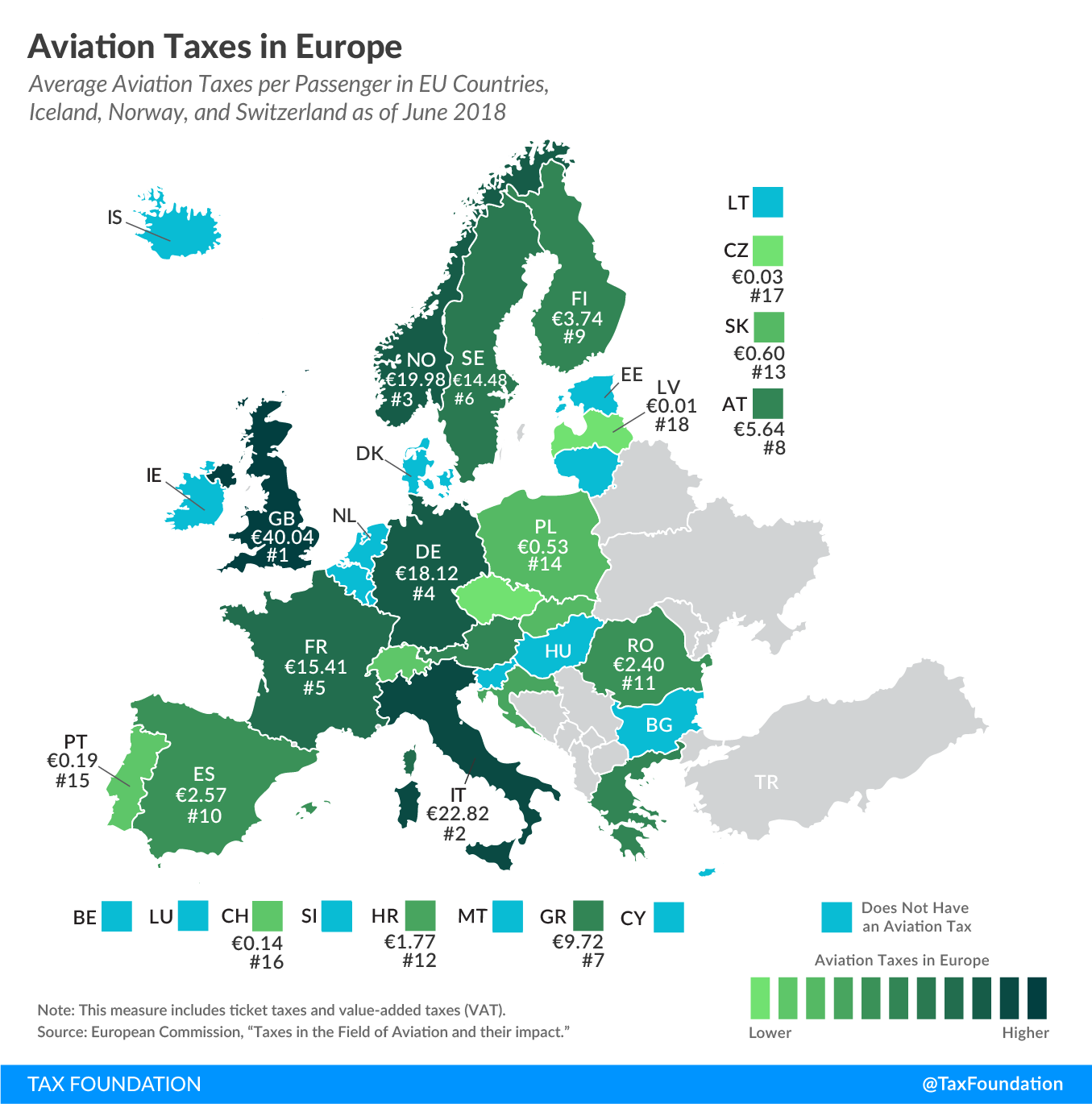

Aviation Taxes in Europe

1 min readBy:Flights in Europe are known for being cheap, allowing travelers to fly from London to Berlin for as little as €18 (US $21.23). However, more than half the European countries levy some type of tax on air travel. Today’s map shows the average amount of aviation taxes per passenger, measured as total aviation taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue divided by the total number of passengers (domestic and international). Ticket taxes and value-added taxes (VAT) are covered in this measure.

Both ticket taxes and VAT depend on the passenger’s destination and the country of departure. Only seven European countries covered in the map charge ticket taxes, namely Austria, France, Germany, Italy, Norway, Sweden, and the United Kingdom. Most European countries levy either standard or reduced VAT rates on domestic flights. International air travel is VAT-exempt.

In 2018, the United Kingdom levied the highest taxes on aviation of all European countries covered, at an average of €40.04 ($47.22) per passenger. Italy (€22.82 or $26.91) and Norway (€19.98 or $23.56) levied the second and third highest taxes.

While countries such as Canada, Japan, or the United States levy excise duties on aircraft fuel, EU law does not allow for such duties on aircraft fuel used for commercial international and intra-EU flights. EU countries can levy an excise duty on aircraft fuel used for domestic flights; however, no EU country does so. EU countries do levy excise duties on other types of fuel, on average €0.56 per liter ($2.48 per gallon) on gasoline and €0.45 per liter ($2.00 per gallon) on diesel.

Share this article