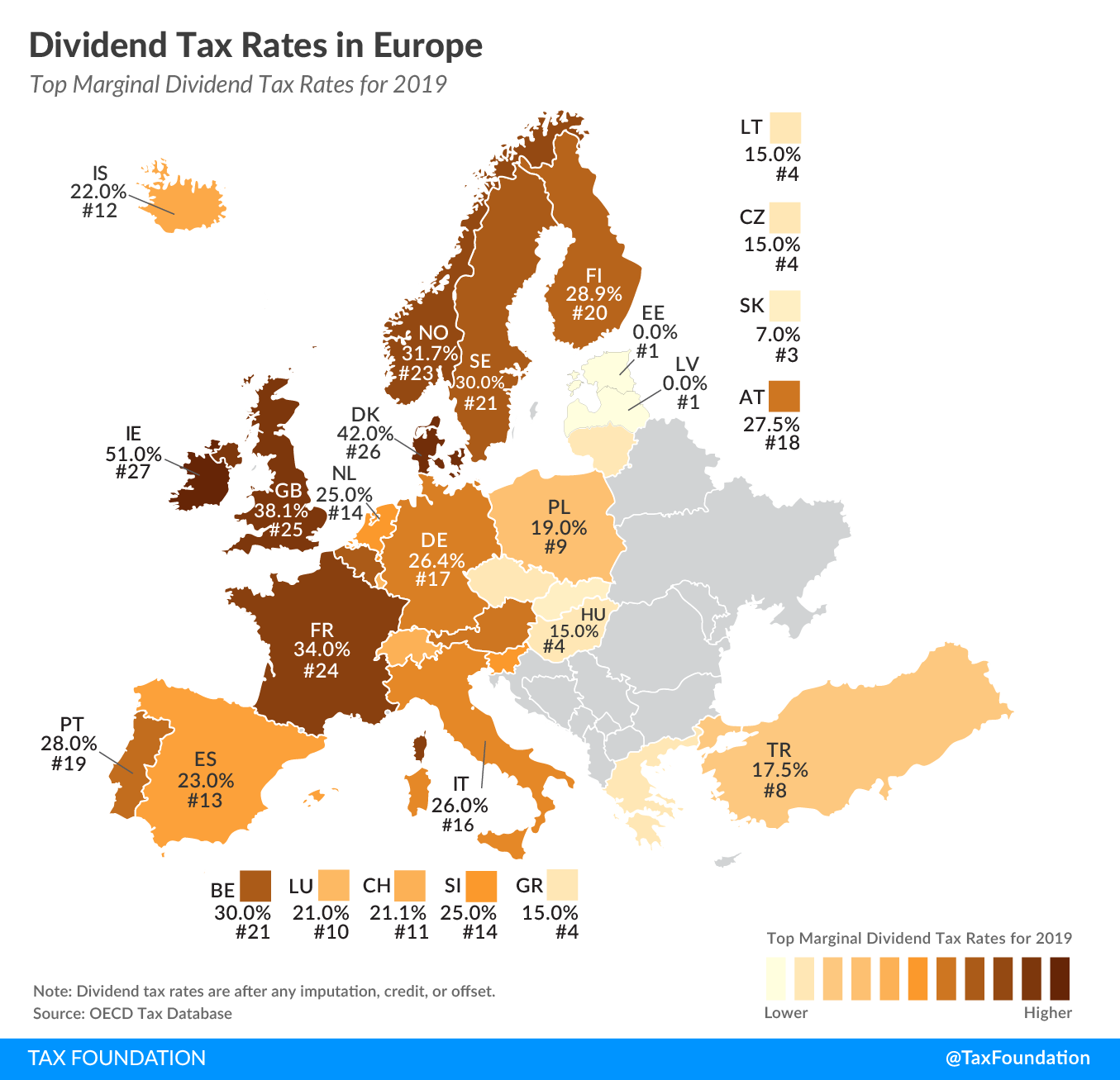

Dividend Tax Rates in Europe, 2019

2 min readBy:Many countries’ individual income tax systems taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. investment income in addition to wage income. They do this by levying taxes on income from capital gains and dividends. Today’s map focuses on taxes on dividends, showing how dividend tax rates vary across European countries.

A dividend is a payment made to an individual from after-tax corporate profits. Once shareholders of a business receive this dividend income, they pay dividend taxes on it. The dividend tax rates shown in our map are expressed as the top marginal personal dividend tax rate, taking account of all imputations, credits, or offsets.

Estonia and Latvia are the only two European countries covered that currently do not levy a tax on dividend income. Of the countries that do levy a dividend tax, Slovakia has the lowest tax rate, at 7 percent.

Ireland, in contrast, has the highest dividend tax rate at 51 percent. Denmark and the United Kingdom follow, at 42 percent and 38.1 percent, respectively.

On average, the European countries covered tax dividend income at 23.5 percent.

Some countries have integrated their taxation of corporate and dividend income to eliminate double taxation. In most countries, though, dividend taxes add another layer of taxation on corporate income.

Imagine a business earns a profit of $100. This profit is subject to a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. of 22.5 percent (the average of the European countries covered), resulting in corporate income taxes of $22.50 and after-tax profits of $77.50. The business decides to distribute these after-tax profits as dividends to its shareholders. These shareholders then need to pay an average of 23.5 percent in dividend taxes, a tax bill of $18.21. The total tax bill on a $100 profit then amounts to $40.71, which is an integrated tax rate of 40.71 percent. As this example shows, when analyzing corporate income taxation, it is important to look at dividend taxes in the context of other layers of taxation.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe