Bank Taxes in Europe

2 min readBy:The 2007-2008 financial crisis triggered a global debate on whether, and if so how, taxation can be used as an instrument to stabilize the financial sector and to generate revenue to partially cover the costs associated with the recent and potential future crises.

Three approaches were mainly discussed, namely

- financial stability contributions (levied on financial institutions’ liabilities and/or assets)

- financial activities taxes (levied either on financial institutions’ profits or remunerations)

- financial transaction taxes (levied on trade in financial instruments such as stocks, bonds, derivatives, and currencies)

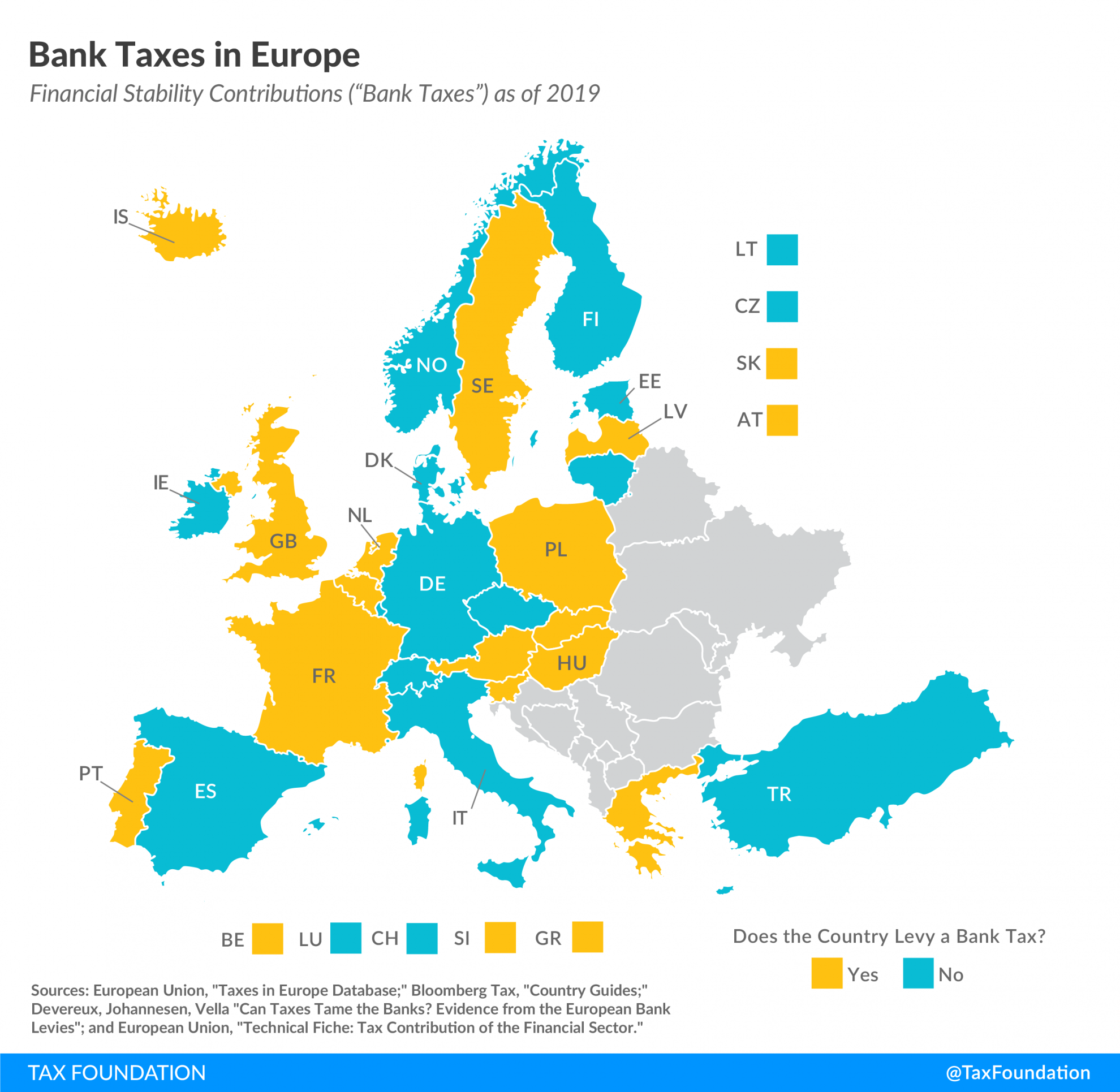

Today’s map shows which European OECD countries implemented financial stability contributions, commonly referred to as “bank taxes.”

Austria, Belgium, France, Greece, Hungary, Iceland, Latvia, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Sweden, and the United Kingdom all levy bank taxes. Almost all of these countries implemented the levy between 2009 and 2012, with Greece (1975) and Poland (2016) the only exceptions.

Most countries levy their bank taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on a measure of liabilities or a measure of assets. However, some countries decided on a different tax base. For example, France taxes the minimal amount of capital necessary to comply with the regulatory requirements.

|

Notes: **Exceptions apply depending on the stock and growth of lending to non-banks. Sources: European Union, “Taxes in Europe Database”; Bloomberg Tax, “Country Guides”; Devereux, Johannesen, Vella “Can Taxes Tame the Banks? Evidence from the European Bank Levies”; and European Union, “Technical Fiche: Tax Contribution of the Financial Sector.” |

|||

| Country | Tax Rate | Tax Base | Year of Implementation |

|---|---|---|---|

| Austria (AT) | 0% – 0.258% | Total liabilities net of equity and insured deposits | 2011 |

| Belgium (BE) | 0.13231% | Debt towards clients | 2012 |

| France (FR) | 0.25% | Minimum regulatory capital requirement | 2011 |

| Greece (GR) | 0.6% | Value of the credit portfolio | 1975 |

| Hungary (HU) | 0.15% – 0.2% | Total assets net of interbank loans | 2010 |

| Iceland (IS) | 0% – 0.376% | Total debt | 2011 |

| Latvia (LV) | 0.036% | Total liabilities net of equity and insured deposits | 2011 |

| Netherlands (NL) | 0% – 0.044% | Total liabilities net of equity and insured deposits | 2012 |

| Poland (PL) | 0.44% | Total assets | 2016 |

| Portugal (PT) | 0.05% | Total liabilities net of equity and subordinated debt | 2011 |

| Slovakia (SK)* | 0.2% | Total liabilities net of equity and insured deposits | 2012 |

| Slovenia (SI)** | 0.1% | Total assets | 2011 |

| Sweden (SE) | 0.036% | Total liabilities net of equity and insured deposits | 2009 |

| United Kingdom (GB) | 0% – 0.15% | Total liabilities net of equity and insured deposits but netting of gross assets and liabilities against the same counterpart and deduction for liquid assets | 2011 |