Tax Relief for Families in Europe

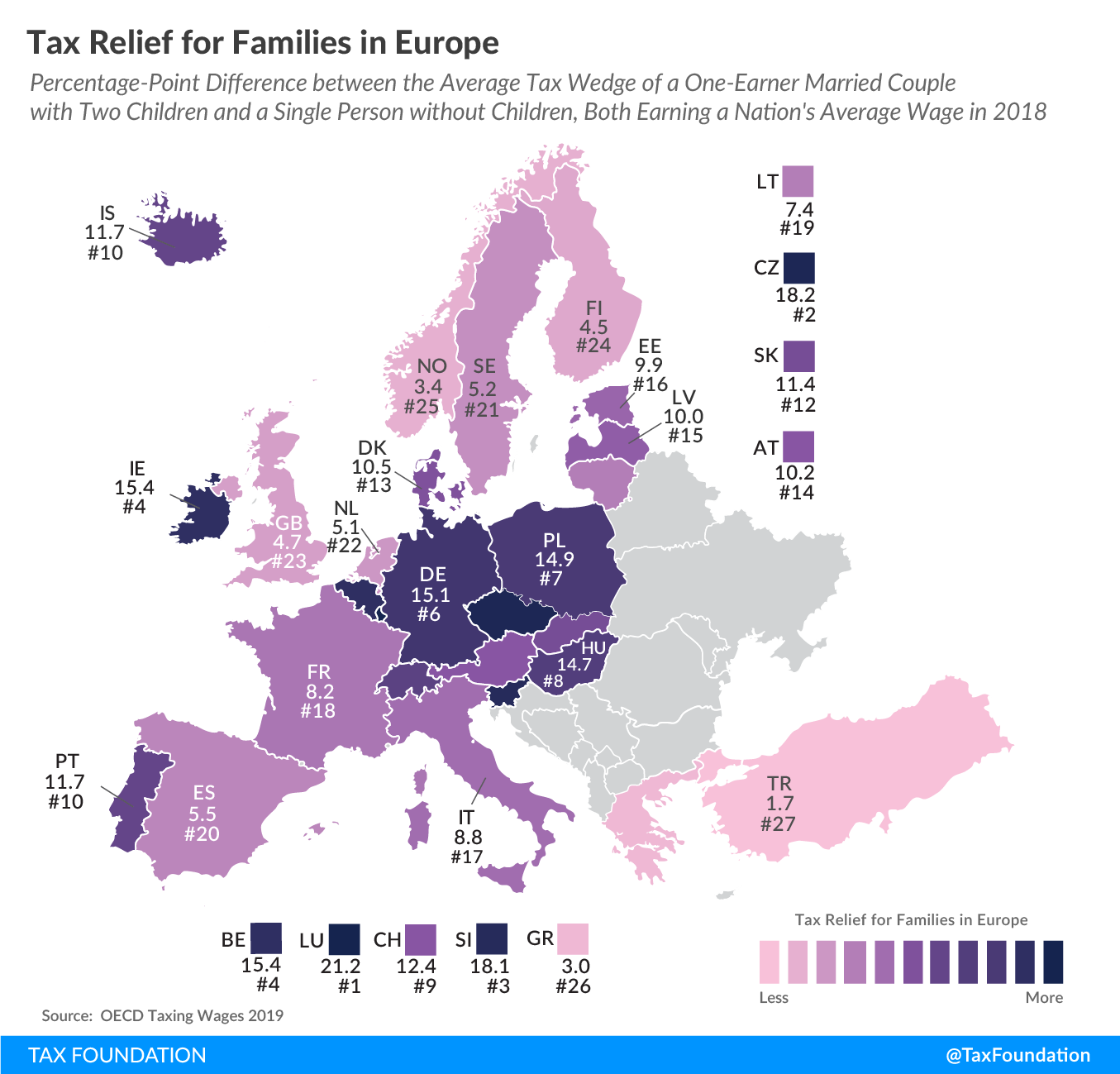

2 min readBy:Many countries provide targeted tax relief for families with children, typically through targeted taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. breaks that lower income taxes. As today’s map shows, the extent to which such tax relief is granted varies substantially across European countries.

One way to measure targeted tax relief for families is to compare the tax burdens on labor of a family with one earner and two children and a single worker without children, both earning the same pretax income.

The tax burden on labor, or “tax wedge,” is defined as the difference between an employer’s total labor cost of an employee and the employee’s net disposable income. In other words, it is the sum of income taxes and payroll taxes of a worker earning the average wage in a country, divided by the total labor cost of this worker.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn the European countries covered, a family with one earner and two children faced on average a tax burden of 29.9 percent in 2018. The average tax burden a single worker without children faced was 40.2 percent, 10.3 percentage-points higher than a family.

Luxembourg had the largest disparity between the two tax wedges of all countries covered, with a 21.2 percentage-point difference between its 38.2 percent wedge for single workers and 17 percent wedge for families.

Turkey had the smallest gap with tax burdens of 37.2 percent on families and 38.9 percent on singles, a difference of only 1.7 percentage-points.

|

Source: OECD, “Taxing Wages,” https://stats.oecd.org/Index.aspx?DataSetCode=AWCOMP. |

Single person earning a nation’s average wage, no child | One-earner married couple earning a nation’s average wage, 2 children | Percentage-Point Difference |

|---|---|---|---|

| Austria | 47.6% | 37.4% | 10.2 |

| Belgium | 52.7% | 37.3% | 15.4 |

| Czech Republic | 43.7% | 25.5% | 18.2 |

| Denmark | 35.7% | 25.2% | 10.5 |

| Estonia | 36.5% | 26.6% | 9.9 |

| Finland | 42.3% | 37.8% | 4.5 |

| France | 47.6% | 39.4% | 8.2 |

| Germany | 49.5% | 34.4% | 15.1 |

| Greece | 40.9% | 37.9% | 3.0 |

| Hungary | 45.0% | 30.3% | 14.7 |

| Iceland | 33.2% | 21.5% | 11.7 |

| Ireland | 32.7% | 17.3% | 15.4 |

| Italy | 47.9% | 39.1% | 8.8 |

| Latvia | 42.3% | 32.3% | 10.0 |

| Lithuania | 40.6% | 33.2% | 7.4 |

| Luxembourg | 38.2% | 17.0% | 21.2 |

| Netherlands | 37.7% | 32.6% | 5.1 |

| Norway | 35.8% | 32.4% | 3.4 |

| Poland | 35.8% | 20.9% | 14.9 |

| Portugal | 40.7% | 29.0% | 11.7 |

| Slovak Republic | 41.7% | 30.3% | 11.4 |

| Slovenia | 43.3% | 25.2% | 18.1 |

| Spain | 39.4% | 33.9% | 5.5 |

| Sweden | 43.1% | 37.9% | 5.2 |

| Switzerland | 22.2% | 9.8% | 12.4 |

| Turkey | 38.9% | 37.2% | 1.7 |

| United Kingdom | 30.9% | 26.2% | 4.7 |

| Average | 40.2% | 29.9% | 10.3 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe