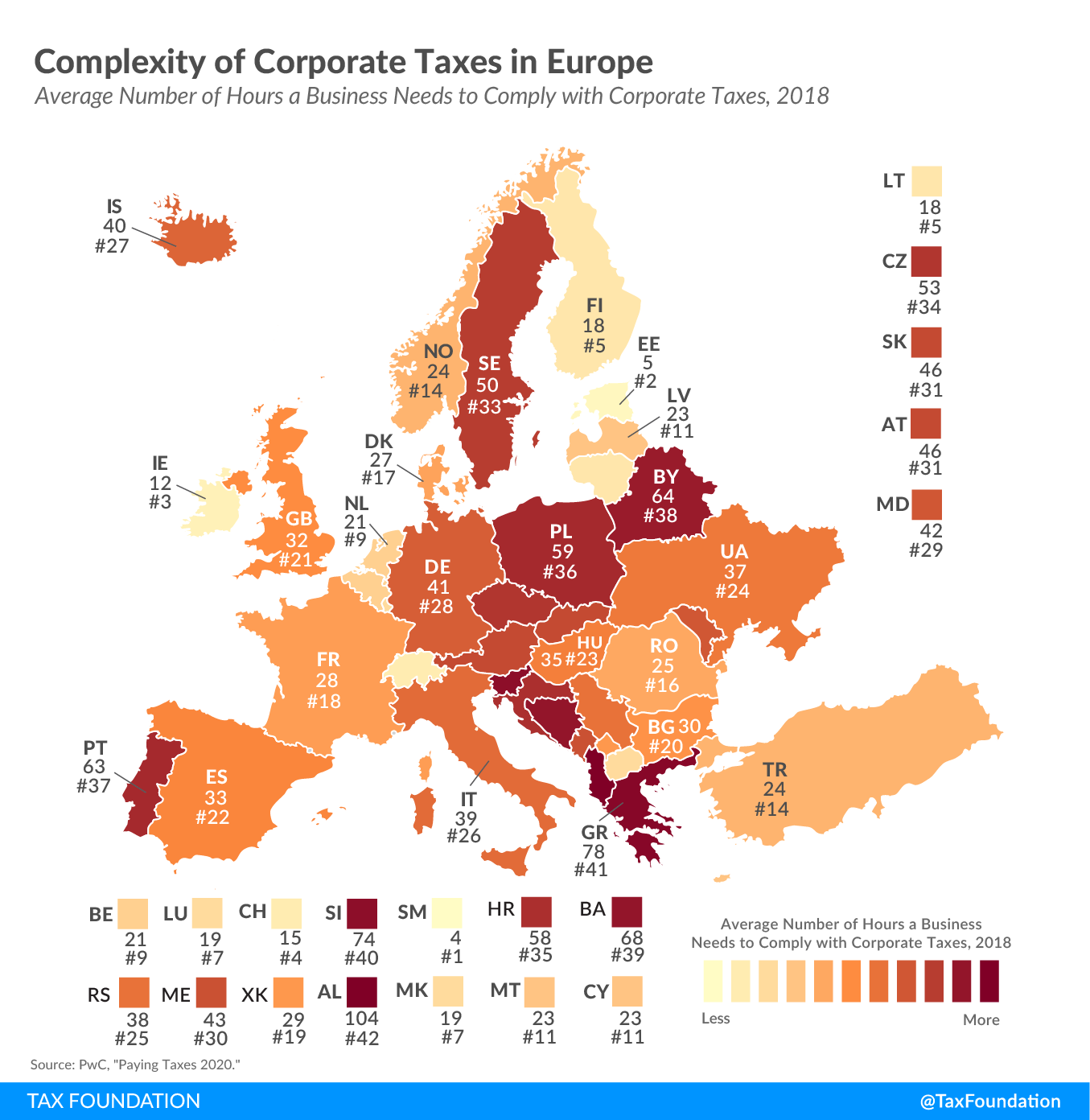

Complexity of Corporate Taxes in Europe

3 min readBy:Corporate tax codes should be designed to be easy for businesses to comply with and for governments to administer and enforce. Today’s map shows how complex—or easy—it is to remit corporate taxes across Europe.

One way to quantify corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code complexity is to measure the time needed to comply with the tax administratively. The time to comply indicator—measured in an annual study by the World Bank and PwC—reflects the average number of hours it takes a domestic medium-size business per year to prepare, file, and pay corporate taxes.

