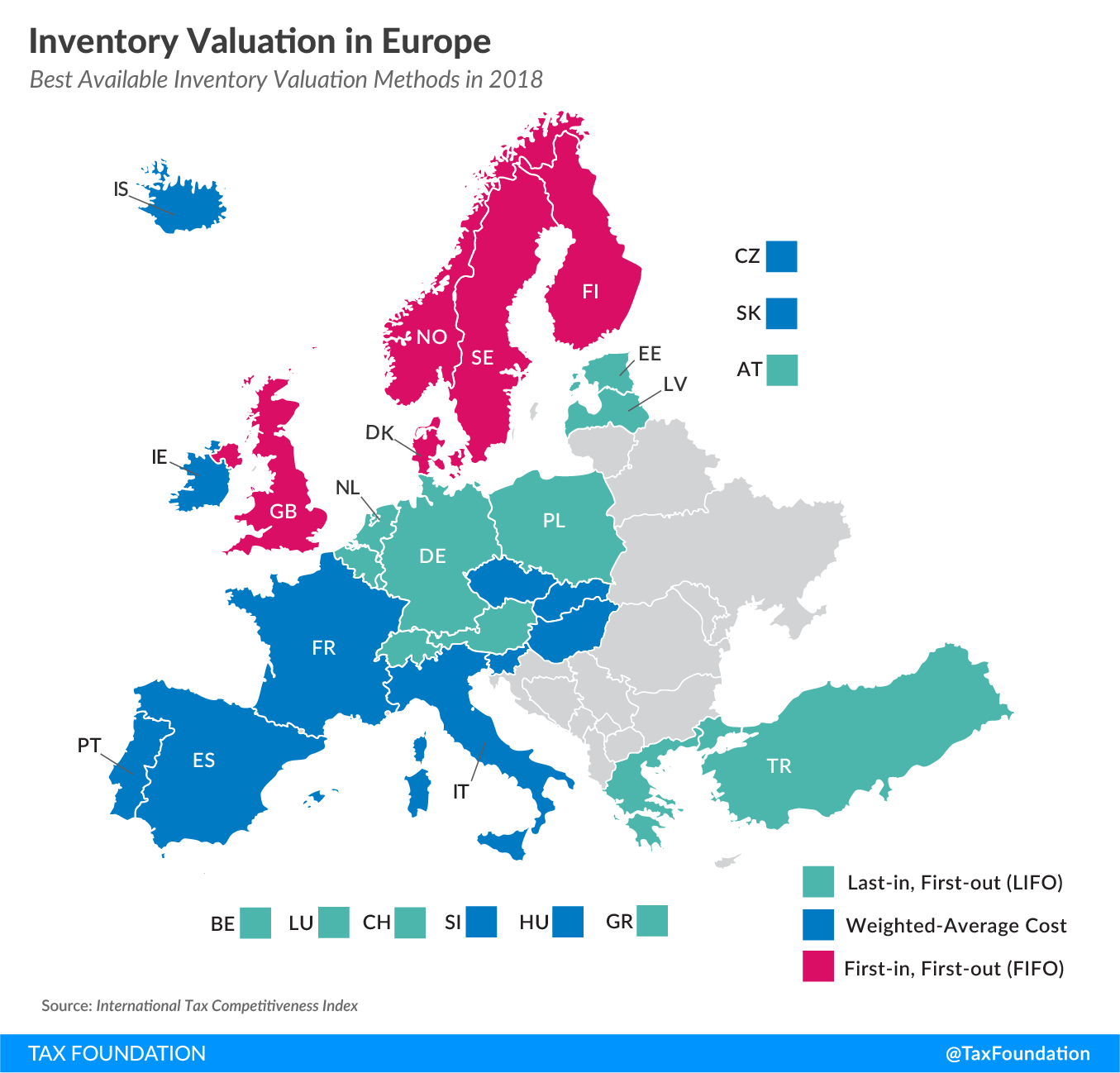

Inventory Valuation in Europe

2 min readBy:As with capital investment, businesses cannot immediately deduct the full cost of inventory purchases against taxable income. Instead, the cost of inventories is deducted when sold and the deduction amount depends on the inventory valuation method. Today’s map shows which of the three inventory valuation methods European countries allow their businesses to use for tax purposes.

Because it would be impractical to track specific inventories, there are three cost-flow assumptions to calculate how much inventory costs should be deducted from taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. when inventories are sold: First-in, First-out (FIFO); Last-in, First-out (LIFO); and Weighted-Average Cost.

The map reflects the best inventory valuation method available in a country, with LIFO the most preferred one, Weighted-Average Cost second, and FIFO last. Of the 26 countries covered, 11 allow businesses to use LIFO, 10 only allow the Weighted-Average Cost method, and five restrict their businesses to FIFO.

The choice of cost-flow assumption impacts a business’s taxable income. To illustrate this, assume a business first purchases an item of inventory at $10. Later, if prices have increased, the business may buy a second unit of the same item for $15. Now that the business has two units of this item in its inventory, one of these items is sold for $20.

- Under FIFO, businesses assume that the first inventory item purchased is the first one to be sold. So FIFO assigns a cost of $10 to the item sold because the first item purchased had a price of $10. The taxable income then is $10 ($20 revenue minus $10 cost).

- Under LIFO, businesses assume that the last inventory item purchased is the first one to be sold. So LIFO assigns a cost of $15 to the first item sold because that is the price of the most recent item purchased. The taxable income then is $5 ($20 revenue minus $15 cost).

- Under the Weighted-Average Cost method, businesses assume that the cost of the units sold in any given year is the weighted-average cost of all the available inventories for sale that year. In our example, the unit sold would be valued at $12.50 (average of $10 for the first item and $15 for the second item). This leads to a taxable income of $7.50 ($20 revenue minus $12.50 cost).

As these examples show, the method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale. This results in the lowest taxable income for businesses. In contrast, FIFO is the least preferred method because it results in the highest taxable income. The Weighted-Average Cost method is somewhere between FIFO and LIFO.

Share this article