Value-Added Tax (VAT)

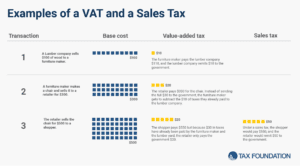

A value-added tax (VAT) is not a tariff, it is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

The Mechanics of a VAT vs. a Sales Tax

Each business along the production chain is required to pay VAT on the added value of the produced good/service at each stage. The VAT due is calculated by multiplying the value of taxable sales by the tax rate and crediting the VAT previously paid. The final consumer, however, bears the VAT burden without receiving credit for previously paid VAT, making it a tax on final consumption. The credit system built into the VAT ensures that only final consumption can be taxed.

Sales taxes, by comparison, are only collected by the retailer at the point of final consumption. However, sales taxes often apply to business inputs that can also be used as consumer goods, such as office equipment, raising costs for businesses rather than taxing final consumption.

The example in the graphic above provides an ideal scenario for both VAT and sales taxes. The lumber company sells wood to the furniture maker, who then sells the furniture to a retailer. Finally, a shopper buys the furniture. In both cases, the total consumption tax paid is $50.

VAT Rates

The worldwide average VAT rate is around 15 percent, with regional averages ranging from 12 percent in Asia to 20 percent in Europe. The US is unique among major countries in that it levies state and local sales taxes instead of a nationwide VAT. The average US state and local sales tax rate was 6.6 percent in 2024.

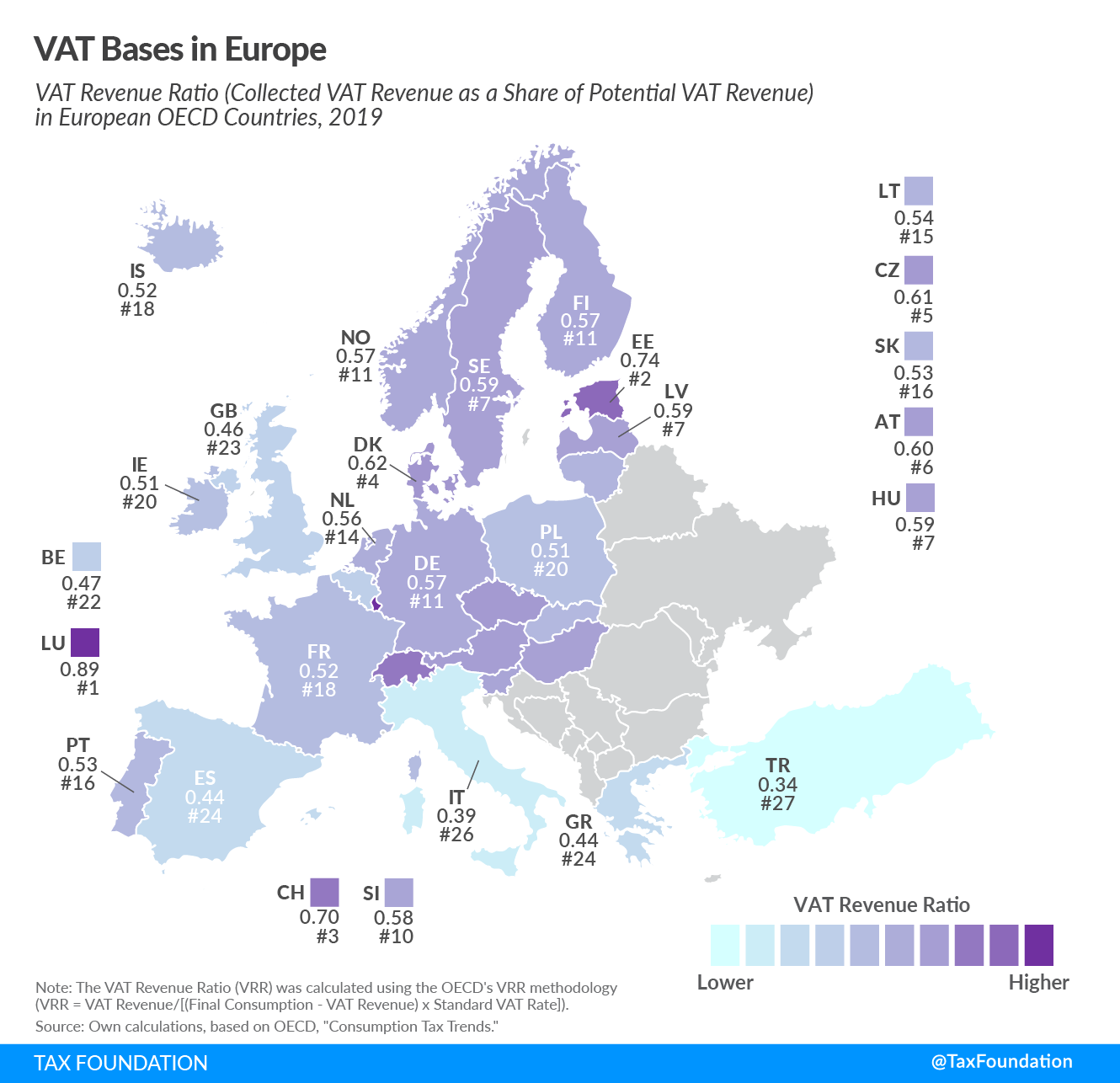

VAT Base

The simplest VAT system would apply a single rate on all final consumption. However, most countries levy reduced rates and exempt certain goods and services from VATs.

One of the main reasons for reduced VAT rates and VAT-exempted goods/services is the promotion of equity, as lower-income households tend to spend a larger share of their incomes on goods and services such as food and public transport. Other reasons include encouraging the consumption of “merit goods” (e.g., books), promoting local services (e.g., tourism), and correcting externalities (e.g., clean power).

However, an Organisation for Economic Co-operation and Development (OECD) study has found that reduced VAT rates and VAT exemptions are often not effective in achieving these policy goals and can even be regressive in some instances. A regressive tax is one where the average tax burden decreases with income and low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden. To address equity concerns, the OECD instead recommends measures that directly aim at increasing poorer households’ real incomes.

VAT Revenue

VAT revenue accounts for a significant share of total tax revenues in countries that levy such a tax (more than 140 countries worldwide and all OECD countries except the United States, which levies a sales tax). In 2022, VAT revenue accounted on average for almost 22 percent of total tax revenue among OECD countries with a VAT.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe