Capital Allowances in Europe, 2019

3 min readBy:Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences. And as today’s map shows, the extent to which businesses can deduct their capital investments varies greatly across European countries.

Businesses determine their profits by subtracting costs (such as wages, raw materials, and equipment) from revenue. However, in most jurisdictions, capital investments are not seen as regular costs that can be subtracted from the revenue in the year of acquisition. Instead, depreciation schedules specify the life span of an asset, which determines the number of years over which an asset must be written off. By the end of the depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. period, the business would have deducted the total initial dollar cost of the asset.

However, in most cases, these depreciation schedules do not consider the time value of money (a normal return plus inflation). For instance, assume a machine costs $1,000 and is subject to a life span of five years. A business can deduct $200 every year for five years. However, due to the time value of money, a deduction of $200 in later years is not as valuable in real terms. As a result, businesses cannot fully deduct the net present value of capital investment. This inflates taxable profits, which, in turn, increases the cost of capital investment. A higher cost of capital can lead to a decline in business investment and reductions in the productivity of capital and lower wages.

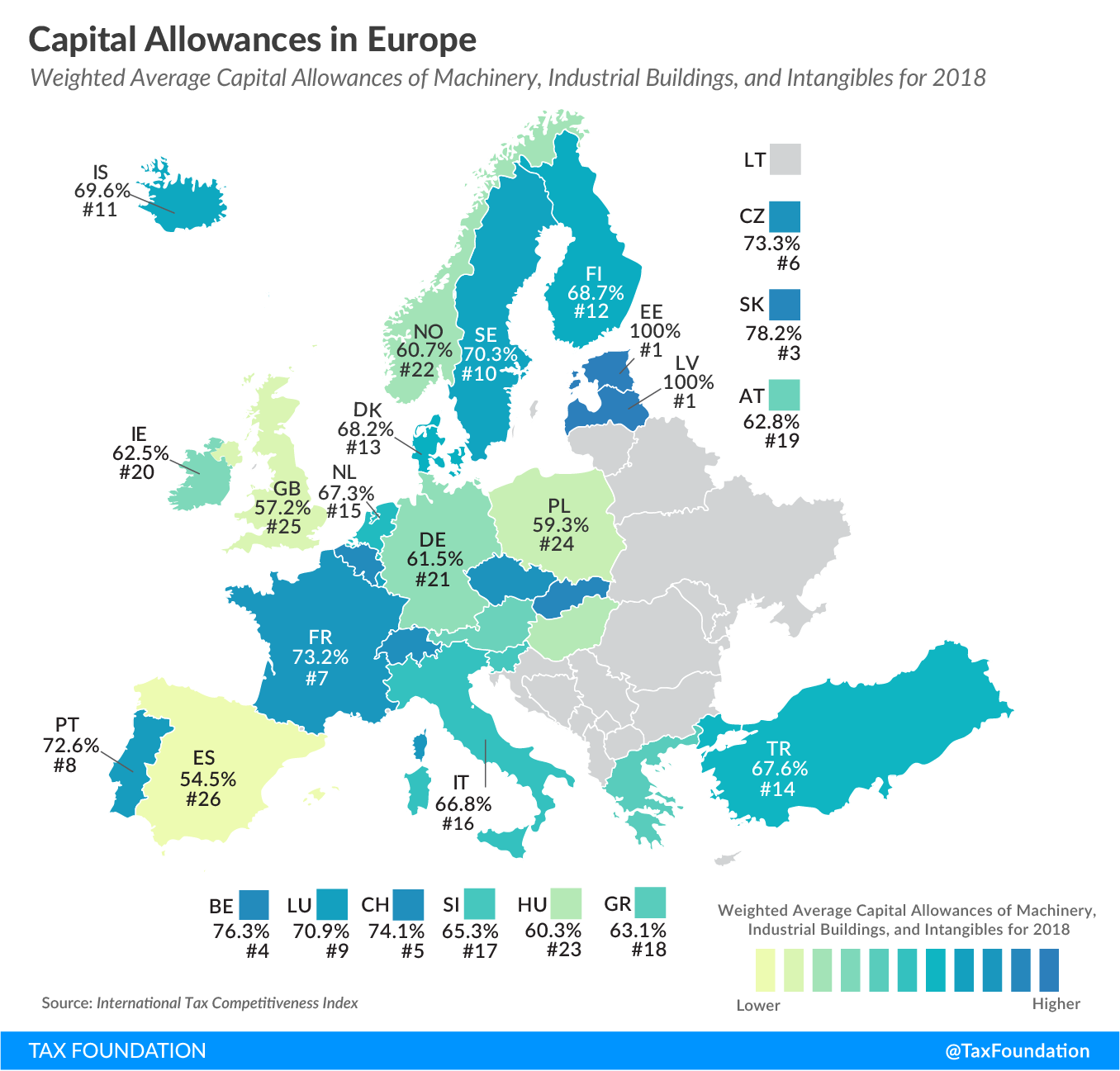

The map reflects the weighted average capital allowances of three asset types: machinery, industrial buildings, and intangibles (patents and “know-how”). Capital allowances are expressed as a percentage of the present value cost that businesses can write off over the life of an asset. The average is weighted by the capital stock’s respective share in an economy (machinery: 44 percent, industrial buildings: 41 percent, and intangibles: 15 percent). For instance, a capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances. rate of 100 percent represents a business’s ability to fully deduct the cost of an asset (e.g., through full immediate expensing or neutral cost recovery).

Latvia (100 percent), Estonia (100 percent), and Slovakia (78.2 percent) allow for the best treatment of capital investment, while businesses in Spain (54.5 percent), the United Kingdom (57.2 percent), and Poland (59.3 percent) can write off lower shares of investment costs. Estonia and Latvia only taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. distributed profits and reinvested earnings are untaxed. This allows for 100 percent of the present value of capital investment to be written off.

On average, businesses in Europe can write off 69.4 percent of the present value cost of their investments in machinery, industrial buildings, and intangibles. By asset category, the highest capital allowances are for machinery (84.2 percent), followed by intangibles (79.5 percent), and industrial buildings (49.9 percent).

The United Kingdom recently improved its place on this measure because the government has adopted a capital allowance for new nonresidential structures and buildings. Previously, UK businesses could not deduct any costs associated with buildings, and the UK weighted average for capital allowances was just 45.7 percent. This new policy would allow businesses to recover 27.9 percent of costs from investments in structures and buildings. This is reflected in the UK’s weighted average of 57.2 percent.

Apart from capital allowances, statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. (CIT) rates significantly determine the amount of corporate taxes businesses are required to pay. One of our previous maps provides an insight into European statutory CIT rates.

International Tax Competitiveness Index

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe