All Related Articles

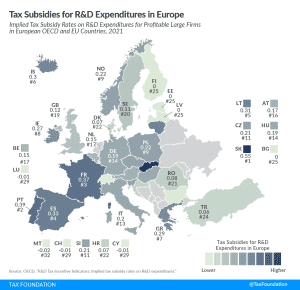

Tax Subsidies for R&D Expenditures in Europe, 2022

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

3 min read

Russia’s Ukrainian War Could Impact EU Carbon Proposal Too

Given the uncertainty surrounding the war in Ukraine, future trade relations with Russia, and the overall CBAM revenue structure. The EU will need to adjust policy when challenges arise as it looks to increase its role in fiscal affairs through new own resources.

5 min read

Post-Versailles Declaration: Tax Policy in the Future of European Energy Security

The unified EU signing of the “Versailles Declaration” is a historic break from the past. Russia’s war against Ukraine has made energy (and related tax policies) an even more urgent focus for the EU.

6 min read

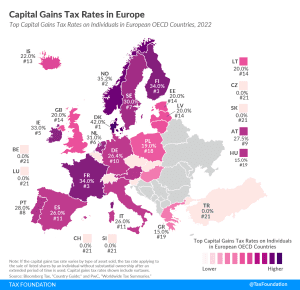

Capital Gains Tax Rates in Europe, 2022

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

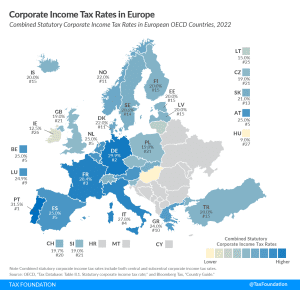

Corporate Income Tax Rates in Europe, 2022

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

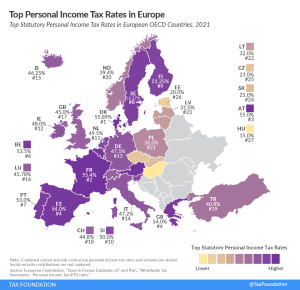

Top Personal Income Tax Rates in Europe, 2022

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

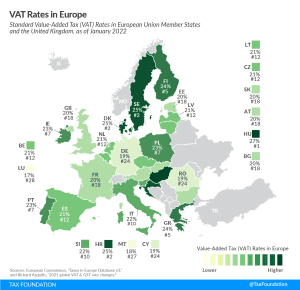

VAT Rates in Europe, 2022

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

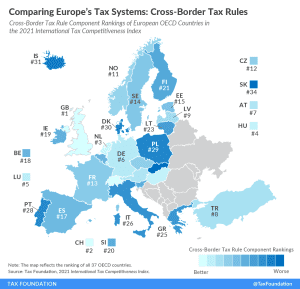

Comparing Europe’s Tax Systems: Cross-Border Tax Rules

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

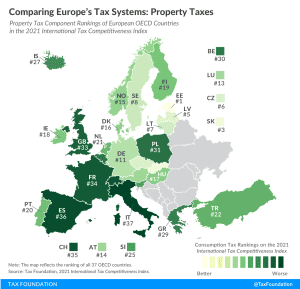

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

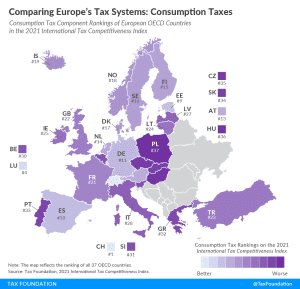

Comparing Europe’s Tax Systems: Consumption Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read