Thin-Cap Rules in Europe

2 min readBy:High-tax countries create an incentive for companies to finance investments with debt because interest payments are taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. -deductible, which is usually not the case for equity costs. This encourages global businesses to lend money internally from entities in low-tax countries to entities in high-tax countries. Tax savings in high-tax countries can exceed the increased tax paid in low-tax countries, decreasing worldwide tax liability.

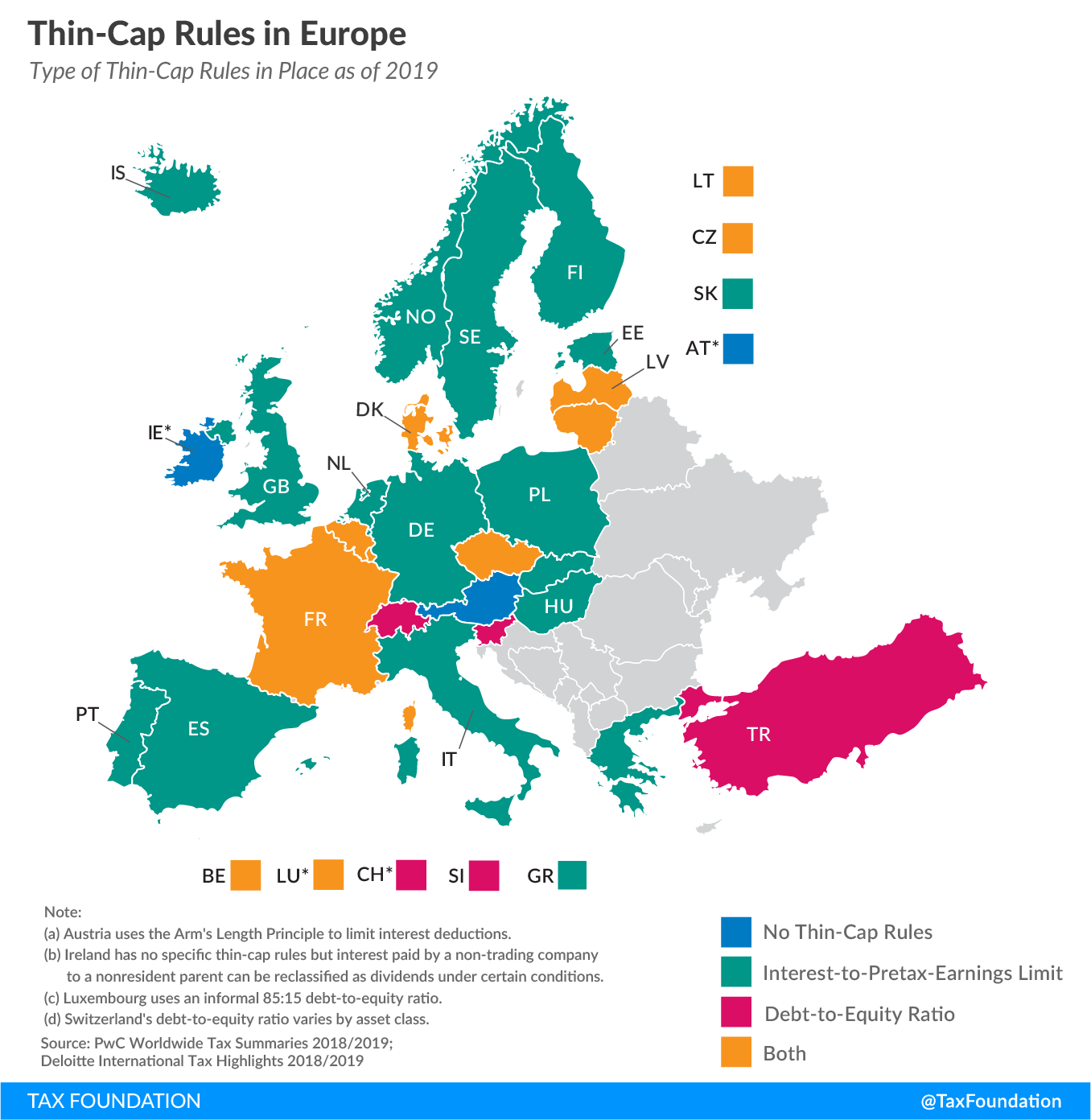

To discourage such international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes. The two most common types used in practice are “safe harbor rules” and “earnings stripping rules.” Safe harbor rules restrict the amount of debt for which interest is tax-deductible by defining a debt-to-equity ratio. Interest paid on debt exceeding this set ratio is not tax-deductible. Earnings stripping rules limit the tax-deductible share of debt interest to pretax earnings.

More than half of the European countries covered have interest-to-pretax-earning limits in place. Most commonly, the limit is set at 30 percent of EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). For instance, a parent company takes a $100 loan from its subsidiary requiring interest payments of $5. EBITDA are $10, so only $3 (30 percent of $10) of the $5 in interest paid are tax-deductible.

Some of the countries have debt-to-equity ratios in place. For instance, Turkey’s debt-to-equity ratio is 3:1. Let’s say a Turkish business takes a $100 loan from its foreign subsidiary. Its current equity amounts to $10, resulting in a debt-to-equity ratio of 10:1. The annual interest on the loan is 5 percent, or $5. Because the business’ debt-to-equity ratio is 10:1 but Turkey’s debt-to-equity ratio is 3:1, only 30 percent of the interest, or $1.5 of the $5, is tax-deductible.

It is important to keep in mind that thin-cap rules not only limit international debt shifting but can also impact real economic activity, such as investment and employment.

Detailed information on OECD countries’ interest deduction limitations can be found here.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeErratum: A correction has been made to the debt-to-equity ratio example. It originally stated that the Turkish business’ debt-to-equity ratio is twice the limit and thus only half of the interest paid, or $2.5, is deductible. However, because the business’ debt-to-equity ratio is 10:1 but Turkey’s debt-to-equity ratio is 3:1, only 30 percent of the interest, or $1.5 of the $5, is tax-deductible.

Share this article