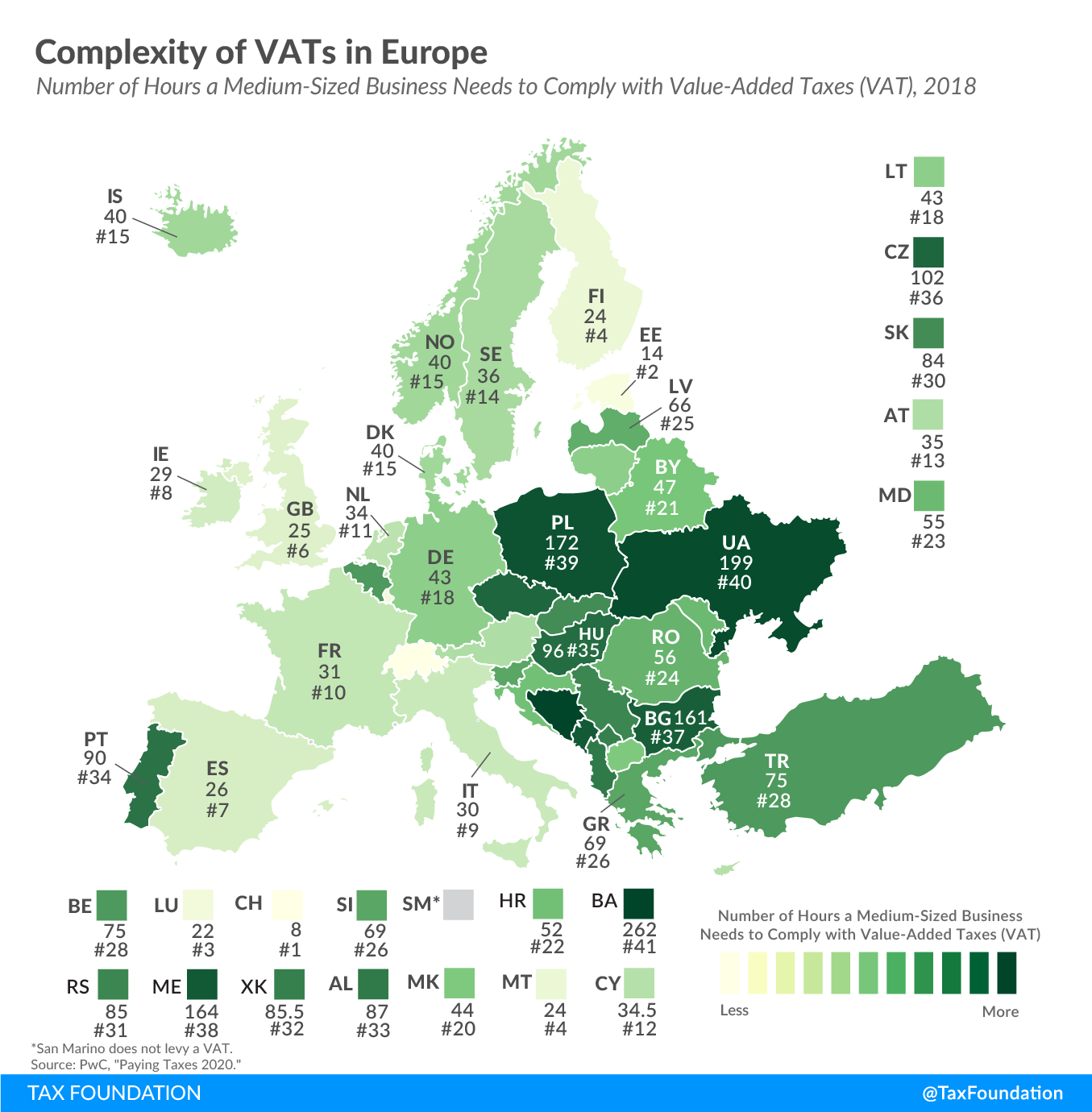

Complexity of VATs in Europe

2 min readBy:Businesses are required to remit Value-Added Taxes (VAT) on goods and services sold to final consumers. The administrative burden of complying with the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. varies significantly across countries. Today’s map shows how complex—or simple—it is to remit VAT in European countries.

One way of estimating the VAT’s administrative burden is to measure the time needed to comply with the tax. The time to comply indicator—measured in an annual study by the World Bank and PwC—reflects the number of hours it takes a domestic medium-size business per year to prepare, file, and pay VAT.

Switzerland’s VAT compliance takes the least amount of time in Europe, at eight hours, followed by 14 hours in Estonia and 22 hours in Luxembourg. In contrast, complying with the VAT requires the most amount of time in Bosnia and Herzegovina (262 hours), Ukraine (199 hours), and Poland (172 hours).

On average, it takes 68 hours to comply with VAT in Europe, compared to a worldwide average of 90 hours.

Simplicity is one of the basic principles of tax policy. As this series on tax complexity in Europe has shown, the administrative burden put on businesses to comply with labor taxes, corporate taxes, and VAT is relatively low in some—but very high in other—European countries. Simplifying complex tax systems reduces the administrative costs associated with remitting taxes, freeing resources for more productive activities.

| Country | Hours Needed to Comply with VAT per Year |

|---|---|

| Albania (AL) | 87 |

| Austria (AT) | 35 |

| Belarus (BY) | 47 |

| Belgium (BE) | 75 |

| Bosnia and Herzegovina (BA) | 262 |

| Bulgaria (BG) | 161 |

| Croatia (HR) | 52 |

| Cyprus (CY) | 34.5 |

| Czech Republic (CZ) | 102 |

| Denmark (DK) | 40 |

| Estonia (EE) | 14 |

| Finland (FI) | 24 |

| France (FR) | 31 |

| Germany (DE) | 43 |

| Greece (GR) | 69 |

| Hungary (HU) | 96 |

| Iceland (IS) | 40 |

| Ireland (IE) | 29 |

| Italy (IT) | 30 |

| Kosovo (XK) | 85.5 |

| Latvia (LV) | 66 |

| Lithuania (LT) | 43 |

| Luxembourg (LU) | 22 |

| Malta (MT) | 24 |

| Moldova (MD) | 55 |

| Montenegro (ME) | 164 |

| Netherlands (NL) | 34 |

| North Macedonia (MK) | 44 |

| Norway (NO) | 40 |

| Poland (PL) | 172 |

| Portugal (PT) | 90 |

| Romania (RO) | 56 |

| San Marino (SM*) | – |

| Serbia (RS) | 85 |

| Slovak Republic (SK) | 84 |

| Slovenia (SI) | 69 |

| Spain (ES) | 26 |

| Sweden (SE) | 36 |

| Switzerland (CH) | 8 |

| Turkey (TR) | 75 |

| Ukraine (UA) | 199 |

| United Kingdom (GB) | 25 |

|

*Note: San Marino does not levy a VAT. Source: PwC, “Paying Taxes 2020,”https://www.pwc.com/gx/en/services/tax/publications/paying-taxes-2020/explorer-tool.html. |

|

Note: This is part of a map series in which we examine tax complexity in Europe

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe