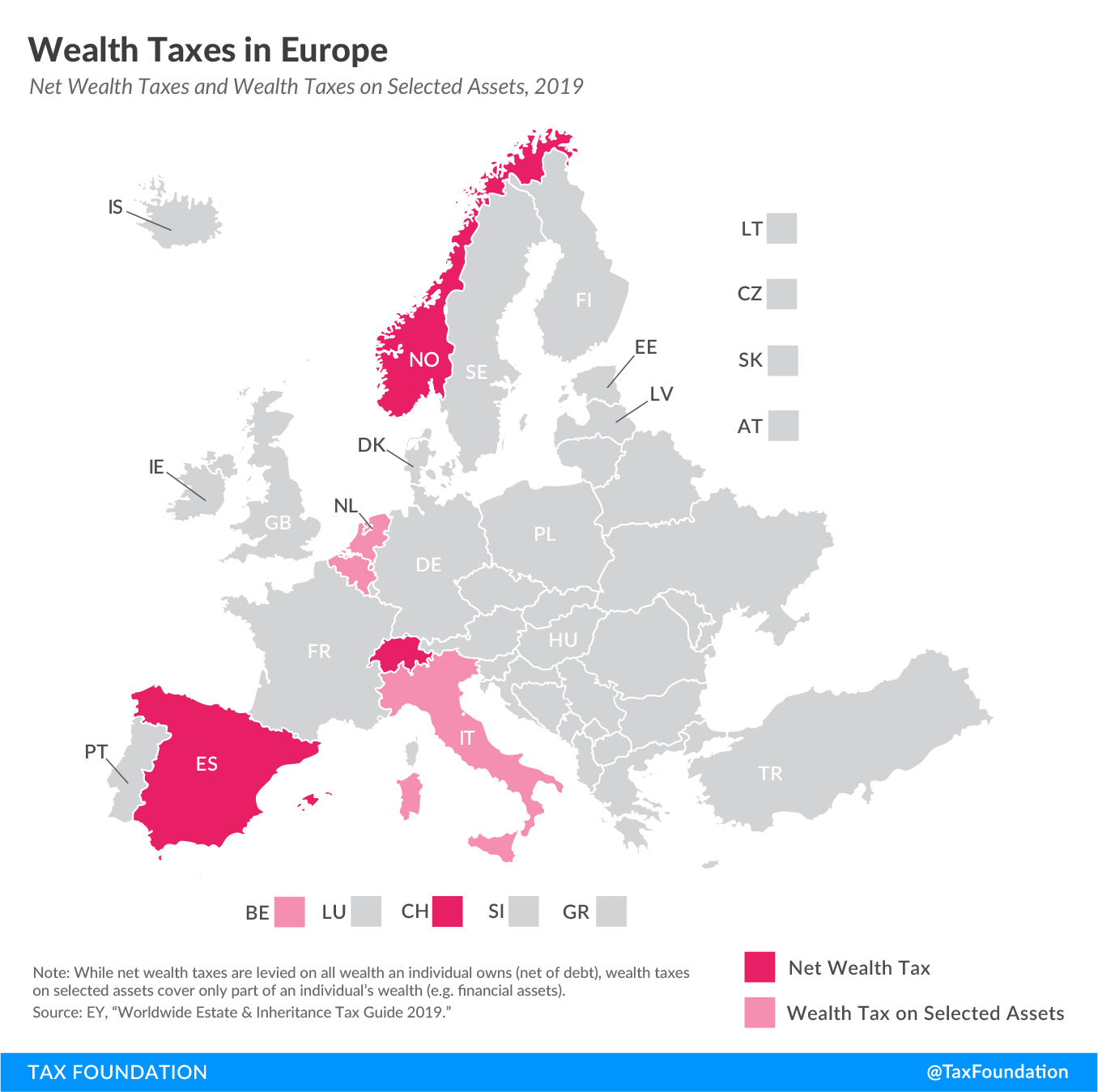

Wealth Taxes in Europe, 2019

3 min readBy:Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

Net Wealth Taxes

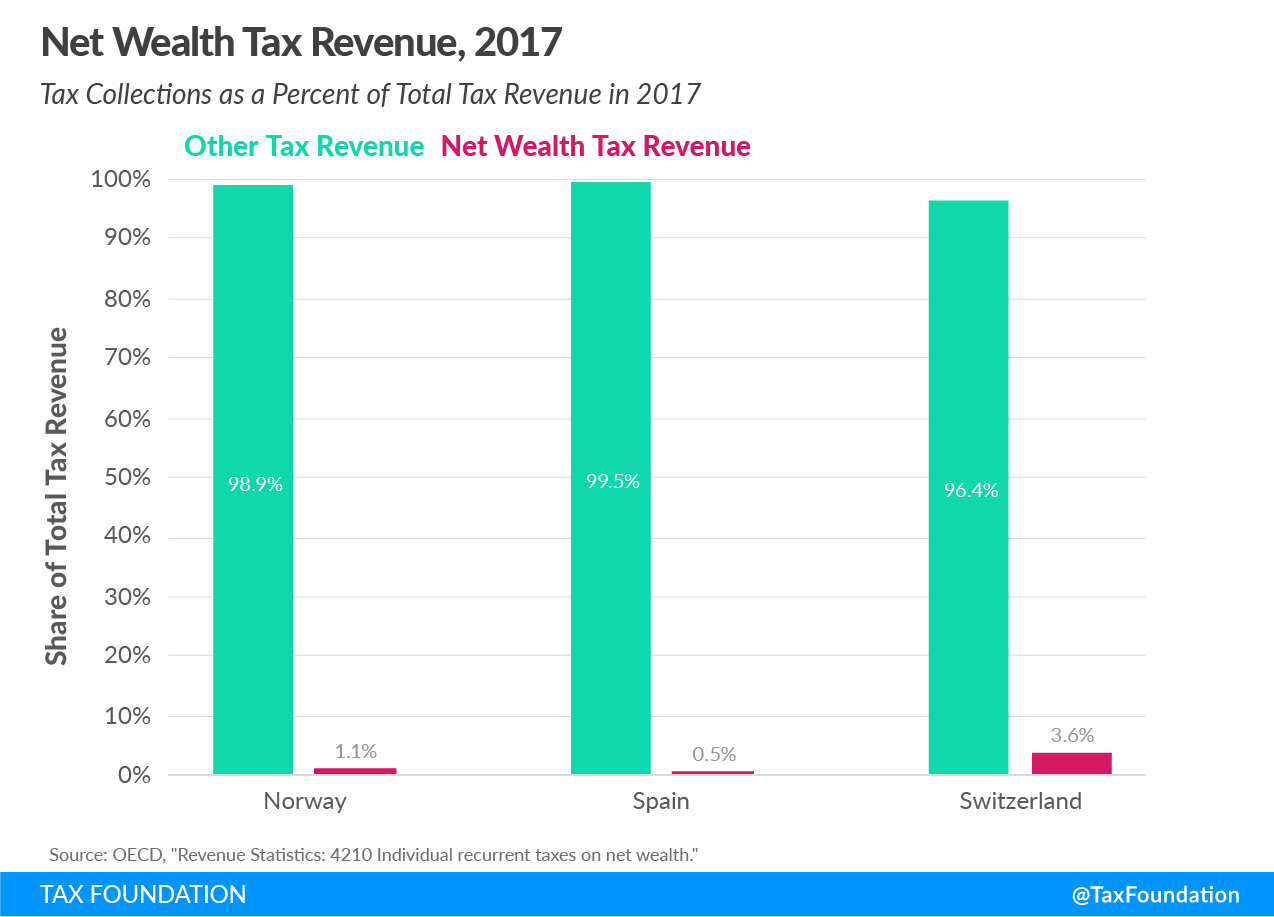

Norway levies a net wealth taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of 0.85 percent on wealth stocks exceeding NOK1.5 million (€150,000 or US $164,000), with 0.7 percent going to municipalities and 0.15 percent to the central government. Norway’s net wealth tax constitutes around 1.1 percent of its total tax revenues and dates to 1892.

Spain’s net wealth tax is a progressive tax ranging from 0.2 percent to 2.5 percent on wealth stocks above €700,000 ($775,000), with rates varying substantially across Spain’s autonomous regions (Madrid offers a 100 percent relief). Spanish residents are subject to the tax on a worldwide basis while non-residents pay the tax only on assets located in Spain. The net wealth tax makes up only 0.5 percent of total tax revenues.

Switzerland levies its net wealth tax at the cantonal level and covers worldwide assets (except real estate and permanent establishments located abroad). The tax rates and allowances vary significantly across cantons. First implemented in 1840, the tax now constitutes around 3.6 percent of total tax revenue.

Wealth Taxes on Selected Assets

Belgium introduced a limited wealth tax on securities accounts last year. The tax applies to holdings over €500,000 ($554,000) at a rate of 0.15 percent.

Italy taxes financial assets at 0.2 percent and properties held abroad at 0.76 percent.

In the Netherlands, the value of net wealth (excluding primary residence and substantial interests in companies) is included in the income tax, with effective tax rates ranging from 0.58 percent to 1.68 percent.

Share this article