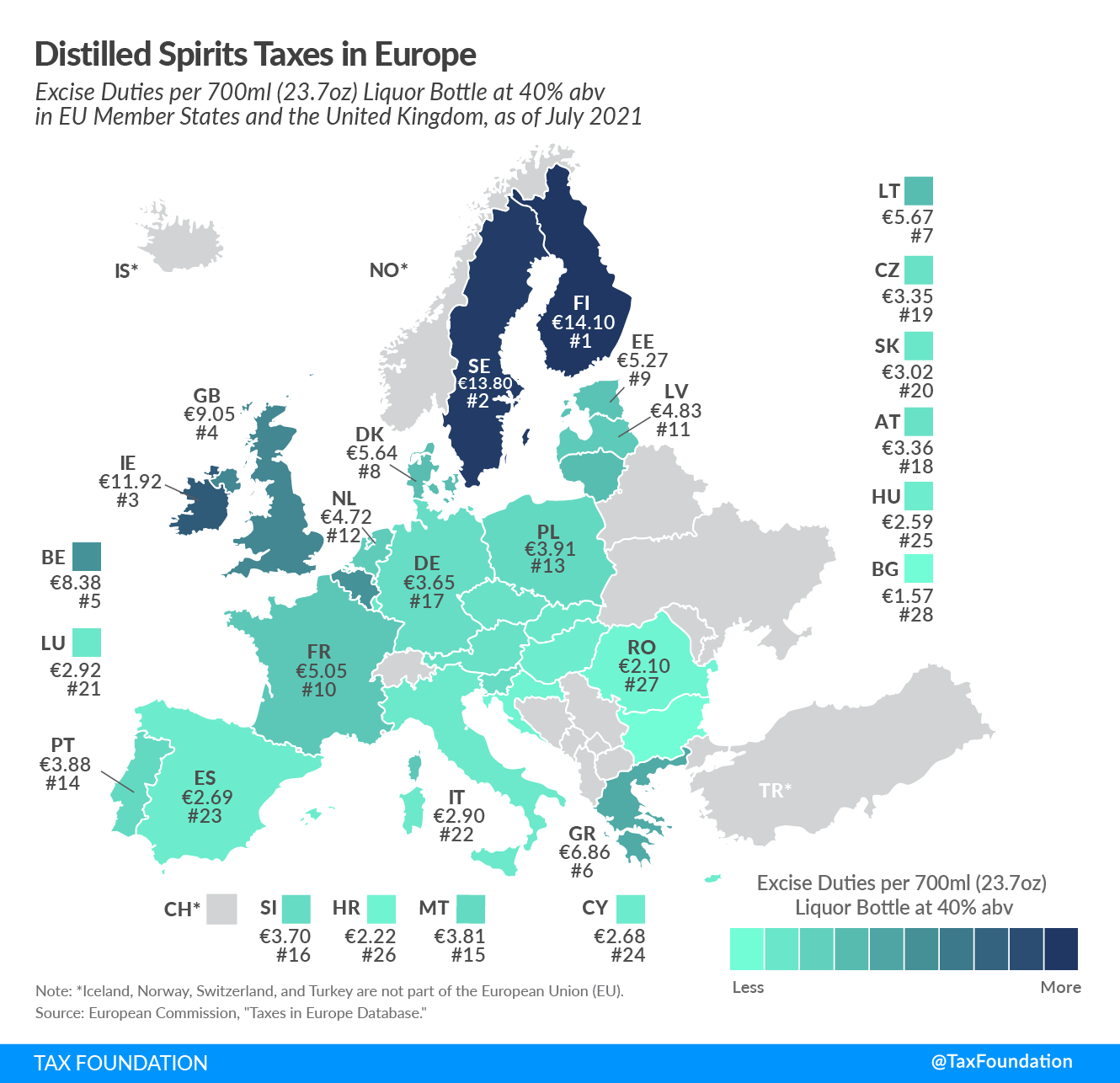

Distilled Spirits Taxes in Europe, 2021

3 min readBy:All European Union (EU) countries and the United Kingdom levy excise duties on distilled alcohol; excise tax is applied to the cost of goods on purchase.

