Recent Changes in Top Personal Income Tax Rates in Europe

4 min readBy:In 2018, revenue from personal income taxes made up 23.9 percent of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue across OECD countries. Countries tax labor income in various ways through payroll taxes, personal income taxes, and, in some cases, surtaxes.

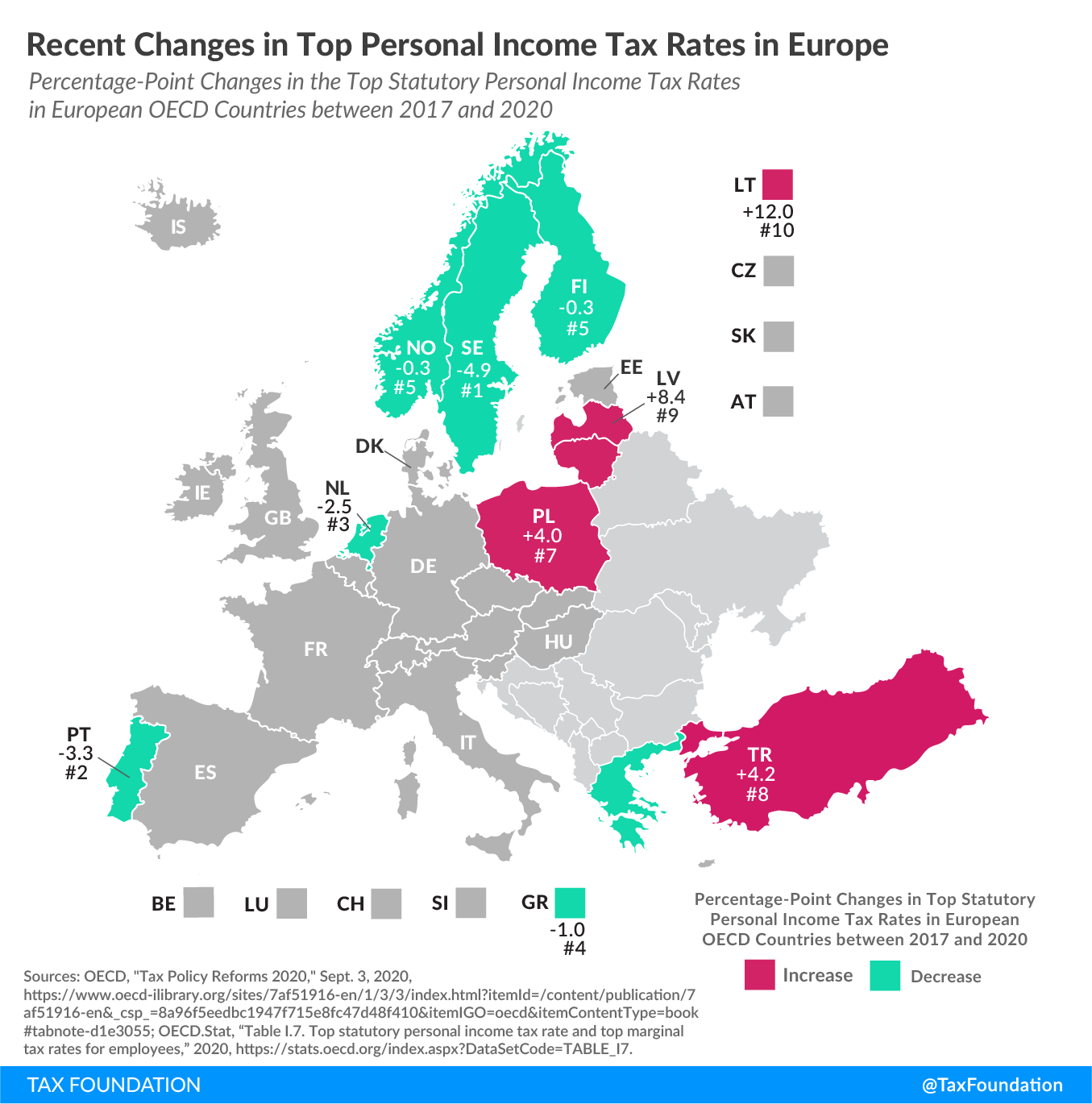

From 2017 to 2020, ten European countries in the OECD changed their top personal income tax rates. Of these ten countries, six cut their top personal income tax rates while the other four raised their top rates.

Latvia and Lithuania moved from flat taxes on personal income to progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. structures. Poland introduced a solidarity surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. while Portugal and Sweden eliminated a surtax. Greece, Finland, the Netherlands, and Norway all made slight cuts to their personal income tax rates. Turkey added a new top personal income tax bracket.

