Super-Deduction

A super-deduction is a tax deduction that permits businesses to deduct more than 100 percent of their eligible expenses from their taxable income. As such, the super-deduction is effectively a subsidy for certain costs. This policy sometimes applies to capital costs or research and development (R&D) spending.

Super-Deductions and Economic Growth

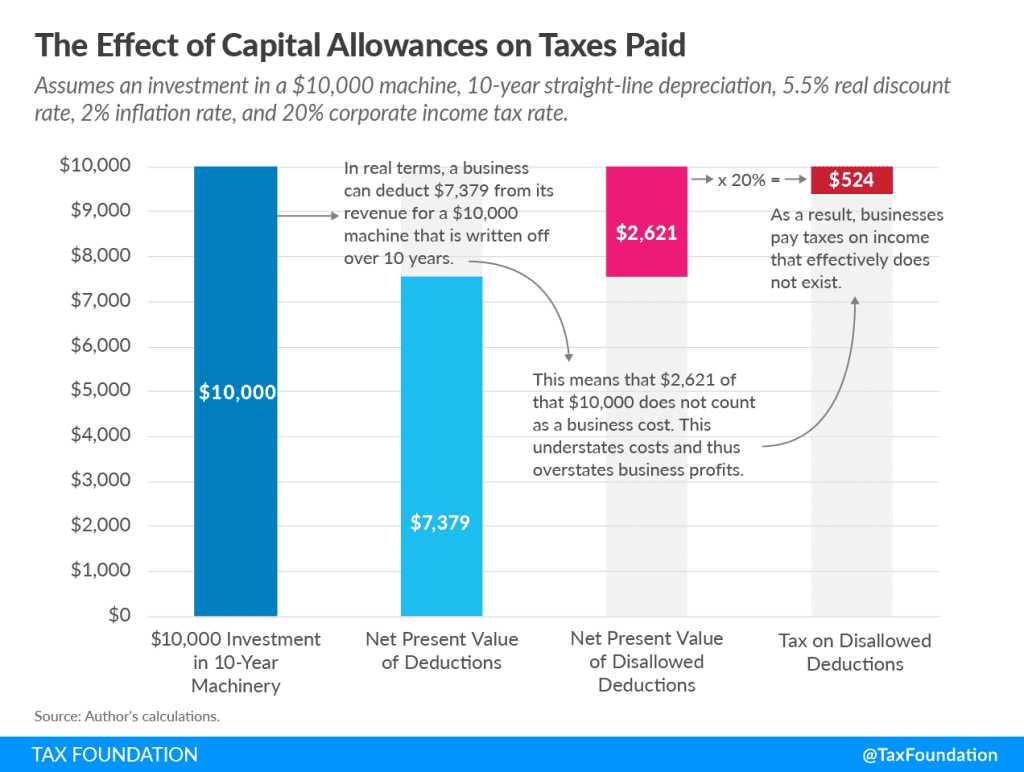

A super-deduction and other capital allowances are a form of cost recovery, or the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions.

For example, the United Kingdom has a temporary super-deduction of 130 percent of investment costs made within a year. If a U.K. business buys a $10,000 machine in 2021, it can then deduct $13,000 from its revenues in 2021.

Over a dozen countries currently allow for super-deductions for innovation-related spending, ranging from 100 to 300 percent of partial or all R&D expenses and investments.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe