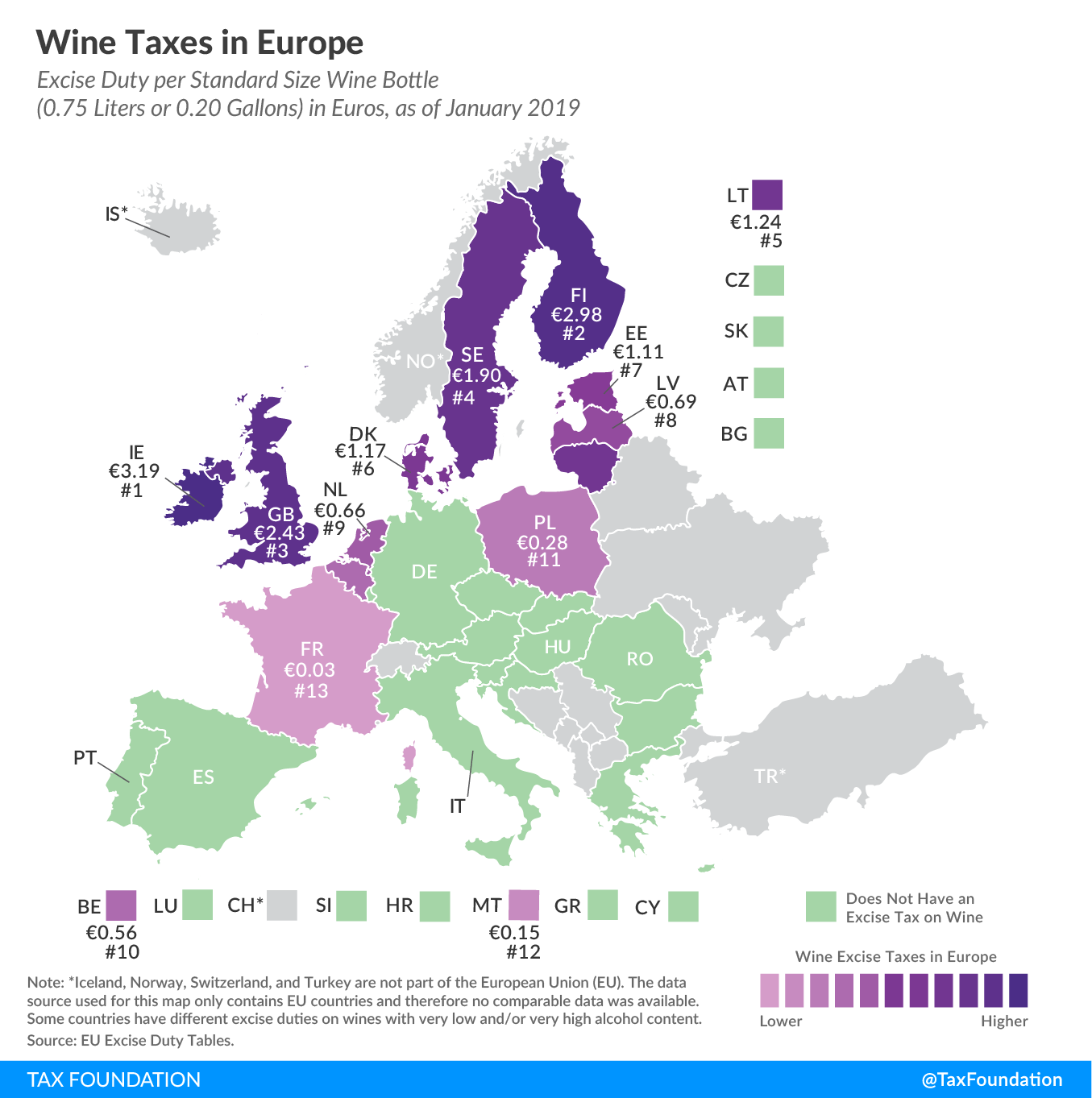

Wine Taxes in Europe

1 min readBy:Thomas Jefferson once said, “I think it is a great error to consider a heavy tax on wines as a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on luxury. On the contrary, it is a tax on the health of our citizens.” About half of the European countries covered in today’s map seem to agree with his statement and do not levy an excise tax on wine.

While 13 countries do levy an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on wine, they do so at very different rates. You’ll find the highest wine tax in Ireland, at €3.19 per standard size wine bottle (0.75 liters or 0.20 gallons). Finland and the United Kingdom are next, at €2.98 and €2.43, respectively.

Of the countries levying a wine tax, by far the lowest rate can be found in a country well-known for its wine: France levies a tax of only €0.03 per bottle. Malta (€0.15) and Poland (€0.28) tax wine at the second and third lowest rates.

All European countries also levy a value-added tax (VAT) on wine. The excise amounts shown in the map above relate only to excise taxes and do not include the VAT, which is charged on the sales value of the wine bottle.

Note: This is part of a map series in which we examine excise taxes in Europe.