All Related Articles

Global Deal or No Deal

On July 1st, 2021, over 130 countries agreed to an unprecedented 15% global minimum tax. One year later, the deal appears stuck. Daniel Bunn joins Jesse to discuss what this delay means for countries and multinational corporations, and what the path ahead looks like for global tax policy and competition.

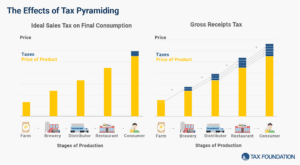

Green Rush: Principles for Taxing Cannabis

Taxing cannabis is brand-new territory. While many states see recreational cannabis as a potential gold mine for tax revenue, the reality of designing a new tax is more complicated.

History of Taxes: A Brief Overview

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

House Votes on the Inflation Reduction Act

The House of Representatives is set to pass the Inflation Reduction Act, the latest iteration of President Biden’s tax and climate agenda. Garrett Watson joins Jesse to discuss what sacrifices were made by key lawmakers to bring this bill to the finish line. They also look at what the economic impact of this proposal would be as the country continues to face historic rates of inflation.

How Do Governments Raise Revenue?

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.