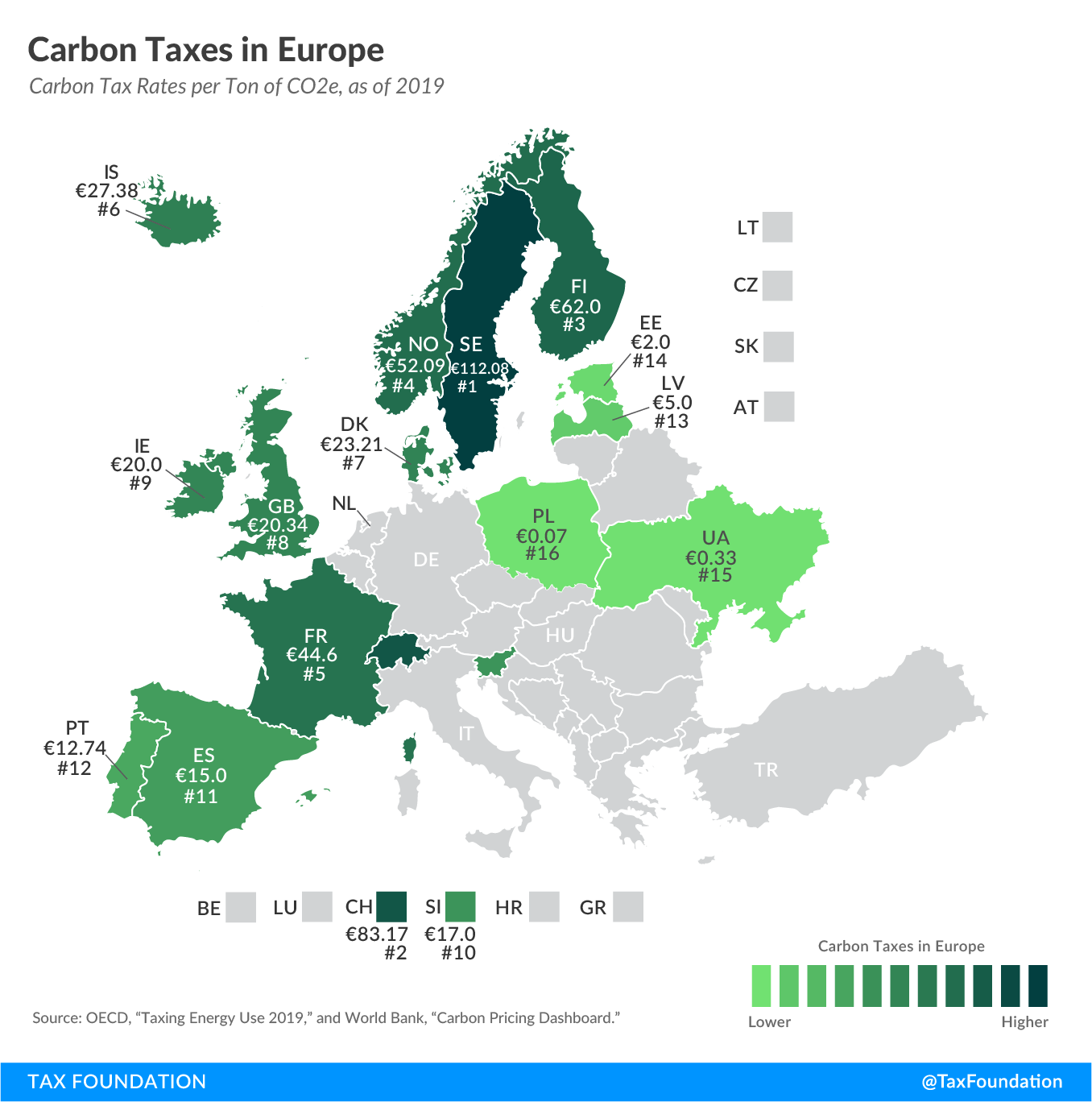

Carbon Taxes in Europe, 2019

3 min readBy:In recent years, several countries have taken measures to reduce carbon emissions using environmental regulations, emissions trading systems (ETS), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax. Since then, 15 European countries have followed, implementing carbon taxes that range from less than €1 per ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

Sweden levies the highest carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. rate at €112.08 (US$ 132.17) per ton of carbon emissions, followed by Switzerland (€83.17, $98.08) and Finland (€62.00, $73.11). You’ll find the lowest carbon taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates in Poland (€0.07, $0.08), Ukraine (€0.33, $0.39), and Estonia (€2.00, $2.36).

Carbon taxes can be levied on different types of greenhouse gases, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. The scope of each country’s carbon tax differs, resulting in varying shares of greenhouse gas emissions covered by the tax. For example, Spain’s carbon tax only applies to fluorinated gases, taxing only 3 percent of the country’s total greenhouse gas emissions. Norway, by contrast, recently abolished most exemptions and reduced rates, now covering over 60 percent of its emissions.

All member states of the European Union (plus Iceland, Liechtenstein, and Norway) are part of the EU Emissions Trading System (EU ETS), a market created to trade a capped number of greenhouse gas emission allowances. With the exception of Switzerland and Ukraine, all European countries that levy a carbon tax are also part of the EU ETS (Switzerland has its own emissions trading system).

The Spanish region Catalonia and the Netherlands are currently considering a carbon tax, and Turkey and the Ukraine are considering an ETS.

|

Notes: The carbon tax rates were converted into USD using the average 2018 USD-EUR exchange rate (0.848); see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. Sources: OECD, “Taxing Energy Use 2019: Figure 3.7, Explicit carbon taxes do not cover all energy-related emissions,” Oct. 15, 2019, http://www.oecd.org/tax/taxing-energy-use-efde7a25-en.htm, and World Bank, “Carbon Pricing Dashboard,” last updated Aug. 1, 2019, https://carbonpricingdashboard.worldbank.org/map_data. |

||||

| Carbon Tax Rate (per ton of CO2e) | Share of Jurisdiction’s Greenhouse Gas Emissions Covered | Year of Implementation | ||

|---|---|---|---|---|

| Euros | US-Dollars | |||

| Denmark (DK) | €23.21 | $27.37 | 40% | 1992 |

| Estonia (EE) | €2.00 | $2.36 | 3% | 2000 |

| Finland (FI) | €62.00 | $73.11 | 36% | 1990 |

| France (FR) | €44.60 | $52.59 | 35% | 2014 |

| Iceland (IS) | €27.38 | $32.29 | 29% | 2010 |

| Ireland (IE) | €20.00 | $23.58 | 49% | 2010 |

| Latvia (LV) | €5.00 | $5.90 | 15% | 2004 |

| Norway (NO) | €52.09 | $61.42 | 62% | 1991 |

| Poland (PL) | €0.07 | $0.08 | 4% | 1990 |

| Portugal (PT)* | €12.74 | $15.02 | 29% | 2015 |

| Slovenia (SI) | €17.00 | $20.05 | 24% | 1996 |

| Spain (ES) | €15.00 | $17.69 | 3% | 2014 |

| Sweden (SE) | €112.08 | $132.17 | 40% | 1991 |

| Switzerland (CH) | €83.17 | $98.08 | 33% | 2008 |

| Ukraine (UA) | €0.33 | $0.39 | 71% | 2011 |

| United Kingdom (GB)** | €20.34 | $23.99 | 32% | 2013 |

Launch Carbon Tax Resource Center

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe