Estate, Inheritance, and Gift Taxes in Europe, 2020

3 min readBy:Inheritance tax dates back to the Roman Empire, which collected 5 percent of inherited property in order to pay soldiers’ pensions. Today, the practice is widespread.

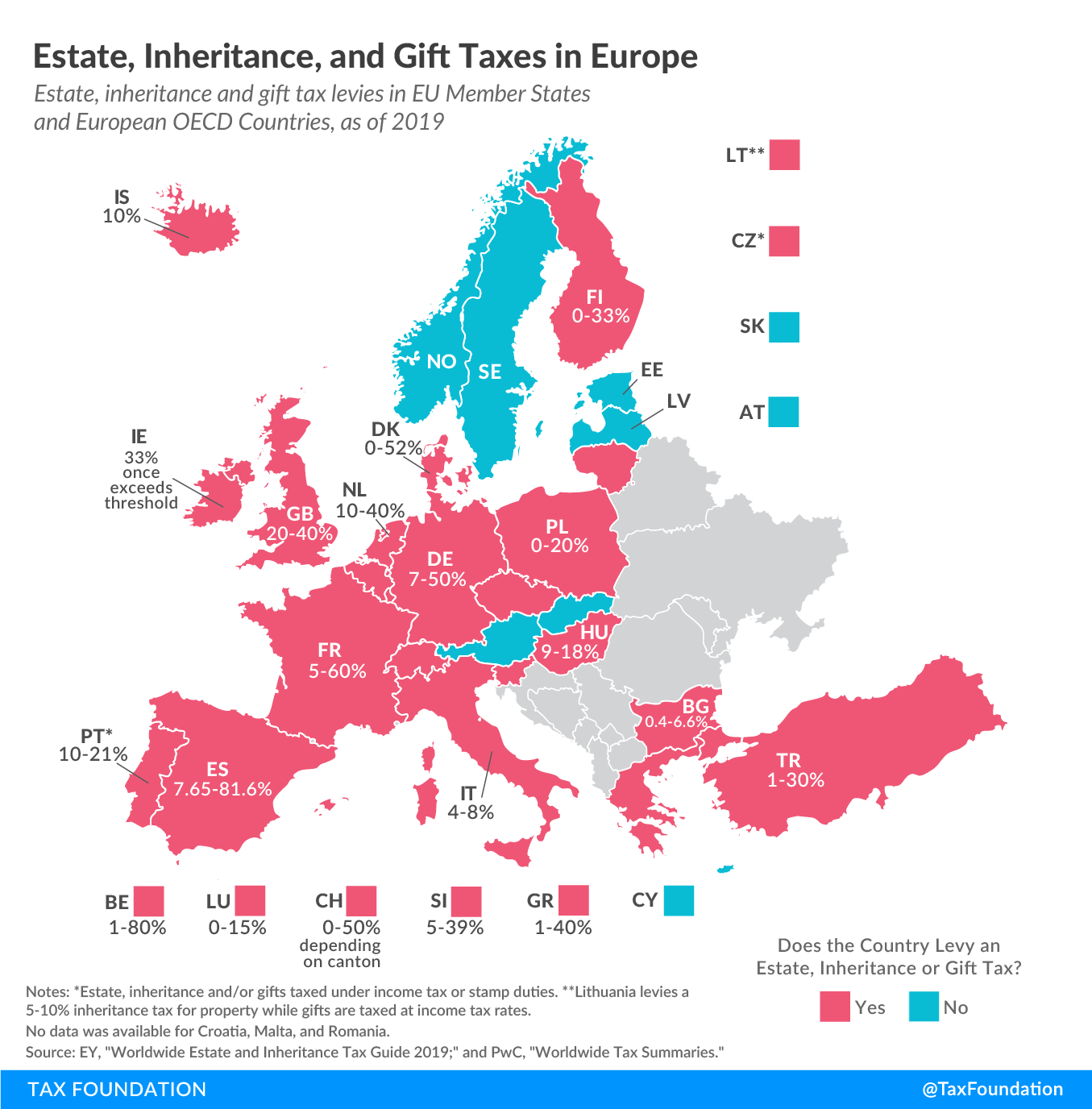

The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes. These countries are Belgium, Bulgaria, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Slovenia, Spain, Switzerland, Turkey, and the United Kingdom.

An estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. Countries typically charge only estate or inheritance taxAn inheritance tax is levied upon the value of inherited assets received by a beneficiary after a decedent’s death. Not to be confused with estate taxes, which are paid by the decedent’s estate based on the size of the total estate before assets are distributed, inheritance taxes are paid by the recipient or heir based on the value of the bequest received. . However, estates can be double-taxed if they are taxed by two jurisdictions that apply different taxes. For this reason, European Union member states have installed mechanisms intended to prevent or relieve double-taxation if such a situation occurs.

The rates applied to estate, inheritance, and gift tax often depend on the level of familial closeness to the inheritor as well as the amount to be inherited. For example, in France, different rates are applied to transfers to ascendants and descendants, transfer between siblings, blood relatives up to the fourth degree, and everyone else. For transfers to ascendants and descendants as well as between siblings, higher rates are applied to larger sums of money.

In some countries, such as Belgium or Switzerland, estate, gift, and inheritance taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates also vary by region. Most tax codes do not tax transfers under a certain amount.

| Country | Estate/Inheritance/Gift Tax | Tax Rate |

|---|---|---|

| Austria (AT) | No | No tax |

| Belgium (BE) | Yes | 1-80% |

| Bulgaria (BG) | Yes | 0.4-6.6% |

| Cyprus (CY) | No | No tax |

| Czech Republic (CZ) | Yes* | Income tax rates |

| Denmark (DK) | Yes | 0-52% |

| Estonia (EE) | No | No tax |

| Finland (FI) | Yes | 0-33% |

| France (FR) | Yes | 5-60% |

| Germany (DE) | Yes | 7-50% |

| Greece (GR) | Yes | 1-40% |

| Hungary (HU) | Yes | 9-18% |

| Iceland (IS) | Yes | 10% |

| Ireland (IE) | Yes | 33% once exceeding threshold |

| Italy (IT) | Yes | 4-8% |

| Latvia (LV) | No | No tax |

| Lithuania (LT) | Yes* | 5-10% inheritance tax for property, gifts taxed at income tax rates |

| Luxembourg (LU) | Yes | 0-15% |

| Netherlands (NL) | Yes | 10-40% |

| Norway (NO) | No | No tax |

| Poland (PL) | Yes | 0-20% |

| Portugal (PT) | Yes* | Stamp duties, 10-21% |

| Slovakia (SK) | No | No tax |

| Slovenia (SI) | Yes | 5-39% |

| Spain (ES) | Yes | 7.65-81.6% |

| Sweden (SE) | No | No tax |

| Switzerland (CH) | Yes | 0-50% depending on canton |

| Turkey (TR) | Yes | 1-30% |

| United Kingdom (GB) | Yes | 20-40% |

|

Source: EY, “Worldwide Estate and Inheritance Tax Guide 2019,” 2019, https://www.ey.com/en_gl/tax-guides/worldwide-estate-and-inheritance-tax-guide-2019; and PwC, “Worldwide Tax Summaries Online,” 2020, https://taxsummaries.pwc.com/. Note: No data was available for Croatia, Malta, and Romania. *Estate, inheritance, and/or gifts taxed under income tax or stamp duties. |

||