Wine Taxes in Europe, 2021

3 min readBy:If you have ever wondered about the tax consequences of opening a bottle of wine in Europe, today’s map will provide you with some insights.

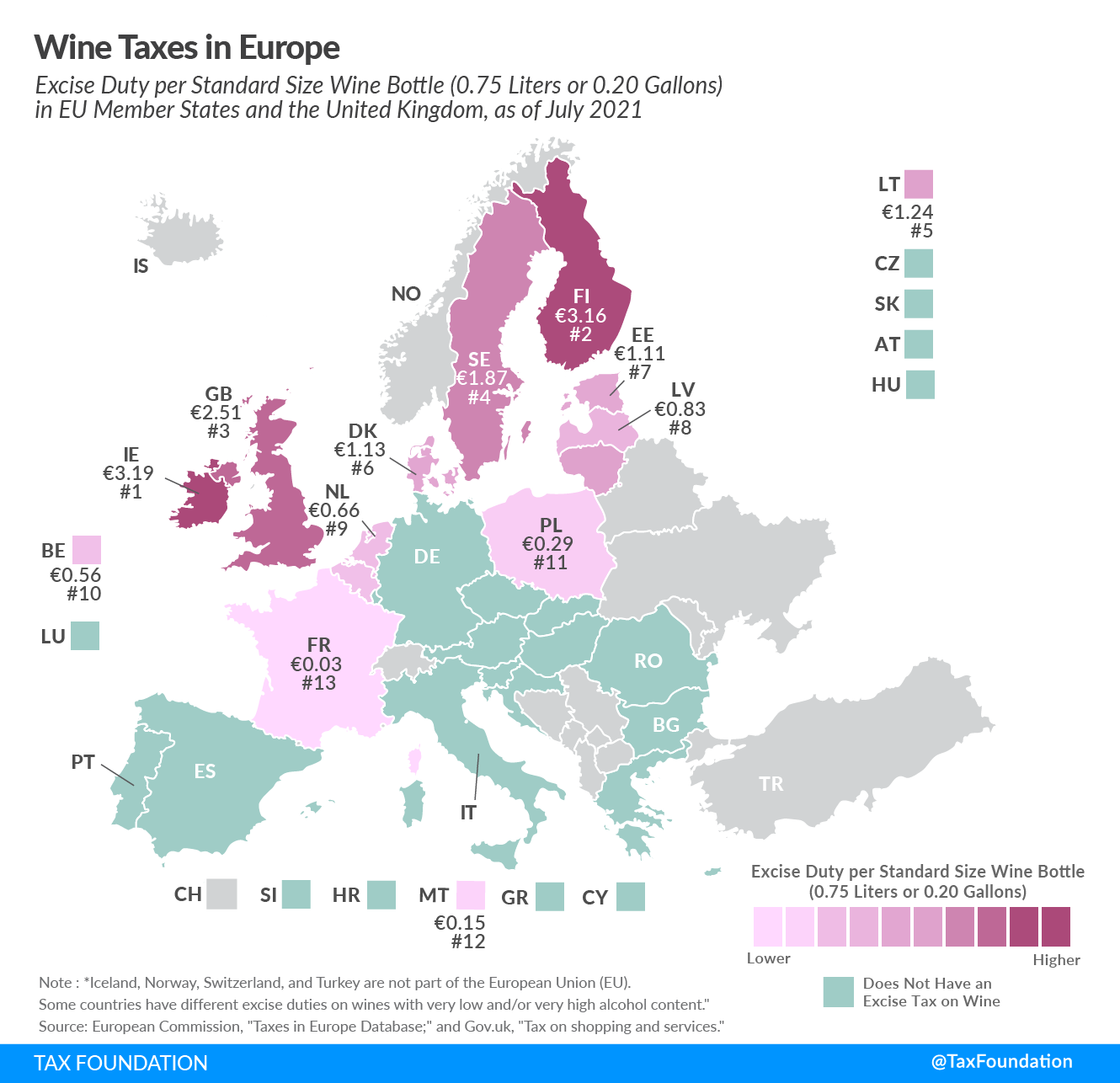

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

While 13 of the countries covered levy an excise tax on wine, they do so at very different rates. The highest wine tax can be found in Ireland, at €3.19 (US $3.63) per standard size wine bottle (0.75 liters or 0.20 gallons). Finland and the United Kingdom are next, at €3.16 ($3.60) and €2.51 ($2.86), respectively.

Of the countries levying a wine tax, the lowest rate can be found in a country well-known for its wine: France, where a very low tax €0.03 ($0.03) per bottle is levied. Malta (€0.15 or $0.18) and Poland (€0.29 or $0.33) tax wine at the second and third lowest rates.

All European countries covered also levy a value-added tax (VAT) on wine, which is a tax charged on the sales value of the wine bottle. The excise amounts shown in the map relate only to excise taxes and do not include the VAT.

| Country | Excise Duty per Standard Sized Wine Bottle (0.75 liters or 0.20 gallons) | |

|---|---|---|

| Euros | US-Dollars | |

| Austria (AT) | – | – |

| Belgium (BE) | €0.56 | $0.64 |

| Bulgaria (BG) | – | – |

| Croatia (HR) | – | – |

| Cyprus (CY) | – | – |

| Czech Republic (CZ) | – | – |

| Denmark (DK) | €1.13 | $1.29 |

| Estonia (EE) | €1.11 | $1.26 |

| Finland (FI) | €3.16 | $3.60 |

| France (FR) | €0.03 | $0.03 |

| Germany (DE) | – | – |

| Greece (GR) | – | – |

| Hungary (HU) | – | – |

| Ireland (IE) | €3.19 | $3.63 |

| Italy (IT) | – | – |

| Latvia (LV) | €0.83 | $0.95 |

| Lithuania (LT) | €1.24 | $1.41 |

| Luxembourg (LU) | – | – |

| Malta (MT) | €0.15 | $0.18 |

| Netherlands (NL) | €0.66 | $0.76 |

| Poland (PL) | €0.29 | $0.33 |

| Portugal (PT) | – | – |

| Romania (RO) | – | – |

| Slovakia (SK) | – | – |

| Slovenia (SI) | – | – |

| Spain (ES) | – | – |

| Sweden (SE) | €1.87 | $2.14 |

| United Kingdom (GB) | €2.51 | $2.86 |

|

Source: European Commission, “Taxes in Europe Database,” accessed July 23, 2021, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and Gov.uk, “Tax on shopping and services: Alcohol and tobacco duties,” https://www.gov.uk/tax-on-shopping/alcohol-tobacco. Note: Some countries have different excise duties on wines with very low and/or very high alcohol content. The average 2020 exchange rate provided by the U.S. Internal Revenue Service (IRS) was used for the conversion from euros to dollars (USD 1 = EUR 0.877). |

||