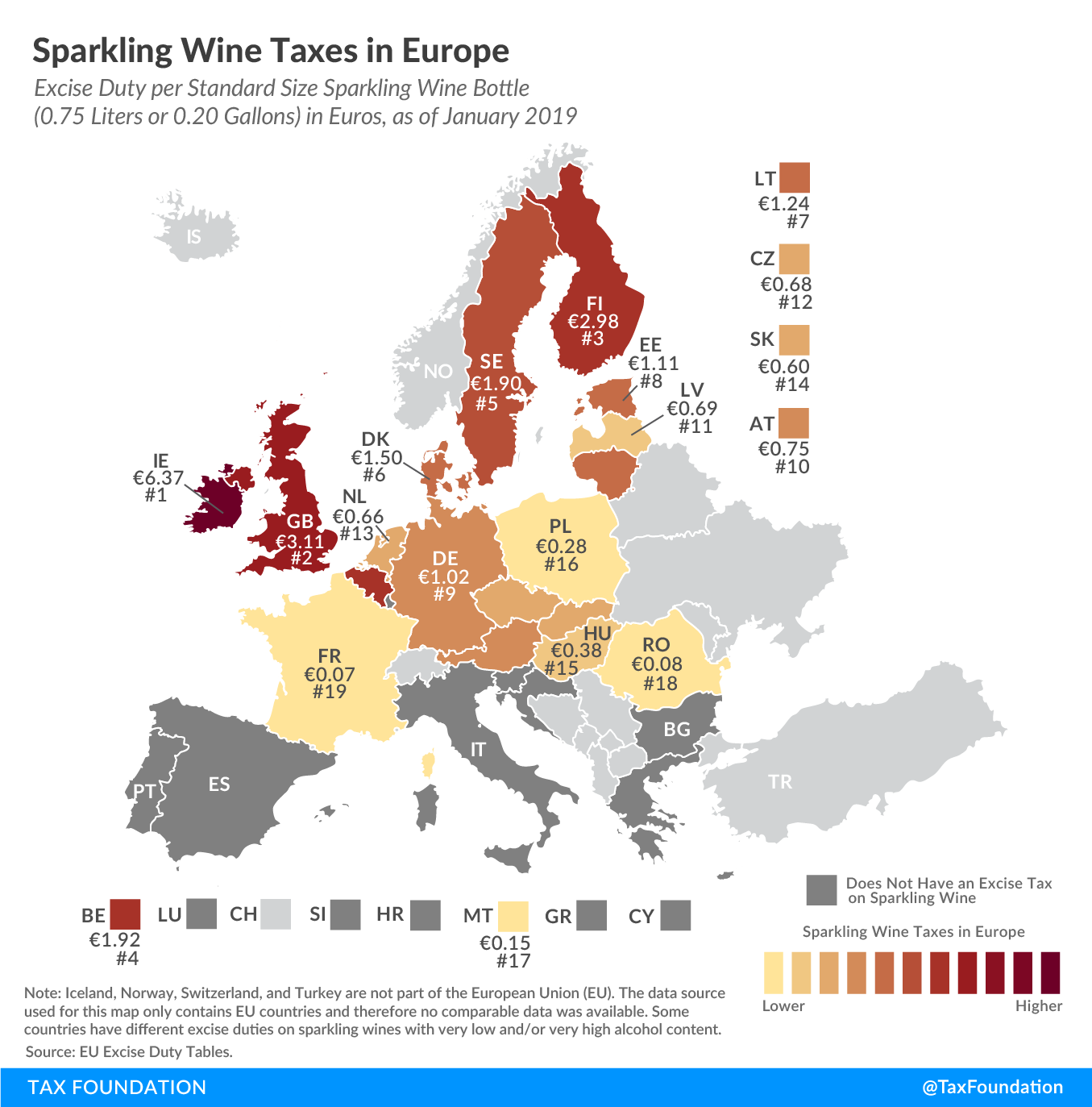

Sparkling Wine Taxes in Europe

1 min readBy:In a few days, people around the world will celebrate the turn of a decade, with many opening a bottle of sparkling wine to wish farewell to 2019 and offer a warm welcome to 2020. How such a bottle of sparkling wine is taxed differs significantly across EU countries, ranging from no excise tax in some countries to over €6 per bottle in Ireland.

You’ll find the highest excise taxes on sparkling wine in Ireland, at €6.37 (US $7.08) per standard sized wine bottle (750ml or 20oz). The United Kingdom and Finland are next, at €3.11 ($3.46) and €2.98 ($3.31), respectively.

Of the countries levying a sparkling wine taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , the lowest rates can be found in France (€0.07, or $0.08), Romania (€0.08, or $0.09), and Malta (€0.15, or $0.17)

All European countries also levy a value-added tax (VAT) on sparkling wine. The amounts shown on the map relate only to excise taxes and do not include the VAT, which is charged on the sales value of the sparkling wine bottle.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe