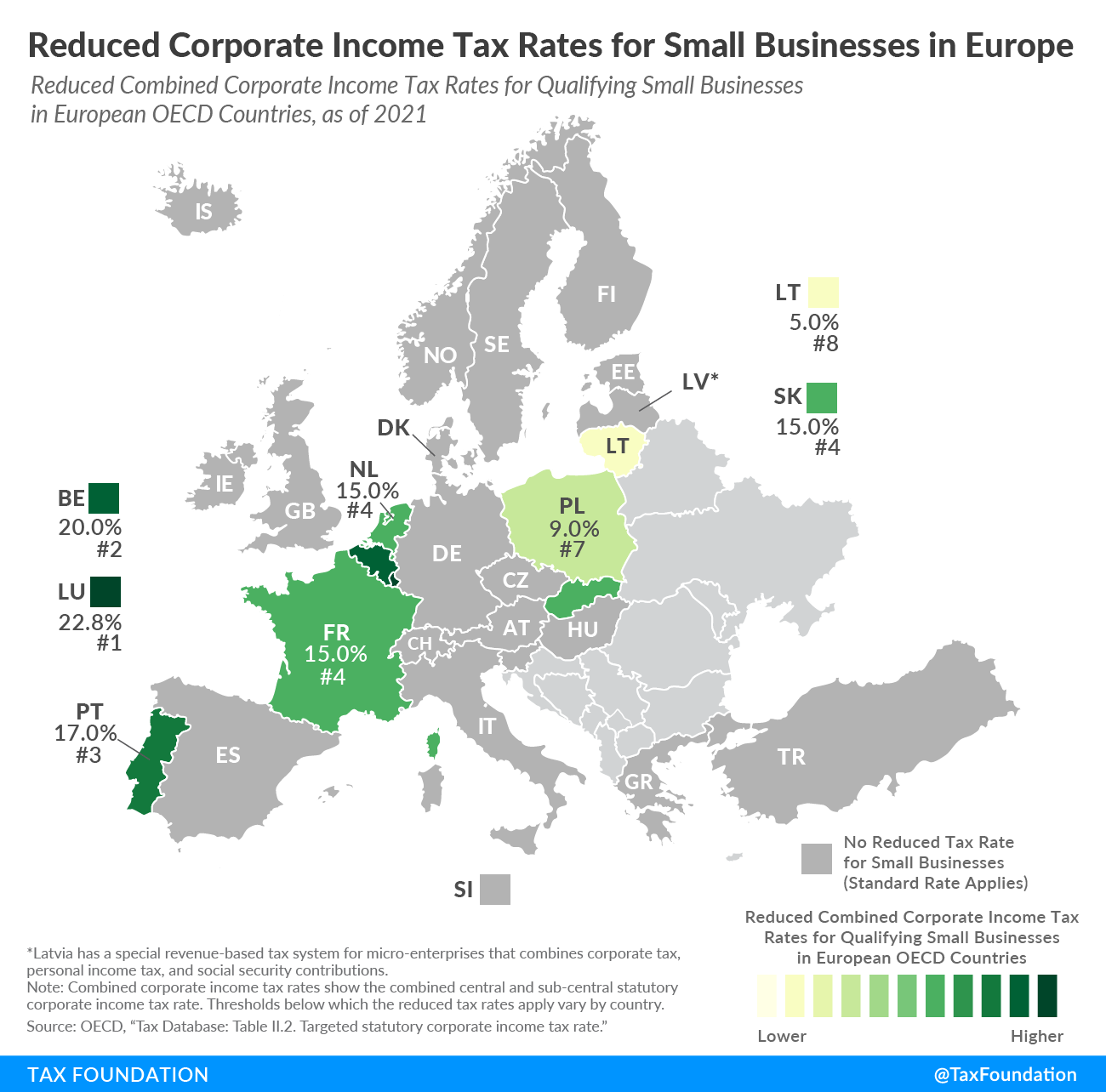

Reduced Corporate Income Tax Rates for Small Businesses in Europe

3 min readBy: ,Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate on businesses that have revenues or profits below a certain threshold.

Belgium, France, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, and Slovakia levy reduced corporate tax rates on businesses below a certain size, ranging in 2021 from 5 percent in Lithuania to 22.8 percent in Luxembourg.

Latvia allows owners of “micro-enterprises” (businesses with revenues below €25,000) the option to be taxed at 25 percent of revenue, of which 80 percent constitutes the owner’s social security contributions and 20 percent personal income tax.

The largest difference between the reduced and the standard top corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate is in Portugal, at 14.50 percentage points. Large businesses pay a standard top rate of 31.50 percent, while small businesses pay a reduced rate of 17 percent on taxable income up to €25,000.

France has the second largest difference, at 13.41 percentage points. A standard top rate of 28.41 percent applies to firms with revenues above €250 million on taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. above €763,000, while small firms with revenues below €10 million pay a reduced rate of 15 percent on profits up to €38,120.

Luxembourg’s difference in rates is smallest, at 2.14 percentage points (standard rate of 24.94 percent and reduced rate of 22.8 percent).

| Reduced and Standard Combined Corporate Income Tax Rates in European OECD Countries, 2021 | |||

|---|---|---|---|

| Country | Reduced Combined Corporate Income Tax | Standard Combined Top Corporate Income Tax Rate | |

| Reduced Rate | Threshold for Reduced Rate | ||

| Austria (AT) | – | – | 25.0% |

| Belgium (BE) | 20.0% | Applicable on the first €100,000 of taxable income of qualifying companies. | 25.0% |

| Czech Republic (CZ) | – | – | 19.0% |

| Denmark (DK) | – | – | 22.0% |

| Estonia (EE) | – | – | 20.0% |

| Finland (FI) | – | – | 20.0% |

| France (FR) | 15.0% | Applicable where turnover does not exceed €10 million, and on the part of the profit that does not exceed €38,120. | 28.4% |

| Germany (DE) | – | – | 29.9% |

| Greece (GR) | – | – | 22.0% |

| Hungary (HU) | – | – | 9.0% |

| Iceland (IS) | – | – | 20.0% |

| Ireland (IE) | – | – | 12.5% |

| Italy (IT) | – | – | 27.8% |

| Latvia (LV) | – | The owner of a micro-enterprise can choose a 25% tax rate on revenues, of which 80% constitute the owner’s social security contributions and 20% personal income tax. Applicable where revenue does not exceed €25,000. (As it is a tax on revenues rather than profits, the rate is not directly comparable to other countries’ reduced rates.) | 20.0% |

| Lithuania (LT) | 5.0% | Applicable for companies where an average number of employees does not exceed 10 and income during the tax period does not exceed €300,000. A one-year corporate income “tax holiday” (0% tax rate) for small business start-ups (meeting the aforementioned criteria) is applied. | 15.0% |

| Luxembourg (LU) | 22.8% | Applicable where taxable income does not exceed €175,000. | 24.9% |

| Netherlands (NL) | 15.0% | Applicable to taxable income up to €245,000. | 25.0% |

| Norway (NO) | – | – | 22.0% |

| Poland (PL) | 9.0% | Applicable where revenues do not exceed €2 million. | 19.0% |

| Portugal (PT) | 17.0% | Applicable on the first €25,000 of taxable income of qualifying companies. | 31.5% |

| Slovak Republic (SK) | 15.0% | Applicable where revenues do not exceed €49,790. | 21.0% |

| Slovenia (SI) | – | – | 19.0% |

| Spain (ES) | – | – | 25.0% |

| Sweden (SE) | – | – | 20.6% |

| Switzerland (CH) | – | – | 19.7% |

| Turkey (TR) | – | – | 25.0% |

| United Kingdom (GB) | – | – | 19.0% |

|

Notes: Combined corporate income tax rates show the combined central and sub-central statutory corporate income tax rate given by the central government rate (less deductions for sub-national taxes) plus the sub-central rate. Source: OECD, “Tax Database: Table II.2. Targeted statutory corporate income tax rate,” last updated April 2021, https://www.stats.oecd.org/Index.aspx?DataSetCode=TABLE_II2. |

|||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe