 percent corporate tax rate, the expensed asset faces a marginal effective tax rate of 0 percent. The deduction the asset receives is equal to the present discounted value of taxes it is expected to pay on the returns. The building faces a marginal effective tax rate of 21.3 percent.[1] Due to depreciation, it pays taxes, in present value, on its returns. If the corporate tax rate is scheduled to rise to 25 percent in 2023, the effective tax burden on these assets rises immediately. However, the impact on the effective rate differs by asset.

Although the short-lived asset receives expensing, the pending rate increase imposes a positive tax burden on the asset in the years prior to the scheduled rate hike. The effective tax rate on the short-lived, expensed asset rises from 0 percent to 15.7 percent in 2021 and rises further to 19.6 percent in 2022. This is because the deduction for the investment is taken when the rate is lower, but most or all of the returns are taxed when the rate is higher. In 2023, the rate settles back to zero when there is symmetry again between the deduction’s value and the tax on returns. The pending rate increase creates a distinct incentive to delay investment.

The long-lived asset also sees an immediate increase in its effective tax rate, but it is smaller—a 5 percentage-point increase, to 26.2 percent. The rate then slowly climbs each year until it hits a rate of 27.6 percent in 2023. This pattern holds because deductions for the building are spread out more evenly across the life of the asset. As a result, a large portion of deductions and returns is being reported against the higher tax rate. Firms would face an immediate incentive to reduce investment but would not face the same incentive to delay investment as they would for the expensed asset.

Impacts of the 2021 UK Budget

The 2021 UK budget made two important corporate tax changes that will affect marginal tax rates on investments. Those changes impact the relative attractiveness of different investment options and the timing of those investments. As mentioned, the corporate tax rate would increase to 25 percent from 19 percent beginning in April 2023. Additionally, a temporary 130 percent super-deduction for plant and equipment would apply until March 31, 2023.

Meanwhile the structures and buildings allowance and declining balance rules for acquired intangible assets would remain the same. The rate for the Research and Development Expenditure Credit (RDEC) remains at 13 percent and the patent box rate at 10 percent.

| Pre-Budget | 2021 Budget | |

|---|---|---|

| Corporate Tax Rate | 19% | 25% beginning in April 2023 |

| Depreciation for Plant and Equipment | Declining balance depreciation at 18 percent per year | 130% super-deduction until March 31, 2023 |

| Depreciation for Structures and Buildings | Straight-line depreciation over 33.3 years | Straight-line depreciation over 33.3 years |

| Depreciation for Acquired Intangible Assets | Declining balance depreciation at 25% per year | Declining balance depreciation at 25% per year |

| Research and Development Expenditure Credit Rate | 13% | 13% |

| Patent Box Rate | 10% | 10% |

|

Sources: Gov.UK, “Budget 2021: Documents,” Mar. 3, 2021, https://www.gov.uk/government/publications/budget-2021-documents; and EY, “Worldwide Capital and Fixed Assets Guide,” 2020. |

||

In his budget speech, the Chancellor referenced estimates by the Office of Budget Responsibility that the corporate tax changes would increase business investment by 10 percent over the next five years despite the scheduled increase in the corporate tax rate increase. This is due to the 130 percent super-deduction for plant and equipment and an additional 50 percent deduction for other qualified investments. These policies were said to reduce corporate tax revenues by ₤24.2 billion while the corporate tax hike in 2023 would increase revenues by ₤47.8 billion.

Although the super-deduction should more than offset the immediate impact of the higher corporate income tax rate in 2021 and 2022, it only applies to plant and equipment. As a result, certain assets will face a tax increase while others will see a large tax cut. On net, however, the effective marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on new investment will decline slightly for non-land assets in 2021 and 2022.

Prior to the budget, the weighted (by the corporate capital stock) average METR on new investment is 11.2 percent. The effective rate varies somewhat by assets and ranges from 19.8 percent for inventory to 12.3 percent for plant and equipment. Intellectual property products receive a significant net subsidy, facing an effective tax rate of negative 36.2 percent. This is due to several policies: expensing for research and development costs, the 13 percent RDEC, and the patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. —a 10 percent special tax rate on income from patents. Structures face an METR of 15.5 percent.