The standard size of a liquor bottle in Europe is 700ml (23.7 oz). Many spirits, such as vodka, gin, rum, and whiskey, contain alcohol content in the range of 40 percent. In the European countries covered, the average excise duty on a 700ml bottle of liquor containing 40 percent alcohol is €5.13 (US $5.85).

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

The lowest rate is applied in Bulgaria, where an excise duty of €1.57 ($1.80) is charged for a 700ml bottle containing 40 percent alcohol, followed by Romania, which charges €2.10 ($2.39). Croatia, which charges excise of €2.22 ($2.53), has the third-lowest excise duty.

In 2016, the Czech Republic, Germany, and Lithuania consumed the most (recorded) litres of alcohol per adult (15+) in the EU. All three countries have excise duties close to or below the European average.

| Excise duty per litre of pure alcohol | Excise duty per 700ml containing 40% alcohol | |||

|---|---|---|---|---|

| EUR | USD | EUR | USD | |

| Austria (AT) | € 12.00 | $13.68 | € 3.36 | $3.83 |

| Belgium (BE) | € 29.93 | $34.13 | € 8.38 | $9.56 |

| Bulgaria (BG) | € 5.62 | $6.41 | € 1.57 | $1.80 |

| Croatia (HR) | € 7.93 | $9.05 | € 2.22 | $2.53 |

| Cyprus (CY) | € 9.57 | $10.91 | € 2.68 | $3.05 |

| Czech Republic (CZ) | € 11.98 | $13.66 | € 3.35 | $3.83 |

| Denmark (DK) | € 20.16 | $22.98 | € 5.64 | $6.44 |

| Estonia (EE) | € 18.81 | $21.45 | € 5.27 | $6.01 |

| Finland (FI) | € 50.35 | $57.41 | € 14.10 | $16.08 |

| France (FR) | € 18.03 | $20.55 | € 5.05 | $5.76 |

| Germany (DE) | € 13.03 | $14.86 | € 3.65 | $4.16 |

| Greece (GR) | € 24.50 | $27.94 | € 6.86 | $7.82 |

| Hungary (HU) | € 9.26 | $10.56 | € 2.59 | $2.96 |

| Ireland (IE) | € 42.57 | $48.54 | € 11.92 | $13.59 |

| Italy (IT) | € 10.36 | $11.81 | € 2.90 | $3.31 |

| Latvia (LV) | € 17.24 | $19.66 | € 4.83 | $5.50 |

| Lithuania (LT) | € 20.25 | $23.09 | € 5.67 | $6.47 |

| Luxembourg (LU) | € 10.41 | $11.87 | € 2.92 | $3.32 |

| Malta (MT) | € 13.60 | $15.51 | € 3.81 | $4.34 |

| Netherlands (NL) | € 16.86 | $19.22 | € 4.72 | $5.38 |

| Poland (PL) | € 13.96 | $15.92 | € 3.91 | $4.46 |

| Portugal (PT) | € 13.87 | $15.81 | € 3.88 | $4.43 |

| Romania (RO) | € 7.48 | $8.53 | € 2.10 | $2.39 |

| Slovakia (SK) | € 10.80 | $12.31 | € 3.02 | $3.45 |

| Slovenia (SI) | € 13.20 | $15.05 | € 3.70 | $4.21 |

| Spain (ES) | € 9.59 | $10.93 | € 2.69 | $3.06 |

| Sweden (SE) | € 49.27 | $56.18 | € 13.80 | $15.73 |

| United Kingdom (GB) | € 32.33 | $36.86 | € 9.05 | $10.32 |

| Average | € 18.32 | $20.89 | € 5.13 | $5.85 |

|

Source: European Commission, “Taxes in Europe Database,” https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html. |

||||