All Related Articles

IRS Funding and Technology

The Internal Revenue Service (IRS) finds itself under fire often. Outdated technology, millions of unanswered calls, and cafeterias full of paper returns—it’s clear that America’s tax collector needs improvement. Jesse is joined by Courtney Kay-Decker and Jared Ballew, chair and vice chair (respectively) of the Electronic Tax Administration Advisory Committee (ETAAC). They discuss ETAAC’s annual report that lays out what the IRS is doing right, and what it’s doing wrong, as the agency continues to see its duties grow.

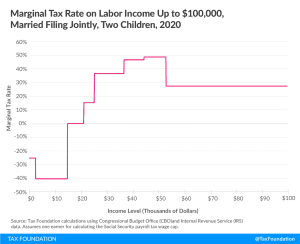

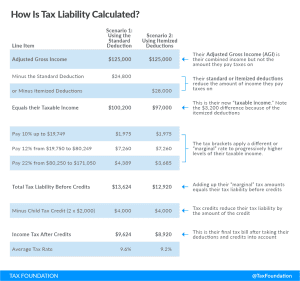

It Pays to Keep It Simple

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

Joe Biden’s Tax Plan Explained

Depending on the outcome of the 2020 presidential election, we could be looking at a very different tax code in the years to come. What tax changes has former Vice President Joe Biden proposed and what would they mean for U.S. taxpayers, businesses, and the overall economy?

Launching Tax Foundation Europe

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

Let’s Make a Global Tax Deal

Late last year, over 130 countries agreed to a global minimum tax, a purported end-all and be-all to the “race to the bottom.” But this policy is complex, and countries are already struggling to implement these new rules. We talk through how this policy came to be, identify where problems are beginning to arise, and dispel some common myths about this emerging new tax system.