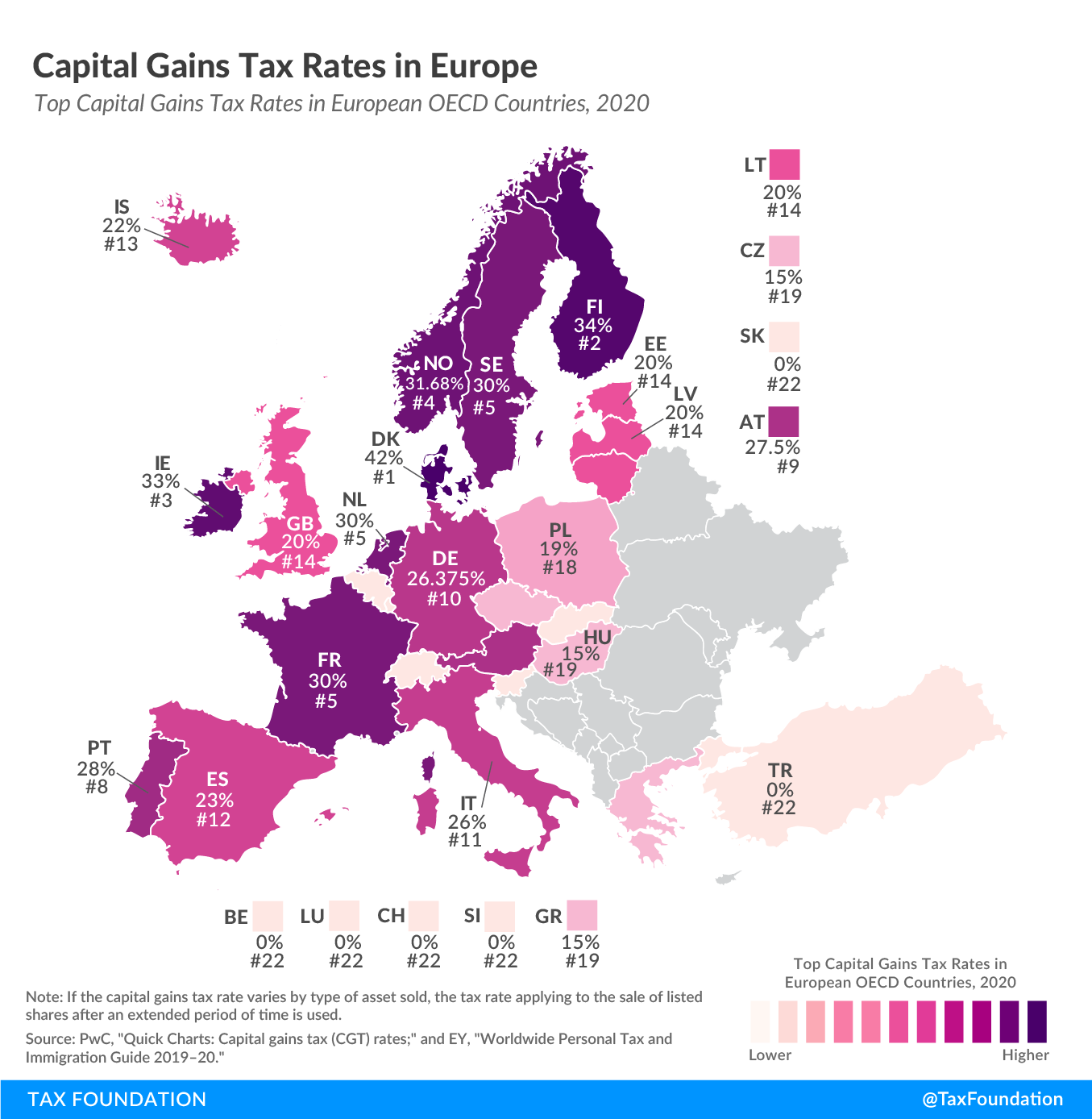

Capital Gains Tax Rates in Europe, 2020

2 min readBy:In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Today’s map focuses on how capital gains are taxed, showing how capital gains tax rates differ across European OECD countries.

When a person realizes a capital gain—that is, sells an asset for a profit—they face a tax on that gain. The capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rates shown in the map are expressed as the top marginal capital gains taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates, taking account of imputations, credits, or offsets. If the capital gains tax rate varies in a country by type of asset sold, the tax rate applying to the sale of listed shares after an extended period of time is used.

Denmark levies the highest capital gains tax of all countries covered, at a rate of 42 percent. Finland and Ireland follow, at 34 percent and 33 percent, respectively.

A number of European countries do not levy capital gains taxes. These include Belgium, Luxembourg, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, the Czech Republic, Greece, and Hungary have the lowest rates, at 15 percent.

On average, the European countries covered tax capital gains at 19.5 percent.

Share this article