Finland

Finland levies a central government income tax and a local income tax. In 2018, the top rate of the federal income tax was lowered to 31.25 from 31.5. Municipal taxes on personal income are levied at flat rates, which varied between 16.50 and 22.50 percent in 2019 depending on the municipality. In addition to the top rate cut, the other bracket rates of the tax scale were also lowered by 0.25 percentage points.

Greece

Greece reduced the top personal income tax rate from 55 to 54 percent (44 percent income tax plus 10 percent solidarity surcharge) in 2020. The top rate applies to income exceeding €40,001 (US $44,794).

Latvia

In 2018, Latvia shifted its system from a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. on personal income to a progressive tax. Prior to this change, Latvia applied a 23 percent flat tax. The new system has three separate brackets, at 20 percent, 23 percent, and 31.4 percent. The top rate applies to income above €62,800 (US $70,325) in 2020.

Lithuania

In 2019, Lithuania transitioned from a 15 percent flat personal income tax to a progressive income tax with two brackets with rates of 20 percent and 27 percent. The top bracket applies to income above 120 percent of average wages which, in 2019, was €136,334 (US $152,670).

Netherlands

The progressive tax system in the Netherlands moved from four brackets with a top personal income tax rate of 52 percent to three brackets with a top rate of 51.75 percent in 2019. The bracket structure was further amended in 2020, reducing the top personal income tax bracket to 49.5 percent.

Norway

Norway applies personal income taxes on two separate tax bases with separate rates. Net ordinary income is taxed at a combined municipal and national rate of 22 percent (a reduction from 23 percent in 2018). Gross personal income is taxed in a progressive manner with four brackets. The top rate on personal income in 2019 is 16.2 percent (an increase from 14.5 percent in 2017), with an income threshold of NOK 964,800 (US $109,611). Overall, the top rate on personal income fell slightly from 38.5 percent in 2017 to 38.2 percent in 2019. The top rate of 38.2 percent remained in 2020.

Poland

Poland has a progressive tax on personal income with a top rate of 32 percent that applies to income above PLN 85,528 (US $21,495). Individuals with income above PLN 1 million (US $251,319) pay a solidarity tax of 4 percent since 2019. Combined, the solidarity tax, which works as a surtax on personal income, and the top personal income tax bracket result in a total top personal rate of 36 percent, up from 32 percent in 2018.

Portugal

Portugal has a top rate of 48 percent on its personal income tax schedule. This rate applies to income above €80,640 (US $89,240). A solidarity tax has been part of the Portuguese system since 2012. The solidarity surcharge applies a 2.5 percent rate to income between €80,000 (US $89,586) and €250,000 (US $279,955). A rate of 5 percent is charged to income over €250,000 (US $279,955). A separate extraordinary surcharge of 3.25 percent on income over €80,640 (US $90,302) was eliminated in 2018. With this change, the solidarity tax and the top rate on the personal income bracket schedule result in a rate of 53 percent, down from 56.25 percent in 2017 prior to the elimination of the extraordinary surcharge.

Sweden

Sweden removed its top personal income tax rate in 2020, which had added a 5 percent surtax to incomes exceeding SEK 703,000 (US $74,336). Sweden levies a flat tax rate of 20 percent as well as a varying municipal tax rate. The current average municipal rate is 32.19 percent.

Turkey

In 2020, Turkey introduced a new top personal income tax rate of 40 percent. The new rate has been added to Turkey’s tax brackets of 15, 20, 27, and 35 percent.

| Country | 2017 Tax Rates | 2018 Tax Rates | 2019 Tax Rates | 2020 Tax Rates |

|---|---|---|---|---|

| 51.4% | 51.1% | 51.1% | 51.1% | |

| 55.0% | 55.0% | 55.0% | 54.0% | |

| 23.0% | 31.4% | 31.4% | 31.4% | |

| 15.0% | 15.0% | 27.0% | 27.0% | |

| 52.0% | 52.0% | 51.8% | 49.5% | |

| 38.5% | 38.4% | 38.2% | 38.2% | |

| 32.0% | 32.0% | 36.0% | 36.0% | |

| 56.3% | 53.0% | 53.0% | 53.0% | |

| 57.1% | 57.1% | 57.2% | 52.2% | |

| 35.8% | 35.8% | 35.8% | 40.0% | |

|

Source: OECD, “Tax Policy Reforms 2020,” Sept. 3, 2020, https://www.oecd-ilibrary.org/sites/7af51916-en/1/3/3/index.html?itemId=/content/publication/7af51916-en&_csp_=8a96f5eedbc1947f715e8fc47d48f410&itemIGO=oecd&itemContentType=book#tabnote-d1e3055; OECD.Stat, “Table I.7. Top statutory personal income tax rate and top marginal tax rates for employees,” 2020, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_I7. |

||||