In 2021 and 2022, the UK budget proposal would reduce the effective tax rate on some assets but raise the effective tax rate on others. Plant and equipment would see a large reduction in its effective tax rate. Although these assets would face the higher corporate rate on their future profits, the super-deduction would more than offset the rate hike for the next two years. The METR on equipment will fall to -23.2 percent in 2021 before rising to 16.6 percent in 2023 after the super-deduction expires and the corporate tax rate increases.

| Overall (35/65 debt/equity split) | Plant and Equipment | Structures | Intellectual Property | Land | Inventory | Overall | Overall, No Land |

|---|---|---|---|---|---|---|---|

| Pre-budget | 12.3% | 15.5% | -36.2% | 12.7% | 19.8% | 11.2% | 10.2% |

| 2021 | -23.2% | 19.8% | -22.0% | 16.6% | 19.8% | 11.1% | 7.0% |

| 2022 | -16.3% | 20.2% | -20.3% | 16.9% | 19.8% | 12.1% | 8.8% |

| 2023 | 16.6% | 20.6% | -37.3% | 17.1% | 25.9% | 15.7% | 14.6% |

| Alternative, 25 percent corporate rate and expensing | -10.5% | 0.2% | -48.3% | 17.1% | 25.9% | 4.9% | -0.4% |

|

Source: Authors’ calculations. |

|||||||

In contrast, structures and land would face an immediate tax increase. These assets are generally long-lived, and a large portion of their expected returns will face the higher corporate tax rate in 2023 and thereafter. The METR on structures would rise immediately in 2021 from 15.5 percent under current law to 19.8 percent. The effective tax rate would then rise slightly to 20.2 percent in 2022, and then to 20.6 percent in 2023.

Intellectual property would also face a tax increase in 2021 and 2022. The METR would rise immediately from -36.2 percent to -22.0 percent in 2021, after which the effective tax rate would rise slightly in 2022 to -20.3 percent. However, in 2023, the tax burden on IP products would end up being lower than it its pre-budget level, -37.3 percent, creating an incentive to delay investment. This occurs because a portion of IP investment is research and development and benefits from expensing. The value of expensing is proportional to the tax rate. As such, a firm could reduce the tax burden on research and development by delaying the investment until 2023 when the rate is higher. In addition, the higher corporate tax rate in 2023 increases the value of the interest deduction for debt-financed investment, especially for assets eligible for the patent box.

Overall, the weighted average marginal tax rate on investment will fall slightly in 2021 from 11.2 percent to 11.1 percent. In 2022, the METR would rise to 12.1 percent. By 2023, the weighted average METR will be 15.7 percent. Excluding land, which should not respond to a change in the tax burden, the weighted average effective rate will fall from 10.2 percent pre-budget to 7.0 percent in 2021 and 8.8 percent in 2022. After 2023, the weighted average METR (excluding land) will be 14.6 percent.

Alternate Corporate Reform

For a basis of comparison, we analyzed an alternate corporate tax reform. Under this alternate policy the corporate tax rate would be immediately raised to 25 percent in 2021. At the same time, 100 percent expensing (rather than 130 percent expensing) would be provided to not only plant and equipment but also structures, and all IP products. The tax treatment of land, dwellings, and inventory would remain unchanged. Firms would also still be allowed to deduct interest expense (with current limitations).

Similar to the budget proposal, 100 percent expensing for plant and equipment and a 25 percent corporate tax rate would increase the incentive to invest in those assets. The marginal tax rate would decline from 12.3 percent to -10.5 percent. However, the incentive would not be as great in the short run.

In contrast with the budget, this alternative reform would be much more favorable to structures and IP. Allowing structures and IP to be expensed would reduce the METR, even with a higher statutory tax rate. The METR for structures would fall from 15.5 percent to 0.2 percent and the METR for IP would fall from -36.2 percent to -48.3 percent. In addition, the absence of the delayed corporate tax increase would not create the incentive to delay IP investments until after the rate hike.

The overall average METR on all assets would be 4.9 percent with a 25 percent corporate tax rate and full expensing relative to the 15.7 percent METR with just a 25 percent corporate tax rate in 2023. Excluding land, the average METR would fall from 10.2 percent to 0.4 percent.

Corporate Taxes, Capital Allowances, and Investment

The UK is not the first country to pursue broader capital allowances as a measure to stimulate economic growth in the near term. Countries have historically used increased capital allowances as a tool to improve investment incentives during macroeconomic downturns.[3]

There is a growing body of empirical evidence that expanded capital allowances lead to higher levels of business investment. A study of temporary expansions of capital allowances in the United States by economists Eric Zwick and James Mahon showed that businesses (particularly small businesses) significantly increased investment in response to the better tax treatment of capital costs.[4] They find that businesses increased investment in eligible capital relative to ineligible capital by 10.6 percent during a temporary policy in force from 2001 to 2004 and by 16.6 percent when that policy was reintroduced between 2008 and 2010. They show that the firms that were most sensitive to the policy change were businesses facing financing constraints for investment.

A separate study conducted by economists Giorgia Maffini, Jing Xing, and Michael P. Devereux estimates the effect of a rules change for accelerated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. allowances the UK introduced in 2004. Their results show that “the investment rate of qualifying companies increased 2.1-2.5 percentage points relative to those that did not qualify.”[5] They also find that it takes time for companies to adjust their investment plans when they become eligible for broader investment allowances.

Both the temporary nature of the 2021 UK budget’s expansion of deductions for capital investment and the coming corporate rate hike make the UK’s situation unique. Both policy changes will erode incentives to invest that might have otherwise been present under a permanent policy. Economist William Gbohoui has modeled the impacts of a temporary tax cut financed by a future tax hike.[6] His results show that stimulative effects depend both on the tax cut and the higher future rate, with the tax hike partially offsetting a boost to growth. Gbohoui’s model is theoretical, but the UK is in a position to test the bounds of a temporary tax cut with a transparent future tax hike.

Conclusion

The UK has taken a unique approach in trying to gear its corporate tax system both to incentivize new investments in the near future and to increase revenues from corporate taxes over the longer term. On the one hand, the super-deduction will encourage additional investment in plant and equipment. On the other hand, the expiration of the super-deduction together with the increase in the corporate tax rate will cause the METR on plant and equipment to increase in the long run.

In addition, the pending corporate rate increase would reduce the incentive to invest in other assets such as IP and structures. In addition, firms will have an incentive to delay IP investment because the effective tax burden will be higher in 2021 and 2022 than in 2023.

Enacting expensing moves in the right direction. It reduces the cost of new investment and would result in a larger capital stock in the long run. However, the temporary nature of the proposal will eventually mean that the capital stock in the UK is smaller than it otherwise would be. An alternative policy of providing full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. with an increased corporate tax rate would have increased investment in the short run and the long run.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] See the methodology section for details on how these rates are calculated.

[2] HM Treasury, “Budget 2021: Policy Costings,” March 2021, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/965777/Budget_2021_policy_costings_.pdf.

[3] Kunka Petkova and Alfons Weichenrieder, “The relevance of depreciation allowances as a fiscal policy instrument: A hybrid approach to CCCTB?” Empirica 47 (April 2019), 579–610.

[4] Eric Zwick and James Mahon, “Tax Policy and Heterogeneous Investment Behavior,” American Economic Review 107:1 (January 2017), 217–248, https://www.aeaweb.org/articles?id=10.1257/aer.20140855.

[5] Giorgia Maffini, Jing Xing, and Michael P. Devereux, “The Impact of Investment Incentives: Evidence from UK Corporation Tax Returns,” American Economic Journal: Economic Policy 11:3 (August 2019), 361-89, https://www.aeaweb.org/articles?id=10.1257/pol.20170254.

[6] William Gbohoui, “Do Temporary Business Tax Cuts Matter? A General Equilibrium Analysis,” IMF, Feb. 15, 2019, https://www.imf.org/en/Publications/WP/Issues/2019/02/15/Do-Temporary-Business-Tax-Cuts-Matter-A-General-Equilibrium-Analysis-46524.

Share this article