The least amount of compliance time with corporate taxes occurs in San Marino (4 hours), Estonia (5 hours), and Ireland (12 hours). For instance, Estonia allows its taxpayers to file business taxes—as well as other taxes—electronically. Taxpayers only need to review a pre-filled form, make any necessary changes, and approve the document with a digital signature.

Albania (104 hours), Greece (78 hours), and Slovenia (74 hours) are the countries where complying with corporate taxes takes the longest.

On average, it takes 37 hours in Europe to comply with corporate taxes, compared to a worldwide average of 59 hours.

Another indicator of tax complexity is the number of tax payments and mandatory contributions businesses are required to make. If a tax is paid and filed online by the majority of medium-size businesses with no requirement to file hard copies of tax returns or supporting documentation, only one payment is included in the indicator regardless of the actual number of payments, reflecting the lower administrative burden of filing electronically.

| Country | Hours Needed to Comply with Corporate Taxes per Year | Number of Corporate Tax Payments per Year | Number of Other Tax Payments per Year |

|---|---|---|---|

| Albania (AL) | 104 | 5 | 18 |

| Austria (AT) | 46 | 1 | 8 |

| Belarus (BY) | 64 | 1 | 4 |

| Belgium (BE) | 21 | 1 | 8 |

| Bosnia and Herzegovina (BA) | 68 | 12 | 20 |

| Bulgaria (BG) | 30 | 1 | 12 |

| Croatia (HR) | 58 | 1 | 10 |

| Cyprus (CY) | 23 | 2 | 13 |

| Czech Republic (CZ) | 53 | 1 | 5 |

| Denmark (DK) | 27 | 3 | 6 |

| Estonia (EE) | 5 | 1 | 7 |

| Finland (FI) | 18 | 1 | 4 |

| France (FR) | 28 | 1 | 6 |

| Germany (DE) | 41 | 2 | 6 |

| Greece (GR) | 78 | 1 | 6 |

| Hungary (HU) | 35 | 2 | 7 |

| Iceland (IS) | 40 | 1 | 7 |

| Ireland (IE) | 12 | 1 | 7 |

| Italy (IT) | 39 | 2 | 11 |

| Kosovo (XK) | 29 | 5 | 4 |

| Latvia (LV) | 23 | 1 | 5 |

| Lithuania (LT) | 18 | 1 | 8 |

| Luxembourg (LU) | 19 | 5 | 6 |

| Malta (MT) | 23 | 2 | 5 |

| Moldova (MD) | 42 | 1 | 6 |

| Montenegro (ME) | 43 | 1 | 4 |

| Netherlands (NL) | 21 | 1 | 7 |

| North Macedonia (MK) | 19 | 1 | 5 |

| Norway (NO) | 24 | 1 | 3 |

| Poland (PL) | 59 | 1 | 4 |

| Portugal (PT) | 63 | 1 | 6 |

| Romania (RO) | 25 | 1 | 10 |

| San Marino (SM) | 4 | 2 | 4 |

| Serbia (RS) | 38 | 1 | 31 |

| Slovak Republic (SK) | 46 | 1 | 6 |

| Slovenia (SI) | 74 | 1 | 8 |

| Spain (ES) | 33 | 1 | 7 |

| Sweden (SE) | 50 | 1 | 4 |

| Switzerland (CH) | 15 | 2 | 10 |

| Turkey (TR) | 24 | 1 | 8 |

| Ukraine (UA) | 37 | 1 | 3 |

| United Kingdom (GB) | 32 | 1 | 6 |

|

Source: PwC, “Paying Taxes 2020,”https://www.pwc.com/gx/en/services/tax/publications/paying-taxes-2020/explorer-tool.html. |

|||

Most European countries file corporate taxes once a year (or multiple times electronically). Bosnia and Herzegovina requires the most corporate tax payments, 12 annually.

Apart from corporate taxes, businesses are required to remit labor taxes and other types of taxes, which include property taxes, property transfer taxes, dividend taxes, capital gains taxes, financial transactions taxes, waste collection taxes, vehicle and road taxes, and any other small taxes or fees. The number of such “other tax payments” businesses are required to make varies significantly across European countries, ranging from three in Norway and Ukraine to 31 in Serbia.

Note: This is part of a map series in which we examine tax complexity in Europe

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe