Providing journalists, taxpayers, and policymakers with basic data on taxes and spending is a cornerstone of Tax Foundation Europe’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility.

Our policy team regularly provides accessible, data-driven insights from sources such as the European Commission, the Organisation for Economic Co-Operation and Development (OECD), and others.

Featured Data

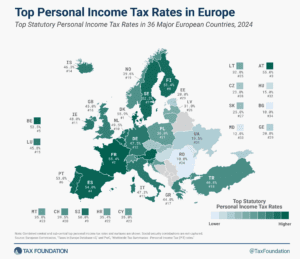

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

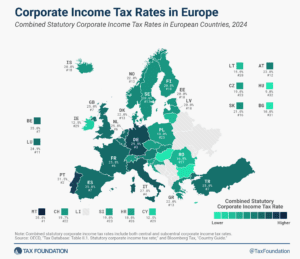

Corporate Income Tax Rates in Europe, 2024

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

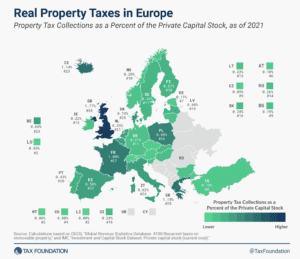

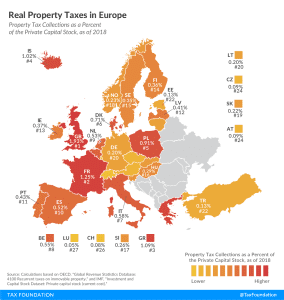

Real Property Taxes in Europe, 2023

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

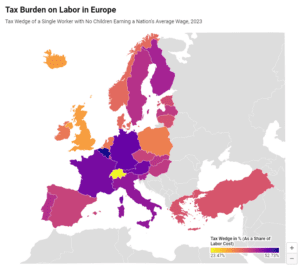

Tax Burden on Labor in Europe, 2024

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

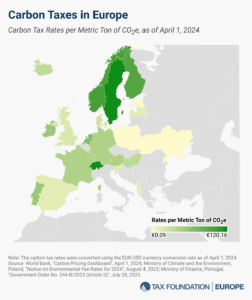

Carbon Taxes in Europe, 2024

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min readAll European Tax Data

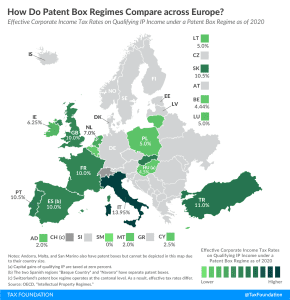

Patent Box Regimes in Europe, 2020

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

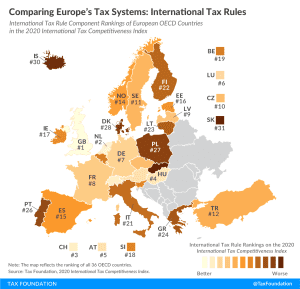

Comparing Europe’s Tax Systems: International Tax Rules

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read

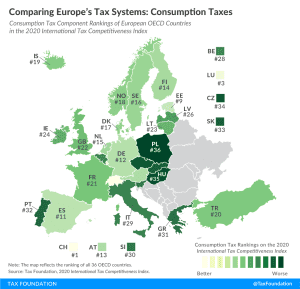

Comparing Europe’s Tax Systems: Consumption Taxes

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

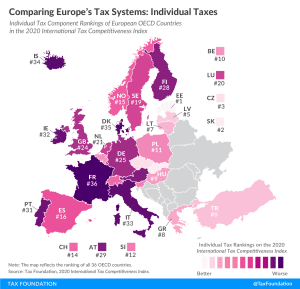

Comparing Europe’s Tax Systems: Individual Taxes

How do individual income tax codes compare among European OECD countries? Explore our new map to see how individual income tax systems in Europe compare.

3 min read

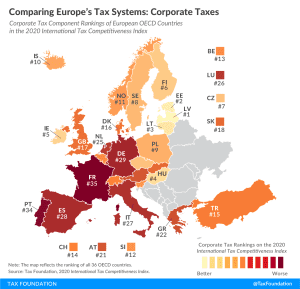

Comparing Europe’s Tax Systems: Corporate Taxes

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

3 min read

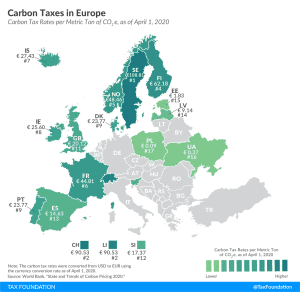

Carbon Taxes in Europe, 2020

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

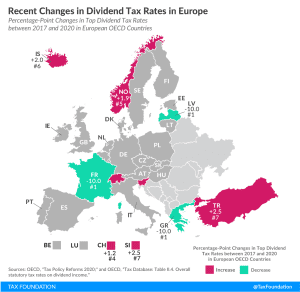

Recent Changes in Dividend Tax Rates in Europe

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

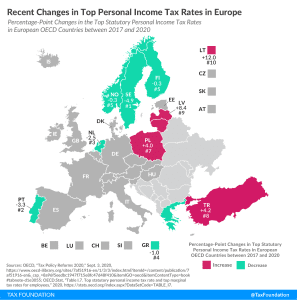

Recent Changes in Top Personal Income Tax Rates in Europe

Ten European OECD countries recently changed their top personal income tax rates. Of the ten countries, six cut their top personal income tax rates while the other four raised their top rates.

4 min read

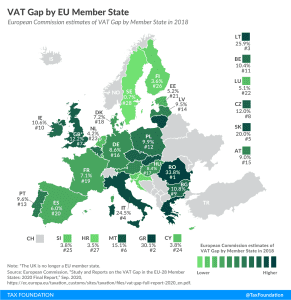

New European Commission Report: VAT Gap

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

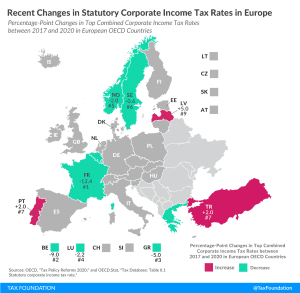

Recent Changes in Statutory Corporate Income Tax Rates in Europe

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read

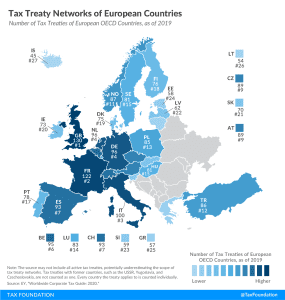

Tax Treaty Network of European Countries

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

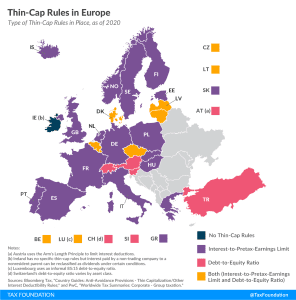

Thin-Cap Rules in Europe

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read

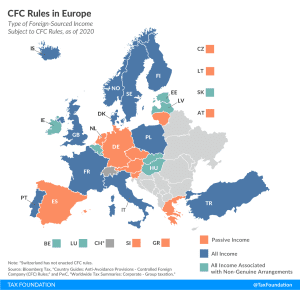

CFC Rules in Europe

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

5 min read

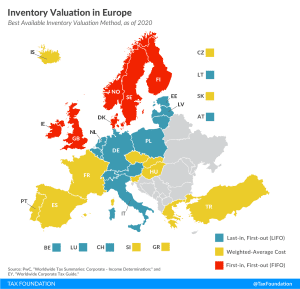

Inventory Valuation in Europe

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

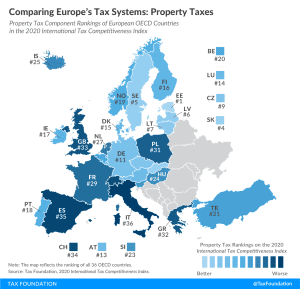

Real Property Taxes in Europe, 2020

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

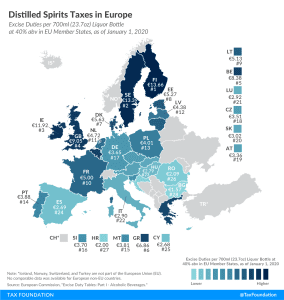

Distilled Spirits Taxes in Europe

2 min read

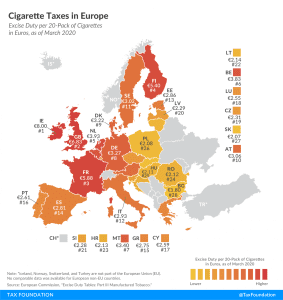

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read