Gas Taxes in Europe, 2020

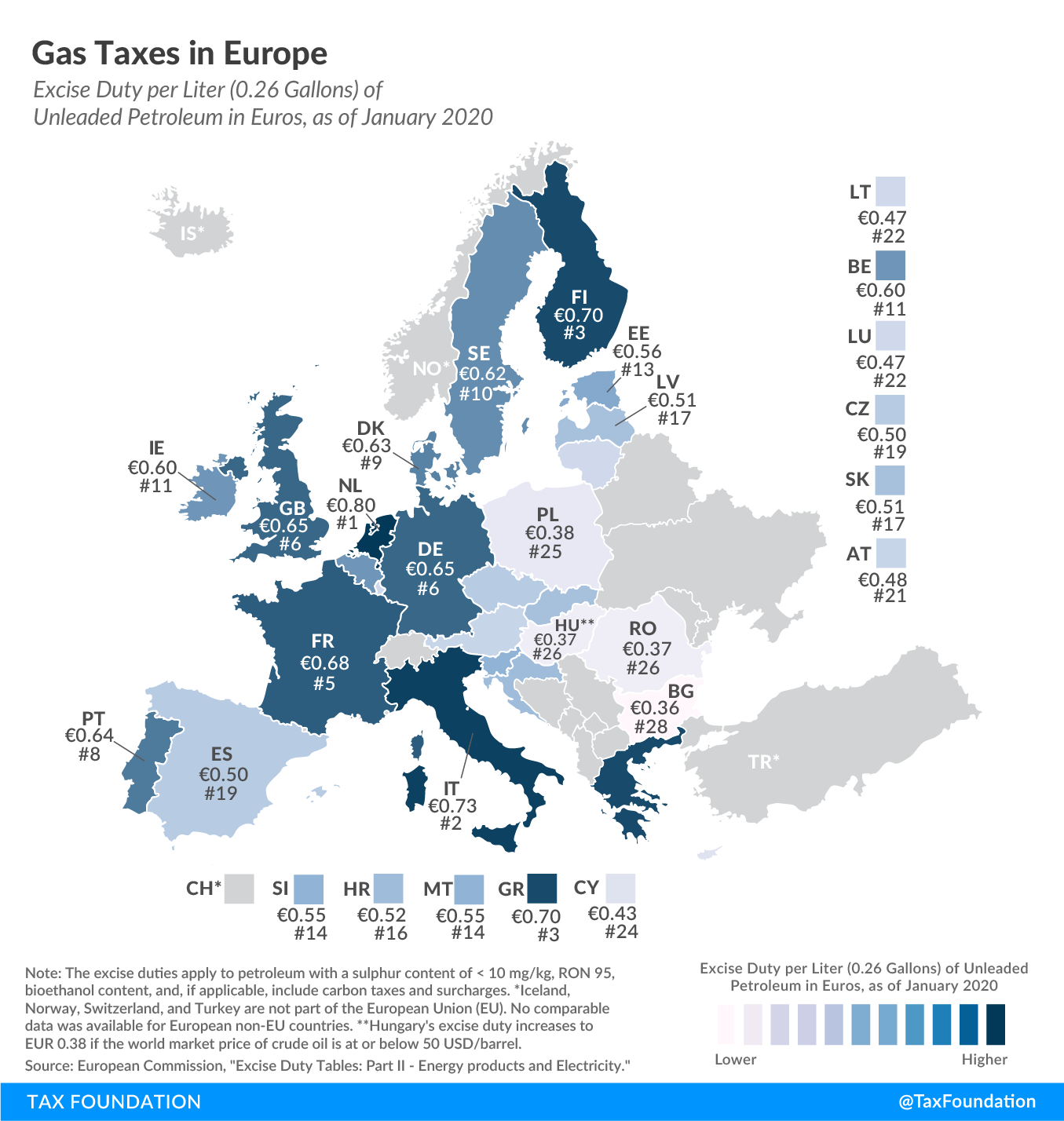

4 min readBy:To facilitate and foster cross-border trade and to prevent significant competitive distortions, the European Union requires EU countries to levy a minimum excise duty of €0.36 per liter (US $1.53 per gallon) on gas. As today’s map shows, only Bulgaria sticks to the minimum rate, while all other EU countries opt to levy higher excise duties on gas.

The Netherlands has the highest gas tax in the European Union, at €0.80 per liter ($3.39 per gallon). Italy is second, at €0.73 per liter ($3.09 per gallon), followed by Finland and Greece, which have a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of €0.70 per liter ($2.97 per gallon).

The lowest gas tax is in Bulgaria, at €0.36 per liter ($1.53 per gallon), followed by Hungary (€0.37 per liter or $1.57 per gallon) and Poland (€0.38 per liter or $1.61 per gallon).

Between one-third and one-half of new passenger vehicles in the European Union are diesel vehicles. Therefore, many European consumers face excise duties on diesel instead of gas. The EU sets a slightly lower minimum excise duty of €0.33 per liter ($1.40 per gallon) on diesel.

Twenty-six out of 27 EU countries levy a lower excise duty on diesel than on gas. Both the United Kingdom, which is no longer part of the EU, and Belgium levy the same rate on the two fuel types. The average excise duty on gas is €0.55 per liter ($2.35 per gallon) in the European Union (including the UK), and €0.45 per liter ($1.90 per gallon) on diesel.

The United Kingdom levies the highest excise duty on diesel, at €0.65 per liter ($2.76 per gallon), followed by Italy (€0.62 per liter or $2.63 per gallon) and Belgium (€0.60 per liter or $2.54 per gallon).

The countries with the lowest excise duties on diesel are Bulgaria, at €0.33 per liter ($1.40 per gallon), followed by Hungary, Poland, and Romania, which all charge duties of €0.34 per liter ($1.44 per gallon).

All EU countries also levy a value-added tax (VAT) on gas and diesel. The excise amounts shown in the map above relate only to excise taxes and do not include the VAT, which is charged on the sales value of gas and diesel.

| Gas Tax | Diesel Tax | |||||

|---|---|---|---|---|---|---|

| Per Liter in EUR | Per Gallon in USD | Rank | Per Liter in EUR | Per Gallon in USD | Rank | |

|

Austria (AT) |

€ 0.48 | $2.03 | 21 | € 0.40 | $1.70 | 19 |

|

Belgium (BE) |

€ 0.60 | $2.54 | 11 | € 0.60 | $2.54 | 3 |

|

Bulgaria (BG) |

€ 0.36 | $1.53 | 28 | € 0.33 | $1.40 | 28 |

|

Croatia (HR) |

€ 0.52 | $2.20 | 16 | € 0.41 | $1.74 | 16 |

|

Cyprus (CY) |

€ 0.43 | $1.82 | 24 | € 0.40 | $1.70 | 19 |

|

Czech Republic (CZ) |

€ 0.50 | $2.12 | 19 | € 0.43 | $1.82 | 14 |

|

Denmark (DK) |

€ 0.63 | $2.67 | 9 | € 0.43 | $1.82 | 14 |

|

Estonia (EE) |

€ 0.56 | $2.37 | 13 | € 0.49 | $2.08 | 7 |

|

Finland (FI) |

€ 0.70 | $2.97 | 3 | € 0.53 | $2.25 | 5 |

|

France (FR) |

€ 0.68 | $2.88 | 5 | € 0.59 | $2.50 | 4 |

|

Germany (DE) |

€ 0.65 | $2.76 | 6 | € 0.47 | $1.99 | 10 |

|

Greece (GR) |

€ 0.70 | $2.97 | 3 | € 0.41 | $1.74 | 16 |

|

Hungary (HU)* |

€ 0.37 | $1.57 | 26 | € 0.34 | $1.44 | 25 |

|

Ireland (IE) |

€ 0.60 | $2.54 | 11 | € 0.49 | $2.08 | 7 |

|

Italy (IT) |

€ 0.73 | $3.09 | 2 | € 0.62 | $2.63 | 2 |

|

Latvia (LV) |

€ 0.51 | $2.16 | 17 | € 0.41 | $1.74 | 16 |

|

Lithuania (LT) |

€ 0.47 | $1.99 | 22 | € 0.37 | $1.57 | 22 |

|

Luxembourg (LU) |

€ 0.47 | $1.99 | 22 | € 0.36 | $1.53 | 24 |

|

Malta (MT) |

€ 0.55 | $2.33 | 14 | € 0.47 | $1.99 | 10 |

|

Netherlands (NL) |

€ 0.80 | $3.39 | 1 | € 0.50 | $2.12 | 6 |

|

Poland (PL) |

€ 0.38 | $1.61 | 25 | € 0.34 | $1.44 | 25 |

|

Portugal (PT) |

€ 0.64 | $2.71 | 8 | € 0.49 | $2.08 | 7 |

|

Romania (RO) |

€ 0.37 | $1.57 | 26 | € 0.34 | $1.44 | 25 |

|

Slovakia (SK) |

€ 0.51 | $2.16 | 17 | € 0.37 | $1.57 | 22 |

|

Slovenia (SI) |

€ 0.55 | $2.33 | 14 | € 0.47 | $1.99 | 10 |

|

Spain (ES) |

€ 0.50 | $2.12 | 19 | € 0.38 | $1.61 | 21 |

|

Sweden (SE)** |

€ 0.62 | $2.63 | 10 | € 0.44 | $1.87 | 13 |

|

United Kingdom (GB) |

€ 0.65 | $2.76 | 6 | € 0.65 | $2.76 | 1 |

|

Average |

€ 0.55 | $2.35 | € 0.45 | $1.90 | ||

|

Minimum Rate |

€ 0.36 | $1.53 | € 0.33 | $1.40 | ||

|

Source: European Commission, “Excise Duty Tables: Part II Energy products and Electricity,” https://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/taxation/excise_duties/energy_products/rates/excise_duties-part_ii_energy_products_en.pdf. |

||||||

|

Notes: The excise duties apply to gas and diesel with a sulfur content of < 10 mg/kg, RON 95 (gas), bioethanol content, and, if applicable, include carbon taxes and surcharges. The excise duties were converted into USD using the average 2019 USD-EUR exchange rate (0.893); see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. *Hungary’s excise duty increases to EUR 0.38 per liter for gas and EUR 0.37 per liter for diesel if the world market price of crude oil is at or below $50 USD/barrel. **The listed excise duties were taken from the rates applied to environmental class 1 gas and diesel. |

||||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe