Wine Taxes in Europe

2 min readBy:This is the beginning of a map series in which we’ll explore different types of excise taxes, starting with excise duties on wine. If you have ever wondered about the tax consequences of opening a bottle of wine—yes, there is a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. angle to everything—today’s map will provide you with some insights.

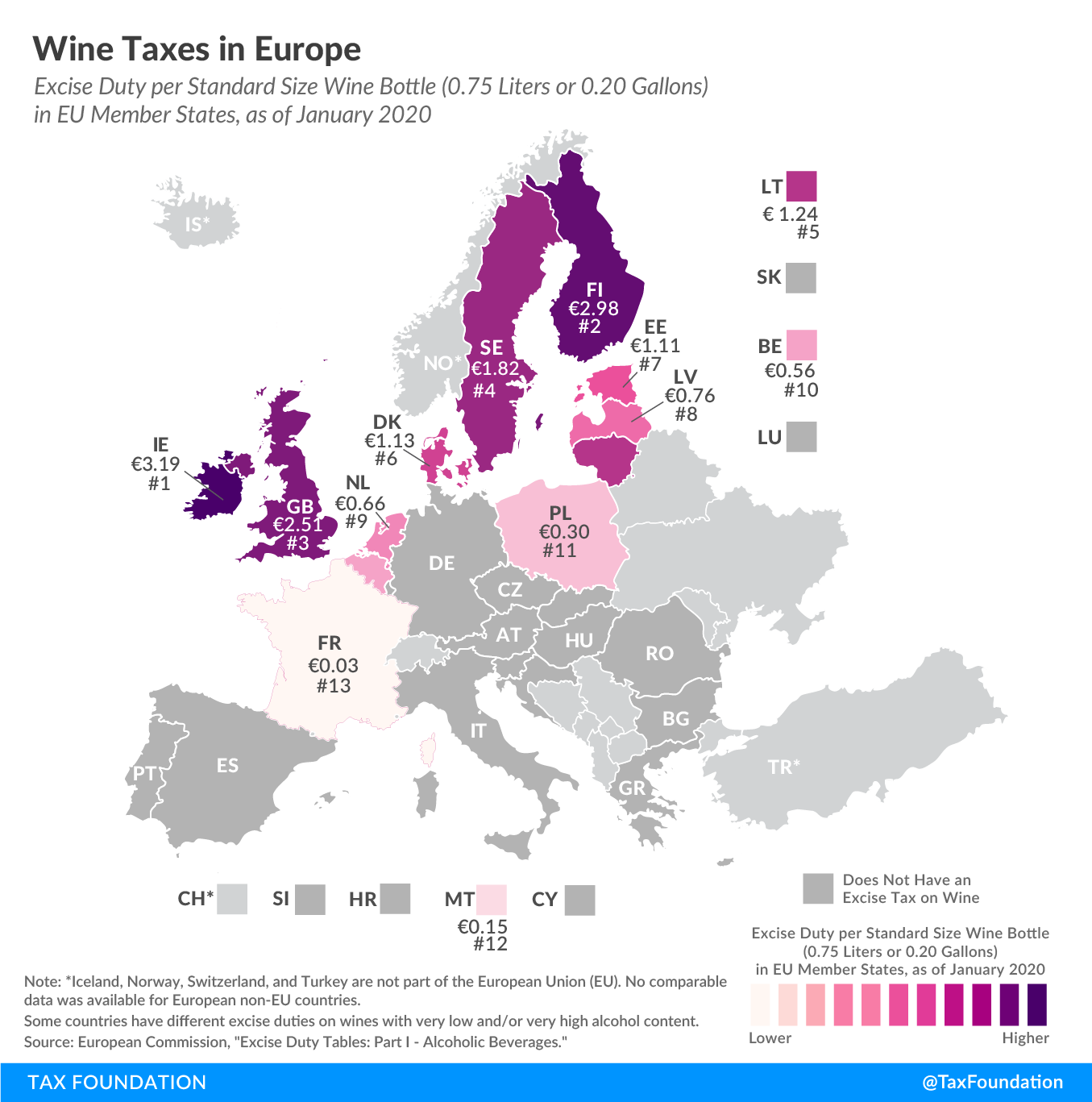

As one might expect, southern European countries well-known for their wines—such as France, Greece, Portugal, and Spain—have decided against taxing it or do so at a very low rate, while further north countries tend to levy taxes—sometimes hefty taxes.

While 13 EU countries levy an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on wine, they do so at very different rates. You’ll find the highest wine tax in Ireland, at €3.19 (US $3.57) per standard size wine bottle (0.75 liters or 0.20 gallons). Finland and the United Kingdom are next, at €2.98 ($3.33) and €2.51 ($2.81), respectively.

Of the countries levying a wine tax, by far the lowest rate can be found in a country well-known for its wine: France levies a tax of only €0.03 ($0.03) per bottle. Malta (€0.15 or $0.17) and Poland (€0.30 or $0.33) tax wine at the second and third lowest rates.

All European countries also levy a value-added tax (VAT) on wine. The excise amounts shown in the map relate only to excise taxes and do not include the VAT, which is charged on the sales value of the wine bottle.

| EU Member State | Excise Duty per Standard Sized Wine Bottle (0.75 liters or 0.20 gallons) | |

|---|---|---|

| Euros | US-Dollars | |

| Austria (AT) | – | – |

| Belgium (BE) | €0.56 | $0.63 |

| Bulgaria (BG) | – | – |

| Croatia (HR) | – | – |

| Cyprus (CY) | – | – |

| Czech Republic (CZ) | – | – |

| Denmark (DK) | €1.13 | $1.27 |

| Estonia (EE) | €1.11 | $1.24 |

| Finland (FI) | €2.98 | $3.33 |

| France (FR) | €0.03 | $0.03 |

| Germany (DE) | – | – |

| Greece (GR) | – | – |

| Hungary (HU) | – | – |

| Ireland (IE) | €3.19 | $3.57 |

| Italy (IT) | – | – |

| Latvia (LV) | €0.76 | $0.85 |

| Lithuania (LT) | €1.24 | $1.38 |

| Luxembourg (LU) | – | – |

| Malta (MT) | €0.15 | $0.17 |

| Netherlands (NL) | €0.66 | $0.74 |

| Poland (PL) | €0.30 | $0.33 |

| Portugal (PT) | – | – |

| Romania (RO) | – | – |

| Slovakia (SK) | – | – |

| Slovenia (SI) | – | – |

| Spain (ES) | – | – |

| Sweden (SE) | €1.82 | $2.04 |

| United Kingdom (GB) | €2.51 | $2.81 |

|

Source: European Commission, “Excise Duty Tables: Part I – Alcoholic Beverages,” Jan. 1, 2020, https://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/taxation/excise_duties/alcoholic_beverages/rates/excise_duties-part_i_alcohol_en.pdf. Note: Some countries have different excise duties on wines with very low and/or very high alcohol content. |

||

Note: This is part of a map series in which we examine excise taxes in Europe.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe