EU Member States Pushing EU-wide Vapor Tax

5 min readBy:In late May, EURACTIV (a media company focusing on EU policy and politics) reported that member states would ask the European Commission (EC) to include novel nicotine products such as heated tobacco products and vapor products in the EU Tobacco Excise Directive. Novel products are currently regulated under the EU Tobacco Products Directive but are not included in the Tobacco Excise Directive, which has not been updated since 2011. In 2018, the EC decided against implementing a tax on novel products because it lacked sufficient data.

This member states’ request follows the EC’s publication of an evaluation of the Tobacco Excise Directive in February. This evaluation analyzes the effectiveness of the directive to continuously ensure proper functioning of the internal market, provide a high level of health protection, and fight against taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. fraud, tax evasion, and cross border shopping. In addition, the evaluation looks at the potential for an EU-wide excise tax on vapor products and heated tobacco—concluding that the current directive is no longer sufficient.

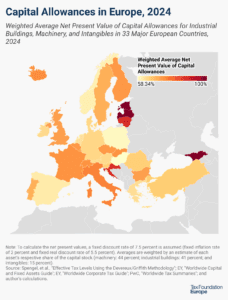

Currently, both heated tobacco and vapor products are taxed (or not taxed) under varying definitions with different bases, but, according to the evaluation, the majority of members states would prefer a harmonized definition and a minimum tax rate. Beside member state support, there is wide stakeholder support for harmonizing definitions at the EU-level to limit regulatory and taxation fragmentation, because this would cut compliance costs. Harmonizing definitions could be a positive step for streamlining taxation regimes across member states. It is also positive that all member states with existing taxes on vapor products already have specific taxes per milliliter—though a few member states have added an unfortunate nicotine base to the tax structure (see Table 1). The EC should build on these structures and tax vapor products based on volume.

While most member states tax heated tobacco specifically, several states simply apply existing tobacco products taxes to the product. That has resulted in a variety of designs including price-based (ad valorem) taxation and high rates. The EC should design taxes on heated tobacco to be specific and given that most member states base their system on weight (see Table 2), such a design would be obvious.

The discussion in Brussels will now move on to defining minimum rates. For novel nicotine products it is crucial that eventual minimum rates avoid repeating the mistakes of the previous Tobacco Excise Directive. After the Baltic countries (Estonia, Latvia, and Lithuania) joined the EU in 2004, they were obligated to increase their cigarette excise taxes, which resulted in several years of sharp increases in illicit trade.

Furthermore, the EC would be well-advised to design an EU-wide excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. structure and minimum rate in respect to the concept of harm reduction. According to this concept, it is more practical to reduce harm associated with use of certain goods rather than eliminating it through bans or punitive level taxation. In other words, the tax rate on vapor products and heated tobacco should at least reflect their harm relative to more harmful tobacco products. It is widely believed that vapor products are significantly less harmful than cigarettes and several studies suggest the same may be true for heated tobacco.

Harm reduction is connected to excise tax design because cigarettes and novel nicotine products are economic substitutes. With excise tax policy, increases or decreases in tax rates of certain goods can affect consumption of other goods that might be substitutes. That is to say, the effectiveness of cigarette excise taxes goes up when cheaper, less harmful substitutes are widely accessible—and vice versa. That means the EC risks curtailing positive smoking cessation trends if a new excise tax results in price levels which discourage smokers from switching to less harmful products.

| EU Member States’ Excise Tax on Vapor Products in Local Currency and U.S. Dollars | |||

|---|---|---|---|

| Member State | Rate per Milliliter | Additional Base | Rate in $ per Milliliter |

| Cyprus | €0.12 | – | $0.13 |

| Denmark | DKK 2.00 | – | $0.30 |

| Estonia | €0.20 | – | $0.22 |

| Finland | €0.30 | – | $0.34 |

| Greece | €0.10 | – | $0.11 |

| Hungary | HUF 55.00 | – | $0.18 |

| Italy | €0.08 | €0.04 for liquid without nicotine | $0.09 |

| Latvia | €0.01 | plus €0.005 per mg of nicotine | $0.01 |

| Lithuania | €0.12 | plus €0.05 per mg of nicotine | $0.13 |

| Poland | PLN 0.50 | – | $0.13 |

| Portugal | €0.30 | – | $0.34 |

| Romania | RON 0.50 | – | $0.12 |

| Slovenia | €0.18 | – | $0.20 |

| Sweden | SEK2.00 | – | $0.21 |

|

Note: Member states not mentioned do not have a specific tax category or rate for vapor products. VAT is not included above. Source: European Commission, World Bank, and Vaporproductstax.com. |

|||

| EU Member States’ Excise Tax on Heated Tobacco Products in Local Currency and U.S. Dollars | ||||

|---|---|---|---|---|

| Member state | Rate per Kilo | Other Bases | Rate in $ per Kilo | Category |

| Austria | €110.00 | – | $123.50 | Heated Tobacco |

| Bulgaria | BGN 233 | – | $133.90 | Smokeless Tobacco |

| Croatia | HRK600 | – | $89.00 | Heated Tobacco |

| Cyprus | €150.00 | – | $168.50 | Heated Tobacco |

| Czech Republic | CZK 2,236 | – | $94.40 | Heated Tobacco |

| Denmark | DKK 1,300.90 | – | $196.10 | Tobacco Intended for Inhalation Without Combustion |

| France | €29.10 | Plus 50.7% ad valorem at retail level | $32.70 | Other Tobacco Product |

| Germany | €15.66 | Plus 13.13% ad valorem at retail level | $17.50 | Pipe Tobacco |

| Greece | €156.70 | – | $176.00 | Electrically Heated Tobacco Product |

| Hungary1 | Not applicable | Heated tobacco product: HUF 10 per stick;

Hybrid: HUF 70 per ml |

Not applicable | Novel Tobacco Product |

| Italy2 | Not applicable | 50% of cigarettes based on consumption time | Not applicable | Inhalation Product Without Combustion |

| Latvia | €70.00 | – | $78.60 | Heated Tobacco |

| Lithuania | €68.60 | – | $77.00 | Heated Tobacco |

| Netherlands | €114.65 | – | $128.80 | Other Tobacco Products |

| Poland | PLN 141.29 | Plus 31.41% of weighted average value at retail level | $36.00 | Novel Product |

| Portugal | €80.00 | Plus 15% ad valorem at retail level | $90.00 | Heated Tobacco |

| Romania | RON396.10 | – | $92.10 | Heated Tobacco |

| Slovakia | €76.70 | – | $86.10 | Smokeless Tobacco |

| Slovenia | €88.00 | – | $98.90 | Manufactured Tobacco Intended for Heating |

| Sweden | SEK 1,957.00 | – | $211.00 | Smoking Tobacco |

|

1 – Hungary taxes heated tobacco products based on number of sticks—a design similar to cigarette taxes. For hybrid products using both liquid and tobacco, a rate for liquid is applied. 2 – Italy taxes heated tobacco products specifically based on the average consumption of each product. A laboratory process has been established in Italy to determine the consumption times. Note: Member states not mentioned do not have a specific tax category for heated tobacco products or the products are not yet available. VAT is not included above. Source: European Commission, Vaporproductstax.com, author’s research. |

||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe