Patent Box

A patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns.

How Patent Boxes Differ from R&D Credits

Patent boxes, and research and development (R&D) credits, are tax incentives that aim to encourage research and development. The main difference is that R&D credits allow for tax breaks based on R&D spending, while patent boxes reduce the taxes on profits resulting from R&D.

Aim and Criticisms

The aim of patent boxes is generally to encourage and attract local R&D by lowering tax costs of R&D. However, some recent research questions whether these policies are effective in driving domestic innovation and points to them encouraging profit shifting to minimize tax liability.

These policies can introduce a new level of complexity to a tax system and create distortions between income derived from IP and non-IP income.

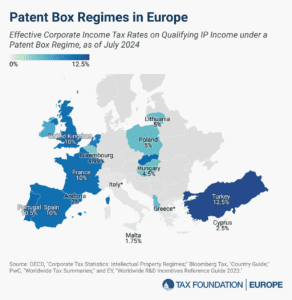

Countries with a Patent Box

The United States does not have a patent box regime. However, many European countries have implemented them over the last years.

Countries outside of Europe that have implemented a regime include, but are not limited to, China, Israel, Korea, Panama, and Singapore.

Modified Nexus Approach

In the past, some countries offered these policies without requiring businesses to undertake the IP’s underlying R&D domestically. This allowed businesses to develop IP in one country and then relocate it to a jurisdiction with a patent box. Consequently, countries without such preferential regimes raised concerns that these patent boxes incentivize profit shifting, harming their tax base.

To address this issue, OECD countries agreed in 2015 on a so-called Modified Nexus Approach for IP regimes as part of Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan. This Modified Nexus Approach limits the scope of qualifying IP assets and requires a link among R&D expenditures, IP assets, and IP income. To be in line with this approach, previously noncompliant countries have either abolished or amended their patent box regimes within the last few years.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe