Tax Foundation Europe produces research and analysis specifically designed to inform five key debates in European tax policy: the concept of tax fairness, the twin transitions of the green and digital economies, government revenue and own resources, competitiveness and productivity, and the future of taxation in Europe.

One of our flagship tools is the European Tax Policy Scorecard (ETPS), which compares the competitiveness and neutrality of each country’s tax system, explains why certain tax codes stand out as better or worse models for reform, and measures the relative impact of EU tax policy on Member States. Explore the ETPS

Featured Issues

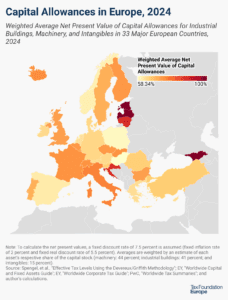

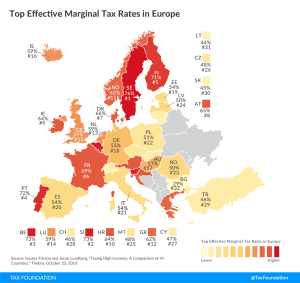

Global Tax Deal | European Tax Maps | Digital Taxes | Carbon Taxes | Cost Recovery

Featured Projects

European Tax Policy Scorecard

The ETPS compares the competitiveness and neutrality of each country’s tax system. A competitive tax code keeps marginal tax rates low and a neutral tax code raises the most revenue with the fewest economic distortions. Together, these principles promote sustainable growth while raising sufficient revenue.

Investment in the United Kingdom Increased following Pro-Investment Tax Reforms

The UK economy is experiencing an upsurge in business fixed investment following two pro-growth tax changes. In the second quarter of 2023, business investment was 9.4 percent higher than the same quarter last year.

10 min read

2023 Spanish Regional Tax Competitiveness Index

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

Testimony: The Role of Corporate Taxation in the European Union’s Future Tax Policy Mix

As policymakers shift their focus away from tax rates and look to harmonize the EU’s corporate tax base, they should understand the benefits of full expensing.

The Role of Pro-Growth Tax Policy and Private Investment in the European Union’s Green Transition

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

Testimony: Capital Gains Taxation in the EU

It is essential to understand that the taxation of capital gains places a double tax on corporate income.

All European Research

New Details on the Austrian Tax Reform Plan

14 min read

There Is More Than Meets the Eye When Analyzing the UK’s Corporate Tax Cut

When taking a closer look at the UK’s recent corporate tax reform experiment, it becomes clear that there was significantly more at work than just a simple rate cut. Increasing the effective marginal tax rate on new investments could have had a negative effect on wages, potentially offsetting the positive effects from the corporate rate cut.

4 min read