All Related Articles

One, Big, Beautiful Bill: The Good, the Bad, and the Ugly

From generous tax breaks to costly trade-offs, the House GOP’s One, Big, Beautiful Bill has a little of everything. It’s a sweeping attempt to extend key provisions of the 2017 Tax Cuts and Jobs Act before they expire in 2026—but what’s actually in it?

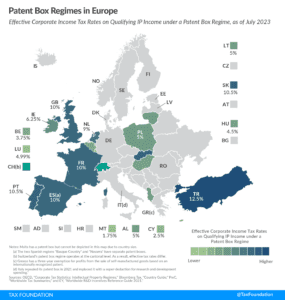

Pillar Two: Electric Boogaloo

The global tax deal and Pillar Two are shaking up the tax landscape worldwide, introducing a web of complexity and confusion.

Pleading GILTI: A Guide to the Complicated World of Global Intangible Low Tax Income

On this episode of The Deduction, we speak with Pam Olson, Tax Foundation Board Member and Consultant on Tax Policy Services at PwC, about the tax on Global Intangible Low Tax Income, or “GILTI.” In 2017, GILTI was implemented as a minimum tax designed to disincentivize U.S. companies from shifting profits overseas, but it doesn’t work how drafters intended, and now President Biden has proposed doubling it.

Pondering Property Taxes

Property taxes are highly unpopular and can get extremely confusing. But when done right, they can be quite good. We talk through what a well structured property tax should look like, which states have good property tax structures in place and which ones don’t, and how these taxes impact a state’s competitiveness in an increasingly mobile economy.